- Ziggma

- Posts

- 💰 Costco Tops Estimates in Q4

💰 Costco Tops Estimates in Q4

Big moves decoded: FCX, INTC, and ORCL

Market Performance

S&P 500: 6,604.72 ⬇️ 0.50%

Nasdaq: 22,384.70 ⬇️ 0.50%

Dow Jones: 45,947.32 ⬇️ 0.38%

Costco’s Rising Membership Rate

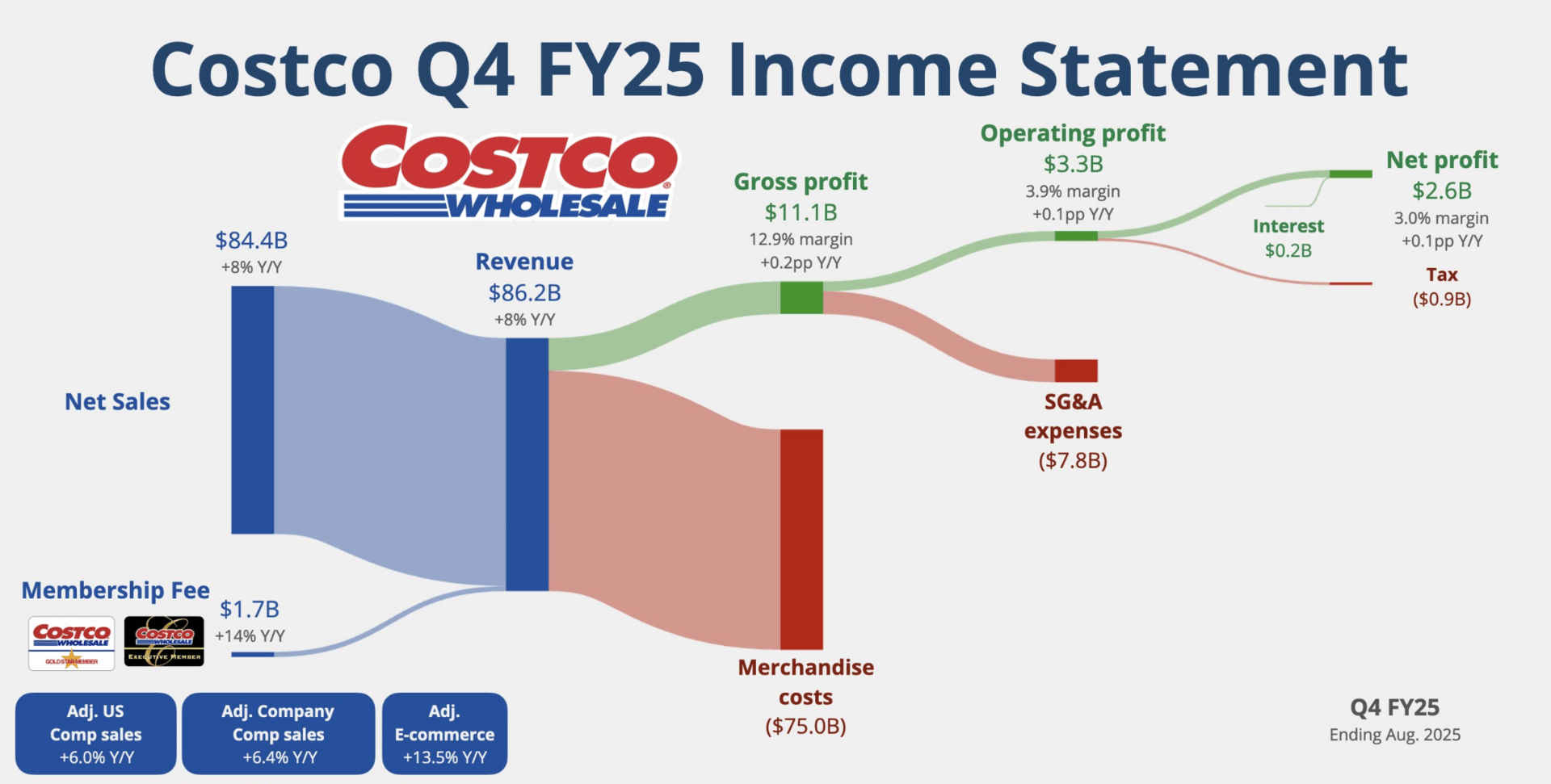

Costco (COST) crushed Wall Street expectations in fiscal Q4, posting earnings of $5.87 per share versus estimates of $5.80 per share, while revenue stood at $86.16 billion vs. estimates of $86.06 billion.

The warehouse giant's success story is awe-inspiring, given the current tariff environment affecting retailers.

What's driving this outperformance?

CFO Gary Millerchip revealed the company has worked hard to offset higher tariff costs by introducing new Kirkland Signature private-label alternatives and shifting toward more U.S.-made products.

With approximately one-third of U.S. sales originating from imported goods, this strategic pivot is crucial.

Membership fee income increased by 14%, driven by new sign-ups, upgrades to higher-tier memberships, and last fall's fee adjustment.

Remarkably, just under half of new signups come from people under 40, showing the brand's appeal to younger consumers.

E-commerce growth of 13.5% demonstrates Costco's successful digital transformation, with full-year online sales exceeding $19.6 billion—representing over 7% of total net sales.

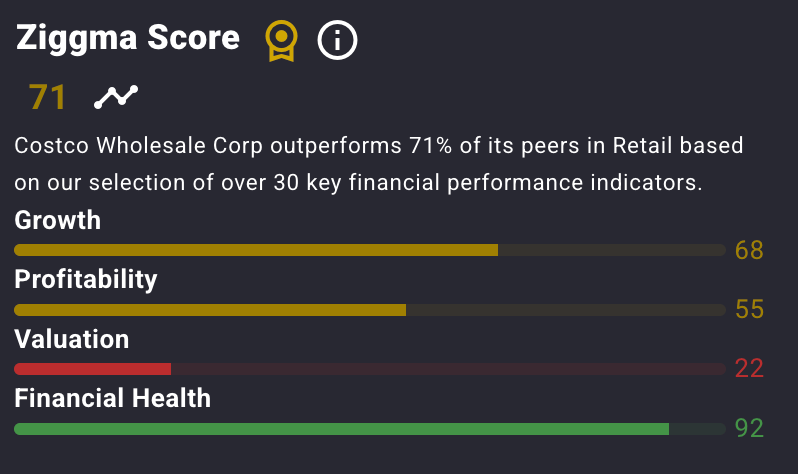

Costco currently has a Ziggma Stock Score of 71, and ranks in the bottom half percentile in terms of valuation.

Our Takeaway

Costco's ability to maintain strong performance while navigating tariff pressures through strategic sourcing and private-label expansion proves the durability of its membership-driven model, making it a defensive play amid sluggish retail spending.

The assistant that scales with you

Great leaders don’t run out of ideas. They run out of hours.

Wing gives you a dedicated assistant who plugs into your workflows – calendar, inbox, research, outreach, and ops – so execution never stalls. Wing can:

Onboard in days, not months

Run the day-to-day so you don’t have to

Adapt as your business grows

With Wing, you buy back time without adding headcount. More focus for strategy, more follow-through on priorities, and a lot fewer “forgot to send” moments.

Market Overview 📈

The S&P 500, Nasdaq, and Dow all closed lower for the third consecutive session as investors grappled with mixed signals.

The sell-off reflected growing concerns about the Federal Reserve's rate path as solid economic data complicated the easing narrative.

The catalyst was stronger-than-expected labor market data 👇.

Initial jobless claims dropped to 218,000 versus the 235,000 estimate, while second-quarter GDP was revised upward to 3.8%.

This robust economic data, combined with rising Treasury yields that pushed the 10-year to 4.2%, dampened hopes for aggressive Fed rate cuts.

Concerns about the government shutdown also weighed on sentiment, with investors closely monitoring developments as the funding deadline approached.

The VIX rose to 17.02, reflecting increasing market anxiety about near-term volatility.

Stock Moves Deciphered 📈

📈 Oracle (ORCL) stock fell after an analyst issued a "Sell" rating, citing overvalued cloud revenues.

The company's plan to raise $18 billion through a bond sale also raised concerns among investors about its debt levels and future cash flows.

📊 Intel (INTC) stock surged to a 52-week high following reports of potential partnership talks with TSMC and Apple, combined with positive news from its quantum computing division, driving strong investor interest in the chipmaker's turnaround prospects.

🏅 Freeport-McMoran (FCX) stock declined amid weakness in the basic materials sector.

Concerns over slowing global economic growth and its potential impact on copper demand drove the shares lower in heavy trading.

Headlines You Can't Miss 👀

📈 Nvidia receives a price target raise from Barclays to $240, implying a 35.6% upside amid optimism for AI dealmaking.

📊 UBS forecasts the S&P 500 to reach 6,800 by June 2026, citing AI strength and lower rates.

🏪 Chewy upgraded to buy by MoffettNathanson with $48 price target on the pet industry recovery.

⚡ Transocean plunges 16.5% on $375M share offering priced below market at $3.05.

🏠 Opendoor gains 3.5% after Jane Street discloses 5.9% stake in real estate platform.

📺 CME Group rises 2% on Citi upgrade to buy with $300 price target, citing catalysts ahead.

⚖️ European Commission opens antitrust probe into SAP over software support practices.

🔍 Webull gets a buy rating from Rosenblatt with 36% upside potential on retail trading growth.

Trending Stocks 📊

🚗 CarMax (KMX) shares plummeted to a five-year low after reporting a surprise decline in used-car sales for its second quarter, despite lower prices, signaling significant headwinds in the market.

📉 Jabil Circuit (JBL) stock declined amid broader weakness in the technology manufacturing sector.

Concerns about supply chain pressures and potentially slowing demand for electronics contributed to the negative investor sentiment.

🧑💻 IBM (IBM) shares climbed after its partnership with HSBC showcased positive results in applying quantum computing to bond trading, boosting investor confidence in the company's future quantum revenue streams.

What’s Next?

Key earnings and macro news 👇

September historically ranks as the worst month for equities, with the S&P 500 averaging 4.2% declines over the past five years.

More than 95% of S&P 500 companies have reported Q3 earnings

Nearly 78% have surpassed analyst expectations this season

Friday: PCE inflation numbers

Government shutdown deadline looms on September 30

Chart of the Day

Source: App Economy Insights

Meme of the Day

Great investing starts with great information.

Forward The Market Scoop to anyone who wants to stay ahead of the market through a pertinent and entertaining newsletter format.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please exercise caution and conduct your own research.