- Ziggma

- Posts

- 💰 China Bans Nvidia's AI Chips

💰 China Bans Nvidia's AI Chips

PLUS: Why is Uber falling?

Market Performance

S&P 500: 6,600.35 ⬇️ 0.1%

Nasdaq: 22,261.33 ⬇️ 0.3%

Dow Jones: 46,018.32 ⬆️ 0.6%

Nvidia Faces China Headwinds 🇨🇳

Nvidia (NVDA) CEO Jensen Huang expressed disappointment after reports emerged that China's internet regulator has banned major tech companies from purchasing the chipmaker's AI semiconductors.

The Financial Times reported that companies, including ByteDance and Alibaba, were ordered to stop purchasing Nvidia's RTX Pro 6000D chips, which are specifically designed for the Chinese market.

When asked about the ban, Huang said, "We can only be in service of a market if the country wants us to be," adding that Nvidia has "probably contributed more to the China market than most countries have."

This latest restriction comes after years of escalating tensions between the U.S. and China over semiconductor exports.

Just last month, the White House announced a deal in which Nvidia would receive export licenses in exchange for 15% of Chinese H2O chip sales going to the U.S. government.

Now, that arrangement appears meaningless if Chinese companies can't even purchase the products.

The situation has become what Huang described as "a bit of a roller coaster," with Nvidia already advising analysts not to include China in their financial forecasts due to ongoing geopolitical uncertainties.

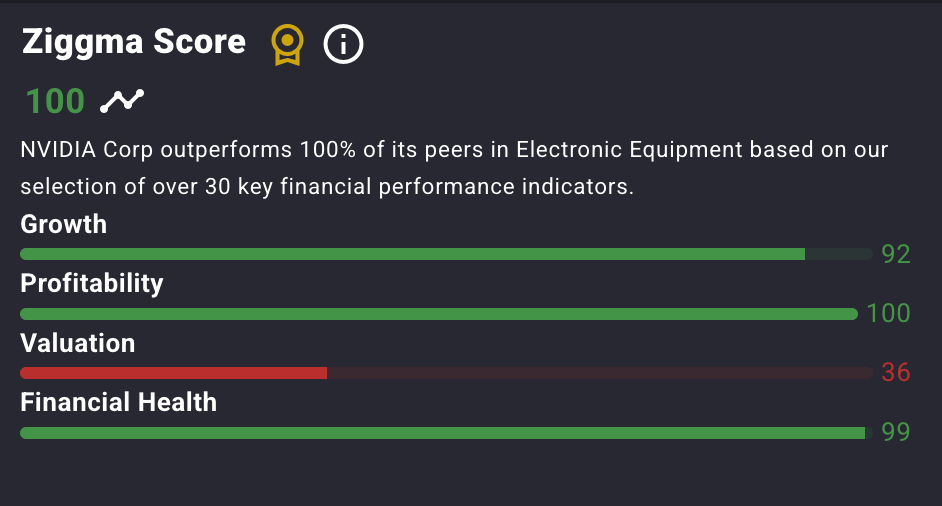

Nvidia currently has a Ziggma Stock Score of 100, despite ranking in the bottom half percentile for valuation.

Our Takeaway

This ban represents another step in the tech decoupling between the world's two largest economies.

For Nvidia, losing access to China's massive AI market could impact long-term growth, even as the chipmaker continues to expand in other regions, such as the UK, with its recent £11 billion investment announcement.

The Real Traders Aren't on CNBC

Your current options for finding stock trades:

Option 1: Spend 4 hours daily reading everything online

Option 2: Pay $500/month for paywalled newsletters and pray

Option 3: Get yesterday's news from mainstream financial media

All three keep you broke.

Here's where the actual edge lives:

Twitter traders sharing real setups (not TV personalities)

Crowdfunding opportunities before they go mainstream

IPO alerts with actual timing

Reddit communities spotting trends early

Crypto insider takes (not corporate PR)

The problem? You'd need to be terminally online to track it all.

Stocks & Income monitors every corner where real money gets made. We send you only the actionable opportunities. No fluff, no yesterday's headlines.

Five minutes daily. Walk away with stock insights you can actually act on every time.

Stocks & Income is for informational purposes only and is not intended to be used as investment advice. Do your own research.

Market Overview 📈

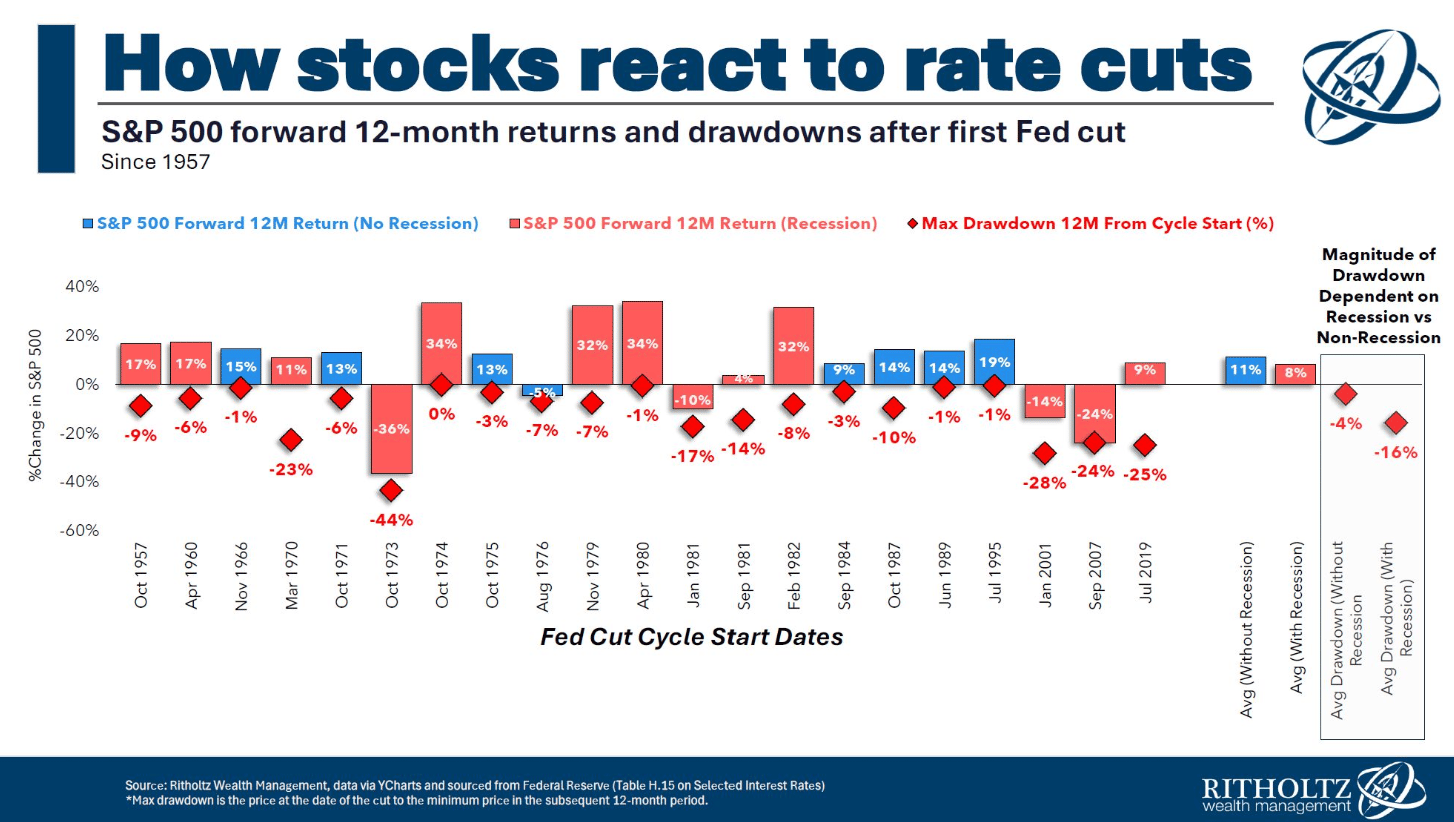

The Federal Reserve delivered exactly what markets expected on Wednesday, cutting rates by 25 basis points to a range of 4%-4.25% in an 11-1 vote.

However, Chairman Jerome Powell's characterization of the move as a "risk management cut" rather than the start of an aggressive easing cycle tempered investor enthusiasm.

Powell noted the challenging environment, saying, "There are no risk-free paths now. It's not incredibly obvious what to do."

The Fed's dot plot showed officials expecting only one more rate cut in 2026, which is slower than the market's pricing of two to three cuts.

The decision created a mixed reaction across sectors. High-flying tech stocks, such as Nvidia, Oracle, and Palantir, declined as investors took profits, while rate-sensitive sectors benefited.

Small-cap stocks in the Russell 2000 jumped 0.18%, as smaller companies typically benefit more from lower borrowing costs due to their reliance on variable financing.

Housing data added to economic concerns, with building permits and housing starts both missing estimates.

Permits fell 3.7% to 1.31 million, while starts dropped 8.5% to 1.307 million, both figures well below the consensus forecast of 1.37 million, highlighting continued weakness in the housing sector.

Stock Moves Deciphered 📈

Hologic (HOLX) rose 7.9% after the medical device maker surged on renewed takeover speculation as private equity giants Blackstone and TPG reportedly revived acquisition discussions, conducting fresh due diligence after their previous $16 billion bid was rejected.

Builders FirstSource (BLDR) fell 5.6% alongside broader weakness in the homebuilding sector, pressured by single-family housing starts declining to near 2.5-year lows amid construction industry challenges and economic uncertainty.

Alibaba (BABA) gained over 2% after securing China Unicom as a major customer for its AI accelerators from semiconductor unit T-Head, demonstrating progress in monetizing its chip development investments.

Headlines You Can't Miss 👀

📈 American Express shares gained 2.7%, as investors expect the lending environment to improve following interest rate cuts.

💰 Deutsche Bank raised its 2026 gold forecast to $4,000/oz after the precious metal hit a record $3,702.95 on Tuesday.

🏪 Walmart reached an all-time high, boosted by a Bank of America price target increase that cited its leadership in AI for retail.

🚗 Lyft skyrocketed 13% on the announcement of its Waymo partnership for Nashville robotaxi services, set to start next year.

📊 The Russell 2000 climbed within 1% of its all-time closing high from November 2021, following the rate cut.

🛒 SPDR S&P Retail ETF (XRT) hit its highest level since January 2022, up nearly 5% for September.

💸 Cytokinetics plans to raise $650 million through the issuance of convertible senior notes due in 2031.

Trending Stocks 📊

Uber Technologies (UBER) fell almost 5% after competitive pressure intensified as rival Lyft announced a partnership with Alphabet's Waymo to bring autonomous vehicles to Nashville next year.

The deal allows riders to hail Waymo robotaxis through either the Waymo One or Lyft app, marking Waymo's first collaboration with Lyft after previous partnerships with Uber in other cities.

Workday (WDAY) surged over 7% after activist investor Elliott Management disclosed a more than $2 billion stake in the HR software company.

Elliott praised Workday's management team and expressed support for the company's multi-year operational plan announced at its Financial Analyst Day. Workday also boosted its share repurchase program by an additional $4 billion.

Fox Corporation (FOX) partially recovered from last week's decline following developments from the Murdoch family trust.

The media giant benefited from renewed confidence in its streaming growth momentum and strong sports content portfolio, as investors looked past recent corporate governance concerns to focus on operational fundamentals.

What’s Next?

Key Events to Watch 👇

September historically ranks as the worst month for equities, with the S&P 500 averaging 4.2% declines over the past five years.

🧑💻 Tech sector focus continues amid AI investment themes

💸 Consumer discretionary earnings may reflect the rate cut impacts

💂 Weekly jobless claims on Thursday morning

🏠 Existing home sales data on Friday

Chart of the Day

Meme of the Day

Great investing starts with great information.

Forward The Market Scoop to anyone who wants to stay ahead of the market through a pertinent and entertaining newsletter format.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please exercise caution and conduct your own research.