- Ziggma

- Posts

- 🗞️ Cisco's AI Boost

🗞️ Cisco's AI Boost

PLUS: Dow tops 48k

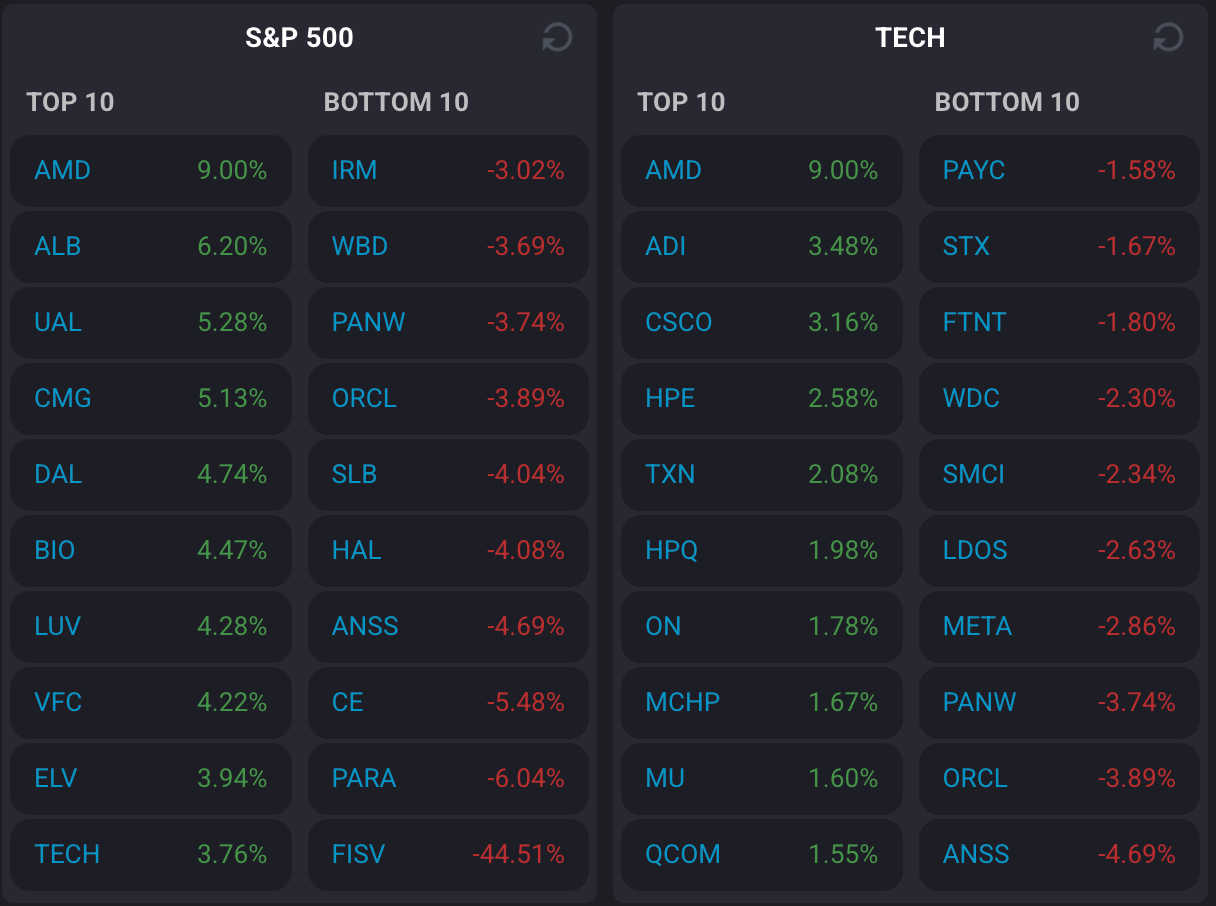

Market Performance

S&P 500: 6,850.92 ⬆️ 0.06%

Nasdaq: 23,406.46 ⬇️ 0.26%

Dow Jones: 48,254.82 ⬆️ 0.68%

Is Cisco An AI Infrastructure Play?

Cisco (CSCO) is proving that the AI infrastructure boom extends far beyond just chip makers.

The networking giant reported fiscal Q1 earnings that exceeded expectations, with revenue rising 8% to $14.88 billion and adjusted EPS reaching $1.00, surpassing the $0.98 estimate.

This marks Cisco's fourth consecutive quarter of growth, following four straight quarters of year-over-year revenue declines.

AI infrastructure orders from hyperscaler customers reached a staggering $1.3 billion, representing what the company called "a significant acceleration in growth."

Cisco's networking business surged 15% to $7.77 billion, crushing the $7.47 billion analyst estimate.

The company is successfully positioning itself as a critical player in the AI infrastructure buildout, particularly after introducing a new Ethernet switch based on Nvidia silicon last month.

CFO Mark Patterson emphasized Cisco’s "multi-year, multi-billion-dollar campus refresh opportunity" driven by strong demand for refreshed networking products.

Cisco's guidance exceeded expectations across the board, with fiscal Q2 revenue expected to be between $15 billion and $15.2 billion, surpassing the $14.6 billion estimate.

The full-year revenue guidance of $60.2 billion to $61 billion also topped the $59.7 billion consensus.

While security and collaboration segments saw slight declines and missed estimates, the explosive growth in networking more than compensated.

Cisco stock has a Ziggma score of 53 and ranks highly in terms of profitability and financial health.

However, the networking stock, which is up 25% in 2025, may not offer significant upside potential.

Our Takeaway

Cisco's results demonstrate that the AI infrastructure opportunity extends beyond GPUs.

As hyperscalers and enterprises build out AI capabilities, they need robust networking infrastructure to connect all those powerful chips.

With $1.3 billion in AI infrastructure orders and multi-year growth visibility, Cisco is positioning itself as a critical player in AI infrastructure at a more reasonable valuation than pure-play chipmakers.

$1K Could’ve Made $2.5M

In 1999, $1K in Nvidia’s IPO would be worth $2.5M today. Now another early-stage AI tech startup is breaking through—and it’s still early.

RAD Intel’s award-winning AI platform helps Fortune 1000 brands predict ad performance before they spend.

The company’s valuation has surged 4900% in four years* with over $50M raised.

Already trusted by a who’s-who roster of Fortune 1000 brands and leading global agencies. Recurring seven-figure partnerships in place and their Nasdaq ticker is reserved: $RADI.

Now open at $0.81/share, allocations limited – price moves on 11/20.

This is a paid advertisement for RAD Intel made pursuant to Regulation A+ offering and involves risk, including the possible loss of principal. The valuation is set by the Company and there is currently no public market for the Company's Common Stock. Nasdaq ticker “RADI” has been reserved by RAD Intel and any potential listing is subject to future regulatory approval and market conditions. Investor references reflect factual individual or institutional participation and do not imply endorsement or sponsorship by the referenced companies. Please read the offering circular and related risks at invest.radintel.ai.

Market Overview 📈

The market delivered a tale of two sectors on Wednesday as the Dow Jones Industrial Average notched its first record close above 48,000, while tech stocks faced renewed pressure.

The 30-stock Dow was powered by a broad rally in financials and economically sensitive stocks. Meanwhile, the S&P 500 barely budged, and the Nasdaq slipped into negative territory.

Investors kept one eye trained on Washington as the federal government appeared poised to end the longest shutdown in U.S. history.

The 43-day closure has delayed critical economic data releases, leaving investors and policymakers uncertain about key metrics, such as October's CPI and jobs reports, which the White House now says may never be released.

The financial sector stole the spotlight, with Goldman Sachs, JPMorgan, American Express, Morgan Stanley, Wells Fargo, and Bank of America all hitting fresh records.

The Financial Select SPDR Fund rose nearly 1%, reflecting optimism about the economic reopening and relief that the government impasse is finally coming to an end.

Meanwhile, the AI trade continued its streak of volatility. While Advanced Micro Devices (AMD) popped 9%, other tech names, such as Oracle and Palantir Technologies, declined.

The bifurcated market reflects investor uncertainty about stretched tech valuations following their recent surge, prompting a rotation into more economically sensitive sectors with lower valuations, such as financials and healthcare.

Stock Moves Deciphered 📈

🚀Advanced Micro Devices (AMD)

AMD shares soared 9% as CEO Lisa Su outlined aggressive growth targets that dismissed concerns about an AI spending bubble.

The chipmaker projected 35% annual revenue growth and forecasted that data center revenues will jump 60% over the next three to five years, significantly expanding its market share in AI infrastructure.

The strong projections come as AMD positions itself as a key alternative to Nvidia in the exploding AI chip market.

⛏️ Albemarle (ALB)

Albemarle surged over 6% as the lithium sector got a boost amid renewed optimism about long-term electric vehicle demand.

The rally was fueled by a "Buy" rating from DBS, which assigned a $140 price target, with analysts suggesting that the stock had become significantly undervalued relative to its future earnings potential in the lithium market.

🛫 United Airlines (UAL)

United Airlines rose by more than 5% following a credit rating upgrade from Moody's, which cited the airline's "very strong" liquidity position as a key factor in the improved outlook.

The vote of confidence comes as United also issued record fourth-quarter revenue guidance, signaling robust travel demand heading into the holiday season.

The upgrade reflects United's successful management of its balance sheet and operational improvements, despite the recent challenges facing the broader airline industry.

Headlines You Can't Miss 👀

📊 34 S&P 500 stocks hit new 52-week highs on Wednesday, including Alphabet, Expedia, General Motors, Ralph Lauren, Goldman Sachs, JPMorgan, Johnson & Johnson, Eli Lilly, CrowdStrike, and IBM.

🏛️ Federal Reserve's Raphael Bostic to step down when his term expires in February after serving as Atlanta Fed President since June 2017, marking the end of tenure as first Black and openly gay regional president.

📉 Beyond Meat price target slashed to $1 by Barclays from $2 following another quarter of declining sales and muted outlook, with the analyst citing weak plant-based meat category demand despite cost control efforts.

💊 Alkermes drops 9% as traders weigh mixed Phase 2 trial results for ALKS 2680, a narcolepsy drug, with the company advancing to Phase 3 but noting that higher doses may be required for effectiveness.

🏨 Bath & Body Works downgraded by Raymond James to Market Perform from Outperform, with the price target removed, citing deeper price cuts and macroeconomic pressure on lower- to middle-income consumers.

📦 RXO freight carrier surges 6% following Morgan Stanley upgrade to overweight from equal weight, adding to Tuesday's 5.7% gain and posting its best two-day run in over a month.

Trending Stocks 📊

👕 On Holding (ON)

On Holding, a Swiss sportswear innovator, jumped nearly 18% after raising its full-year guidance for the third consecutive quarter and delivering another period of impressive double-digit growth.

The company now expects fiscal 2025 sales to reach 2.98 billion francs ($3.72 billion), up from its previous guidance of 2.91 billion francs, representing 34% constant currency growth versus the prior forecast of 31%.

Oklo (OKLO)

Shares of Oklo, a nuclear power startup, rose 6.6% even after reporting a wider-than-expected third-quarter loss of $0.20 per share versus the $0.13 consensus estimate.

The pre-revenue company, which has rallied approximately 400% year-to-date, continues to work toward regulatory approval for its compact, fast microreactor technology.

🤖 Foxconn

Key Nvidia supplier Foxconn reported a robust 17% year-on-year jump in earnings, driven primarily by growth in its AI server business.

The strong performance reflects surging demand for AI infrastructure components as tech giants and cloud providers continue to build massive amounts of AI computing

What’s Next?

Key market and macro news 👇

🎢 Walt Disney Company is expected to report its quarterly earnings, and the results will be closely watched for insights into the health of the media and entertainment industry.

🛍️ JD.com, an e-commerce giant, will provide a look into consumer spending in China and the global e-commerce landscape.

📊 The Bureau of Labor Statistics is scheduled to release the CPI data for October, which will provide insight into inflation trends and influence the Federal Reserve's monetary policy.

👩💼 The weekly jobless claims report will provide a timely snapshot of the labor market's health, which could influence investor sentiment and the Federal Reserve's policy.

Chart of the Day

Source: Visual Capitalist

Meme of the Day

Great investing starts with great information.

Forward The Market Scoop to anyone who wants to stay ahead of the market through a pertinent and entertaining newsletter format.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please exercise caution and conduct your own research.