- Ziggma

- Posts

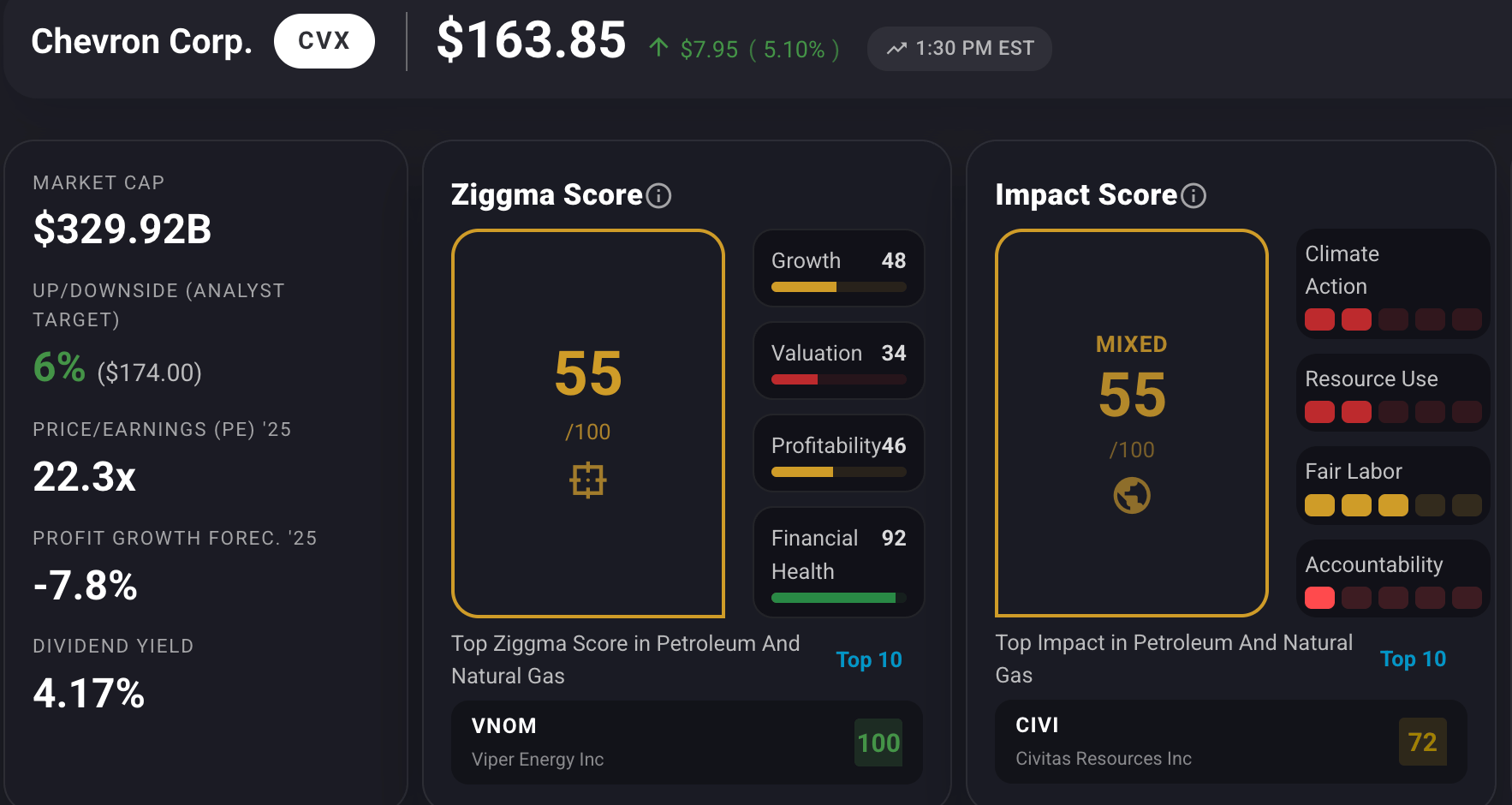

- 🚗 Chevron Spikes 5%

🚗 Chevron Spikes 5%

on Venezuela operations moat

Market Performance

S&P 500: 6,902.05 ⬆️ 0.64%

Nasdaq: 23,395.82 ⬆️ 0.69%

Dow Jones: 48,977.18 ⬆️ 1.23%

Chevron Gains Pace

President Donald Trump's military strike on Venezuela and subsequent capture of Nicolás Maduro has Wall Street buzzing, but the path forward for U.S. oil companies is far from clear.

Chevron stock rose 5% as it holds a unique advantage: it is the only major U.S. oil producer currently operating in Venezuela through government-licensed joint ventures.

While Venezuela holds the world's largest proven oil reserves at 303 billion barrels, restoring production to the 1990s peak of 3.5 million barrels per day would require a staggering $183 billion investment by 2040, according to Rystad Energy.

The real challenge? Uncertainty. With Trump initially stating the U.S. would "run" Venezuela before Secretary of State Marco Rubio appeared to walk back those comments, oil executives face the critical question: who's actually in charge in Caracas?

U.S. oil majors need 30-year stability guarantees before committing tens of billions to a country that previously nationalized assets and expelled ExxonMobil and ConocoPhillips in 2007.

Our Takeaway

This presents a classic high-risk, high-reward scenario. Chevron's existing infrastructure gives it pole position, but widespread skepticism about political stability and the sheer capital requirements mean any meaningful increases in production are years away.

Energy investors betting on a quick Venezuela windfall may need to recalibrate their expectations—this is a marathon, not a sprint.

Market Overview 📈

Markets rallied on Monday as investors shrugged off geopolitical uncertainty surrounding the Venezuelan military operation, instead focusing on potential economic opportunities.

Energy stocks led the charge, with the State Street Energy Select Sector ETF (XLE) surging nearly 3% on speculation that U.S. companies would benefit from rebuilding Venezuela's oil infrastructure.

Financial stocks joined the party, with major banks including Goldman Sachs (+3.7%) and U.S. Bancorp (+2.9%) hitting 52-week highs, as traders bet on continued economic strength in 2026.

Defense contractors also benefited, as General Dynamics and Lockheed Martin rose over 3% and 2% respectively, interpreting Trump's swift military action as signaling future intervention strategies.

Flight-to-safety assets also saw demand—gold futures jumped 2.8% for their best day since October, while Bitcoin traded above $94,000.

Treasury yields slipped modestly, with the 10-year falling to 4.177% as investors processed the weekend's dramatic events.

The sole disappointment came from manufacturing data, where the ISM manufacturing index fell to 47.9% in December, missing the 48.3% consensus and remaining in contraction territory for another month.

Stock Moves Deciphered 📈

⬆️ Coinbase (COIN)

Coinbase surged 7.77% after Goldman Sachs upgraded the cryptocurrency exchange to "Buy" from "Neutral," setting a $303 price target that implies 28% upside from current levels.

Goldman analysts highlighted Coinbase's scale and brand recognition as drivers of above-average revenue growth and market share gains, noting that recent product rollouts make the platform more competitive, particularly in new structural growth products.

💉 Eli Lilly (LLY)

Eli Lilly declined 3.6% as investors rotated out of high-flying pharmaceutical stocks following a period of strong outperformance.

The pullback appears driven by profit-taking rather than fundamental concerns, as capital moved to other market sectors.

The stock remains well-positioned with its GLP-1 franchise, but short-term momentum traders booked gains after the recent rally.

🚀 Robinhood (HOOD)

Robinhood jumped 7% after the trading platform unveiled new features aimed at attracting sophisticated crypto traders, including tax lot selection and multi-venue liquidity routing.

This strategic pivot from its beginner-focused roots signals the company's ambition to compete for advanced users, driving both trading volume and investor confidence in its ability to capture market share from established crypto exchanges.

Headlines You Can't Miss 👀

🏨 Hilton shares slipped 2% after the Department of Homeland Security accused the hotel chain of refusing service to immigration officials in Minneapolis in a coordinated campaign.

✈️ Airlines scrambled to accommodate stranded Caribbean travelers after the FAA temporarily closed airspace during Venezuela operations, with some disruptions expected to last days despite Sunday's reopening.

🇬🇱 Prediction markets saw Greenland acquisition odds rise to 23.5% on Kalshi after Trump renewed calls to take the territory, though levels remained well below earlier 2025 peaks.

🛢️ GasBuddy analyst warns Venezuela regime change won't lower gas prices soon, estimating any production increases would take years to materialize and impact pumps by "pennies per gallon, not dimes."

⚖️ Deposed Venezuelan President Maduro pleaded not guilty in Manhattan federal court to narco-terrorism and drug trafficking charges alongside his wife, Cilia Flores, who also pleaded not guilty.

Trending Stocks 📊

🛖 QXO (QXO)

The roofing and construction products distributor surged 18% after announcing a $1.2 billion preferred equity investment led by private equity giant Apollo.

The substantial capital infusion provides QXO with significant firepower for acquisitions and growth initiatives in the fragmented building products sector.

The deal validates QXO's strategy and positions the company to accelerate its rollup strategy in construction materials distribution.

🚗 Mobileye (MBLY)

The autonomous vehicle technology maker rose 1.5% following a Barclays upgrade to "Overweight" from "Equal Weight."

The investment bank cited a "favorable" risk/reward backdrop for the rating change, suggesting the stock's recent weakness has created an attractive entry point.

Despite near-term headwinds in the auto sector, Barclays expects Mobileye's advanced driver assistance technology to capture increasing market share.

⬇️ Jabil (JBL)

Jabil tumbled over 7% amid a broader rotation away from cyclical manufacturing stocks.

As a major electronics manufacturing services provider, the company faced selling pressure from concerns about potential sector slowdowns, despite no company-specific negative news.

The decline reflects investors repositioning away from industrial exposure amid weak manufacturing data.

💰 Okta (OKTA)

The access management platform company popped roughly 5% after announcing a $1 billion share buyback program.

The substantial repurchase authorization signals management's confidence in the business and commitment to returning capital to shareholders.

The buyback program will run through fiscal 2028, providing ongoing support for the stock.

What’s Next?

Key market and macro news 👇

📊 The Institute for Supply Management (ISM) is expected to release its Services Purchasing Managers' Index (PMI). This report is a key indicator of the health of the U.S. services sector.

🇪🇺 Services growth data from the Eurozone will be closely watched. Signs of acceleration could lead the European Central Bank to adjust its growth forecasts, potentially impacting the euro and international markets.

📖 Following the release of key employment figures around this time, including the Non-Farm Payrolls report, investors will be analyzing the data for signs of economic momentum and its impact on Federal Reserve policy.

🎤 News and announcements from CES, where companies like AMD and NVIDIA often unveil new products, could continue to influence the tech sector.

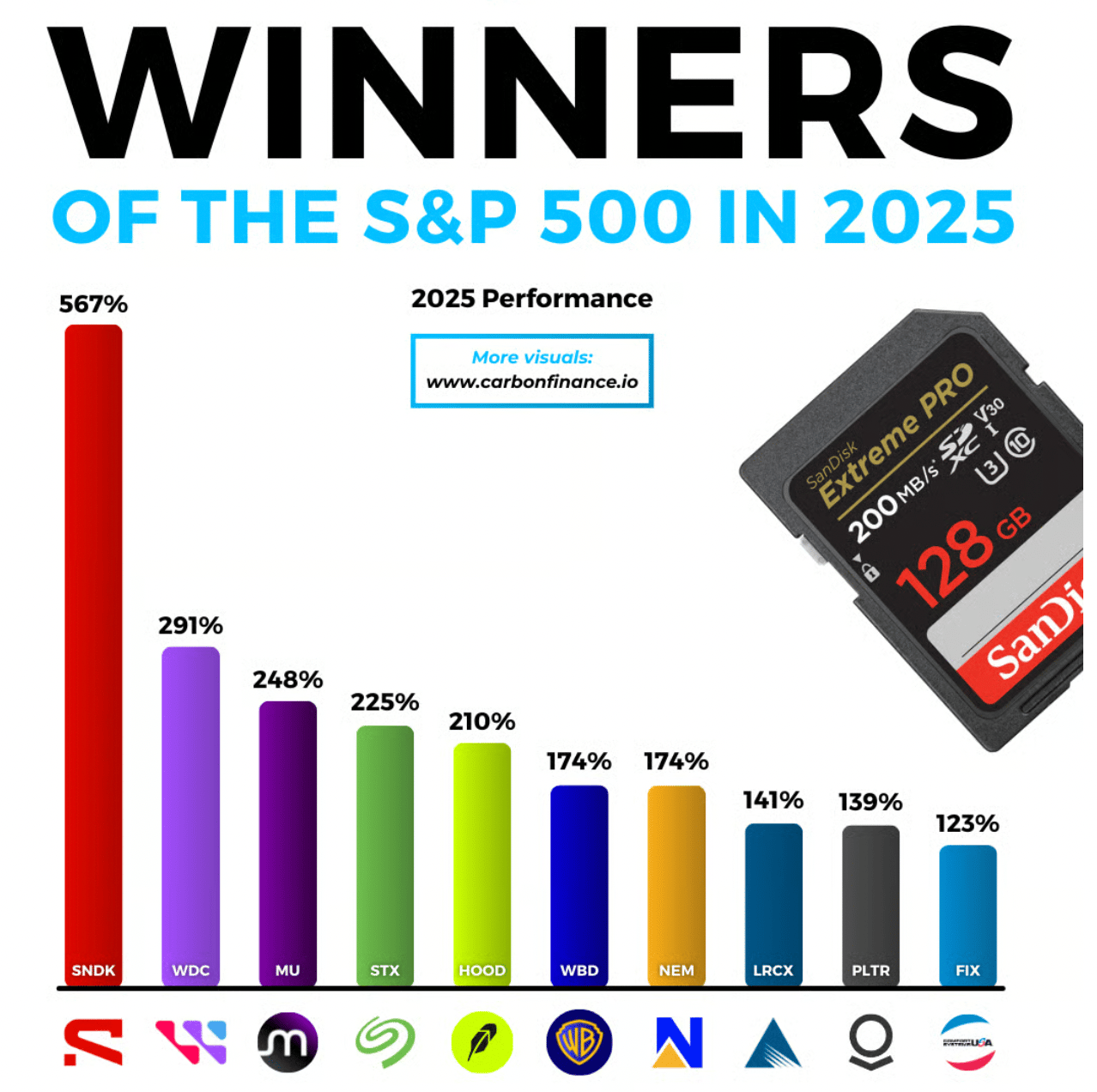

Chart of the Day

Meme of the Day

Great investing starts with great information.

Forward The Market Scoop to anyone who wants to stay ahead of the market through a pertinent and entertaining newsletter format.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please exercise caution and conduct your own research.