- Ziggma

- Posts

- 🗞️ Costco's Membership Model

🗞️ Costco's Membership Model

Costco, PayPal, and Oscar Health

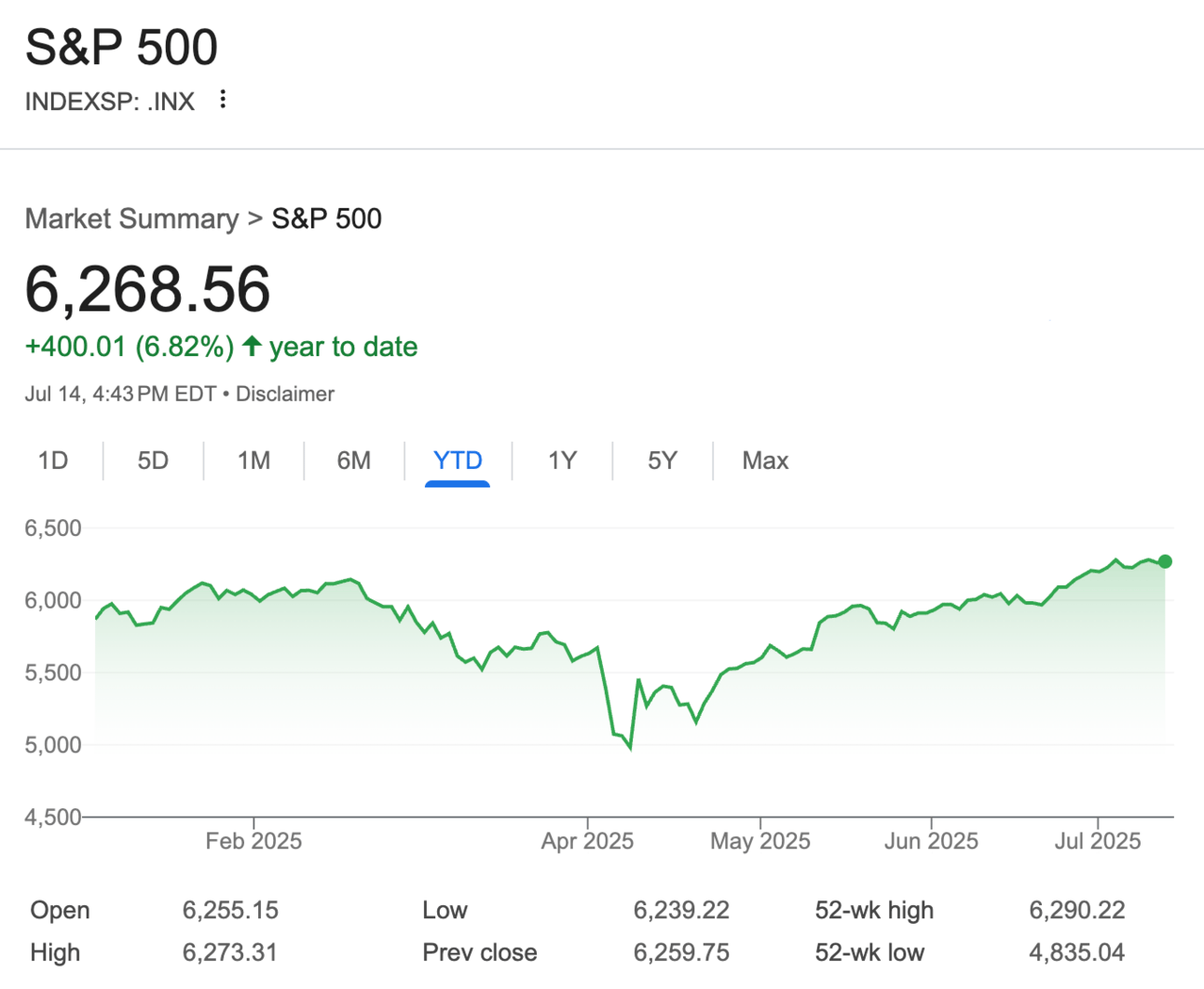

Market Performance

S&P 500: 6,268.56 (+0.14%)

Nasdaq: 20,640.33 (+0.27%)

Dow Jones: 44,459.65 (+0.20%)

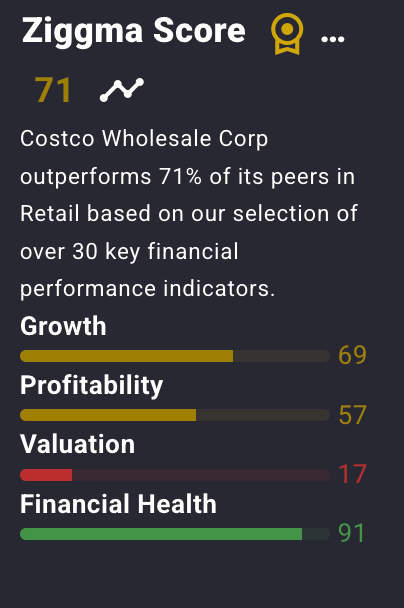

Costco’s Membership Business Is a Cash Cow

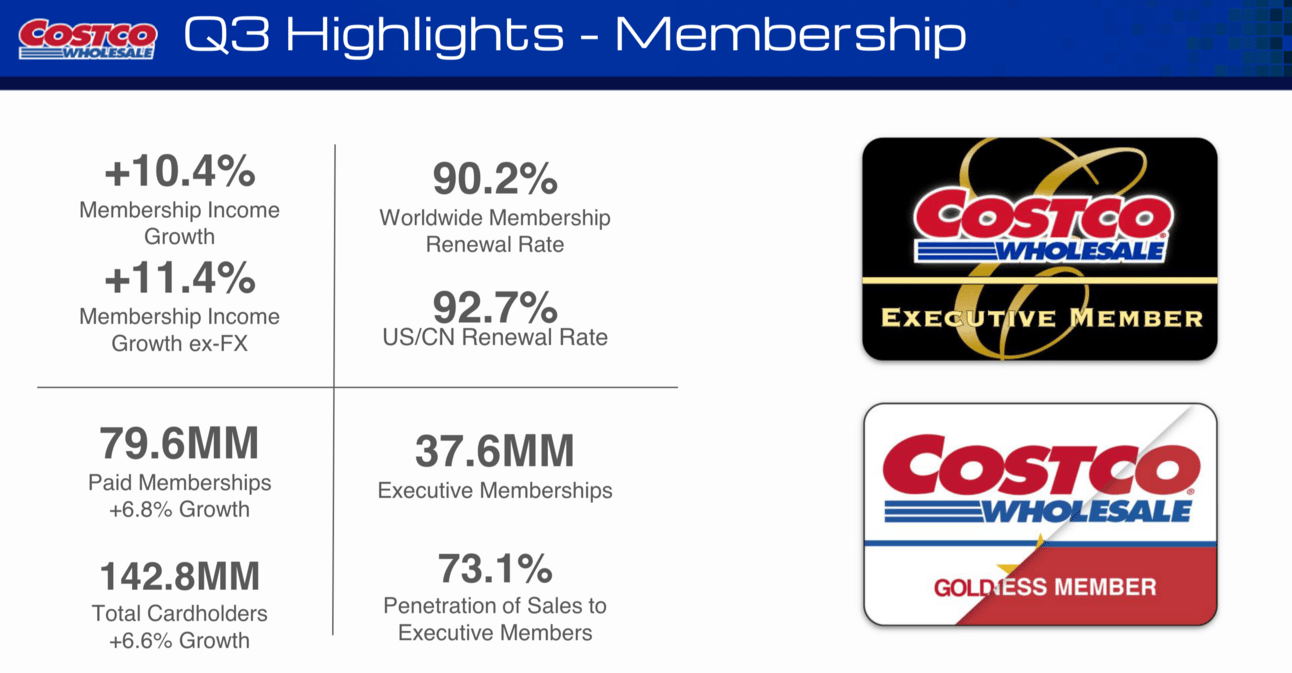

Costco (COST) just handed its highest-paying customers another reason to stay loyal.

Starting now, Executive Members (those paying $130 annually) get exclusive early access to stores beginning at 9 a.m., a full hour before regular Gold Star members can shop.

This move comes just three months after extending gas station hours, which CEO Ron Vachris said led to "two of our all-time highest gallon weeks in the U.S." The timing isn't coincidental.

Executive Members represent just 37.6 million of Costco's 79.6 million total memberships, yet they drive a whopping 73% of total sales.

That's the power of the membership model in action: Your best customers aren't just paying more upfront, they're spending significantly more throughout the year.

The math here is compelling: Executive Members need to spend at least $3,250 annually to break even on their 2% cashback reward.

However, most are spending well beyond that threshold, making them Costco's most valuable asset.

By giving them VIP treatment, Costco isn't just improving the customer experience; it's protecting the profit engine.

Our Takeaway

Costco's latest perk illustrates why membership businesses are so powerful in today's economy.

While most retailers compete on thin margins and promotional pricing, Costco's membership model creates a predictable revenue foundation that covers operating expenses before it sells a single product.

The big box retailer gets paid upfront for customer loyalty, then reinforces that loyalty through exclusive benefits like early store access.

The beauty lies in the math: membership fees represent just 2% of total revenue but account for the majority of net profit.

This high-margin revenue stream allows Costco to maintain its famous low markup strategy (10-15% vs. 25%+ for traditional retailers) while still generating substantial returns for shareholders.

Executive Members paying double the annual fee create an even more profitable customer segment that's both less price-sensitive and more committed to maximizing their membership value.

It's a virtuous cycle that drives both revenue predictability and customer lifetime value — exactly what investors want to see in an inflationary, uncertain economic environment.

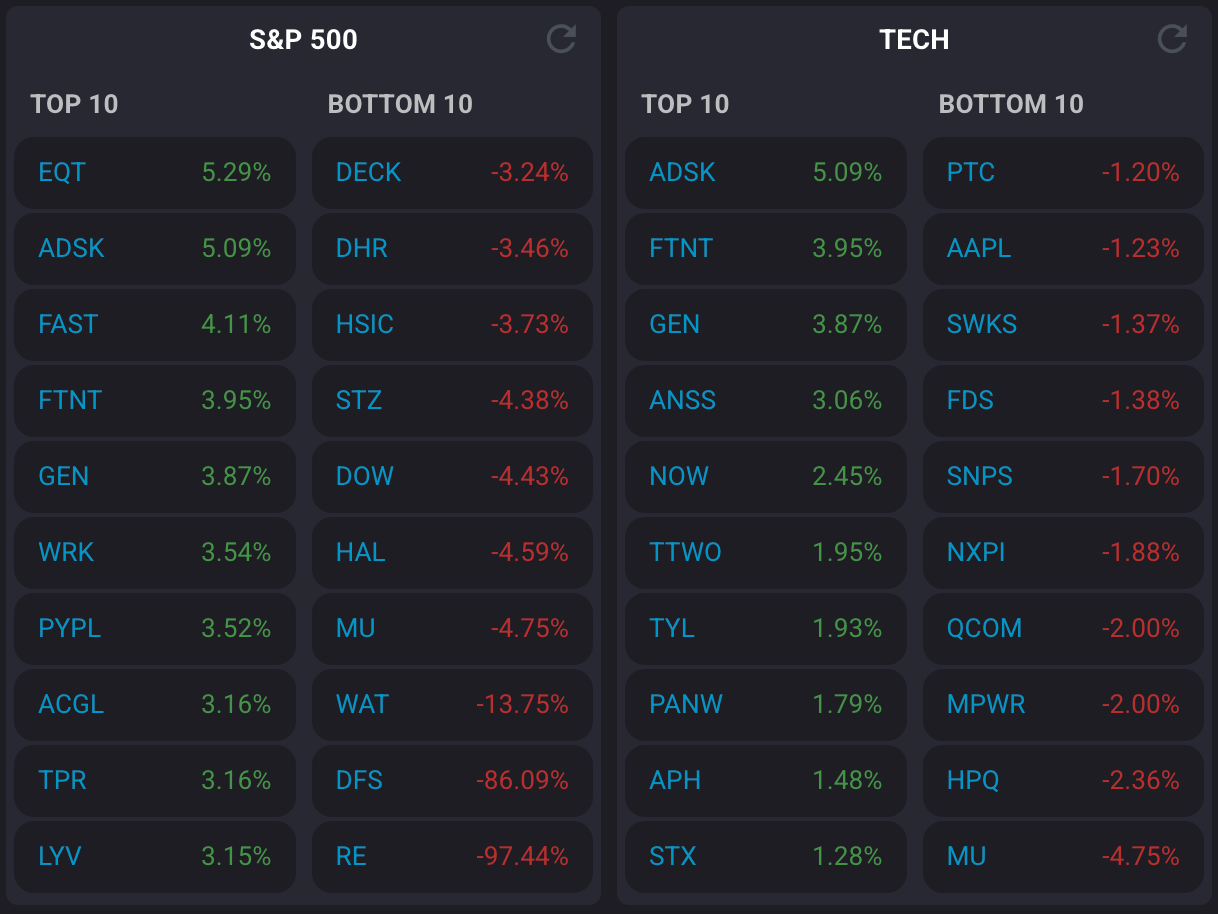

Market Overview

Markets managed modest gains on Monday despite President Trump's weekend announcement of 30% tariffs on the European Union and Mexico, effective August 1.

The resilience suggests investors are betting these duties will eventually be negotiated down, as leaders from both regions indicated plans to continue talks with the Trump administration.

Banking sector optimism dominated sentiment as investors looked ahead to a busy second-quarter earnings week. Analysts expect Q2 to be a challenging earnings season with the S&P 500 projected to post just 4.3% blended earnings growth.

U.S. stock futures were mixed in overnight trading, with Dow futures down 30 points while S&P 500 and Nasdaq 100 futures each declined about 0.1%, as investors await the inflation data and bank earnings that could set the tone for the week ahead.

Headlines You Can't Miss

Nvidia resumes H20 AI chip sales to China following U.S. government assurances after licensing requirements.

Waters plunged nearly 12% on merger announcement with Becton Dickinson's Biosciences unit in complex debt-heavy deal.

Autodesk surged 5% after ending potential acquisition talks with PTC, while PTC fell 2% on the news.

McDonald's receives a “sell” rating from Melius Research with $250 target, citing eroded value perception and competition.

CrowdStrike downgraded to “equal weight” by Morgan Stanley after 50% rally, with growth expectations fully priced in.

Burlington Stores gets a 56% upside target from UBS, citing superior value proposition and "Burlington 2.0" strategy success.

Best Buy downgraded to neutral by Piper Sandler on lack of meaningful catalysts and competitor concerns.

Bank of America warns Trump's latest tariff announcements make Fed rate cuts less likely, citing stagflationary risks.

Trending Stocks

Morgan Stanley analysts noted any adverse impact would likely be negligible, viewing the fintech's diversified revenue streams as providing adequate protection against potential data access fee headwinds.

Analyst Quote🎤: “If implemented, any adverse impact is likely to be negligible in our view.”

Oscar Health (OSCR): The healthcare startup saw shares decline after Piper Sandler downgraded it to “neutral” from “overweight”, expressing concerns about softening risk-reward dynamics.

Analysts fear solid 2025 execution may not provide a sufficient catalyst as attention turns toward 2026 challenges.

Additionally, Trump's proposed healthcare legislation could produce unprecedented disenrollment and risk pool degradation for the company. After surging 60% in Q2, shares have dropped 33% this month.

Analyst Quote🎤: “We fear that solid CY25 execution is an insufficient catalyst to buoy the stock as time advances towards CY26.”

MicroStrategy (MSTR): TD Cowen raised its price target on MSTR stock to $680 from $590, representing 56% upside potential as bitcoin prices surge to new records.

Analyst Quote🎤: “No one will be able to match let alone beat Strategy’s cost of capital advantage.”

What’s Next?

Key Earnings Today 👇

JPMorgan: Q2 revenue forecast at $44 billion vs. $50.2 billion last year. Adjusted earnings are expected to narrow from $6.12 per share to $4.47 per share.

Wells Fargo: Q2 revenue forecast at $20.76 billion vs. $20.69 billion last year. Adjusted earnings are expected to increase from $1.33 per share to $1.4 per share.

Citigroup: Q2 revenue forecast at $20.83 billion vs. $20.14 billion last year. Adjusted earnings are expected to increase from $1.52 per share to $1.63 per share.

BlackRock: Q2 revenue forecast at $5.41 billion vs. $4.8 billion last year. Adjusted earnings are expected to increase from $10.36 per share to $10.6 per share.

Macro News

Tuesday 8:30 AM: June Consumer Price Index

Core CPI expected 0.3% monthly, 3% annual increase

First potential reading showing the Trump tariffs’ impact on inflation

Track upcoming news and earnings on your portfolio companies with Ziggma.

Chart of the Day

Source: Company Presentation

Meme of the Day

Great investing starts with great information. Forward The Market Scoop to anyone who wants to stay ahead of the market through a pertinent and entertaining newsletter format.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.