- Ziggma

- Posts

- 🗞️ Broadcom's AI Moat Widens

🗞️ Broadcom's AI Moat Widens

Big Moves Decoded: JPM, Bloom Energy, and Shake Shack

Market Performance

S&P 500: 6,654.72 ⬆️ 1.56%

Nasdaq: 22,694.61 ⬆️ 2.21%

Dow Jones: 46,067.58 ⬆️ 1.29%

Broadcom Partners With OpenAI

Broadcom (AVGO) and OpenAI just announced they're jointly building 10 gigawatts of custom AI accelerators, a massive infrastructure play that sent Broadcom shares soaring nearly 10% on Monday.

While these companies have been working together quietly for 18 months, they're now going public with plans to deploy OpenAI-designed chips starting late next year.

OpenAI is taking control of its own destiny by designing custom chips rather than relying solely on Nvidia's hardware.

Considering a 1-gigawatt data center costs roughly $50 billion, with $35 billion allocated just to chips, the cost savings from custom silicon are enormous.

OpenAI CEO Sam Altman put it bluntly: designing their own chips means "huge efficiency gains" that translate to "faster models, cheaper models—all of that."

OpenAI currently operates on just over 2 gigawatts of capacity. This partnership adds 10 gigawatts, with Altman hinting that even this massive expansion is "just the beginning."

Over the past three weeks alone, OpenAI has announced roughly 33 gigawatts of compute commitments across partnerships with Nvidia, Oracle, AMD, and now Broadcom.

Broadcom has a Ziggma score of 89, as it ranks highly in terms of profitability and financial health.

The tech giant has surged more than 700% in the last three years and trades at an elevated multiple.

Our Takeaway

Broadcom's position as the infrastructure backbone for AI is being cemented with every major partnership announcement.

The company has already surpassed a $1.5 trillion market cap and is up over 50% this year.

While OpenAI isn't the mystery $10 billion customer Broadcom disclosed last month, this deal proves that custom AI chip development is rapidly becoming the new competitive battleground.

For investors, Broadcom's Ethernet-based AI infrastructure is becoming indispensable as the race toward artificial general intelligence accelerates.

Myth: Pet insurance doesn’t cover everything

Many pet owners worry that insurance won’t cover everything, especially routine care or pre-existing conditions. While that’s true in many cases, most insurers now offer wellness add-ons for preventive care like vaccines, dental cleanings, and check-ups, giving you more complete coverage. View Money’s pet insurance list to find plans for as low as $10 a month.

Market Overview 📈

Stocks rebounded sharply on Monday, recovering from Friday's brutal $2 trillion selloff after President Trump walked back his aggressive stance on China.

Trump's Sunday Truth Social post—"Don't worry about China, it will all be fine!"—was enough to soothe investor nerves rattled by Friday's threat of "massive tariffs" and cancellation of his meeting with Chinese President Xi.

Vice President JD Vance reinforced the conciliatory tone, suggesting negotiations remain possible if Beijing proves "willing to be reasonable."

The tech sector led gains with a 2.5% jump, the best day since May, as companies heavily dependent on Chinese rare earths and manufacturing breathed easier.

Oracle rallied over 5%, Nvidia climbed nearly 3%, and nearly four out of five S&P 500 components traded higher, signaling a broad-based recovery.

However, concerns remain as the government shutdown stretches into a new week with a major payroll deadline looming on October 15.

Meanwhile, earnings season kicks off this week with major banks including Citigroup, Goldman Sachs, JPMorgan Chase, Wells Fargo, Bank of America, and Morgan Stanley all reporting results.

Stock Moves Deciphered 📈

🛍️ Best Buy (BBY)

The electronics retailer surged 10% as easing U.S.-China trade tensions provided significant relief.

Following Trump's conciliatory Sunday post, which walked back tariff threats, investor confidence returned for a company heavily dependent on Chinese-manufactured products.

Best Buy sources a substantial portion of its inventory from China, making it particularly vulnerable to tariff escalations.

🏗️ Fastenal (FAST)

Industrial distributor Fastenal plunged 7.5% after disappointing third-quarter earnings results, marking it as the S&P 500's worst performer for the day.

The company missed analyst expectations as rising operational costs squeezed margins, while slowing industrial production reduced demand for its fasteners and supplies.

Fastenal serves as a bellwether for manufacturing activity, and its weak results signal broader challenges in the industrial economy.

🃏Las Vegas Sands (LVS)

Casino operator Las Vegas Sands fell 6.3% following weak Macau gaming revenue data that disappointed investors.

Super Typhoon Ragasa forced casino closures across the region during what should have been a lucrative period.

The Golden Week holiday had already yielded soft results, with visitors prioritizing entertainment, such as basketball games and concerts, over gambling tables.

Headlines You Can't Miss 👀

🌍 Silver futures approach nominal all-time high, touching $50.095/ounce, close to eclipsing the 1980 peak of $50.35 without inflation adjustment.

💎 USA Rare Earth and other U.S. miners surge 18-24% after Trump threatens retaliation against China's strict rare earth export controls.

🏛️ Philadelphia Fed President Anna Paulson expects tariff price increases to be temporary and supports additional rate cuts this year while advocating caution going forward.

₿ Cryptocurrency rebounds after traders suffered record $19B in liquidations during Friday's selloff, with Bitcoin and Ethereum recovering 8% and 15% respectively from lows.

💻 Intel and Texas Instruments downgraded to underperform by Bank of America, citing limited AI exposure and tariff-related industrial demand concerns weighing on near-term outlook.

🛒 SPDR S&P Retail ETF (XRT) rallies nearly 3% for its best day since July 22, rebounding from Friday's 3.12% decline as China-exposed retailers recover.

🔍 UBS warns pullbacks linked to U.S.-China trade war offer opportunities for investors to add long-term equity exposure, maintaining bull market will remain intact despite volatility.

Trending Stocks 📊

🔋 Bloom Energy (BE)

The energy stock skyrocketed 26.5% after announcing a $5 billion partnership with Brookfield Asset Management to deploy hydrogen and natural gas fuel cells for AI data centers.

The deal provides on-site power that can be activated quickly without relying on traditional electric grid infrastructure.

The bank stock gained 2.4% after announcing its Security and Resiliency Initiative, a decade-long plan to invest up to $10 billion in companies.

These companies will be part of sectors such as defense, aerospace, AI, quantum computing, energy tech, and advanced manufacturing, deemed critical to U.S. national security.

🎫 StubHub (STUB)

The online ticket marketplace advanced approximately 4% following bullish research coverage initiations from multiple Wall Street analysts.

The positive analyst sentiment came less than a month after StubHub's September 17 initial public offering, signaling growing confidence in the platform's business model.

What’s Next?

Key market and macro news 👇

🍼 Johnson & Johnson Earnings & M&A: J&J reports Q3 earnings while also in talks to acquire Protagonist Therapeutics, potentially impacting its stock based on financial performance and the strategic value of the acquisition.

💰 BlackRock Q3 Earnings: The world's largest asset manager, BlackRock, reports Q3 earnings. Focus will be on assets under management (AUM) growth and revenue, reflecting investor confidence and market trends.

🎤Other Key Earnings: Domino's Pizza, Walgreens, and Ericsson also report earnings, providing a snapshot of consumer spending, retail health, and the telecommunications sector's performance in the current economic climate.

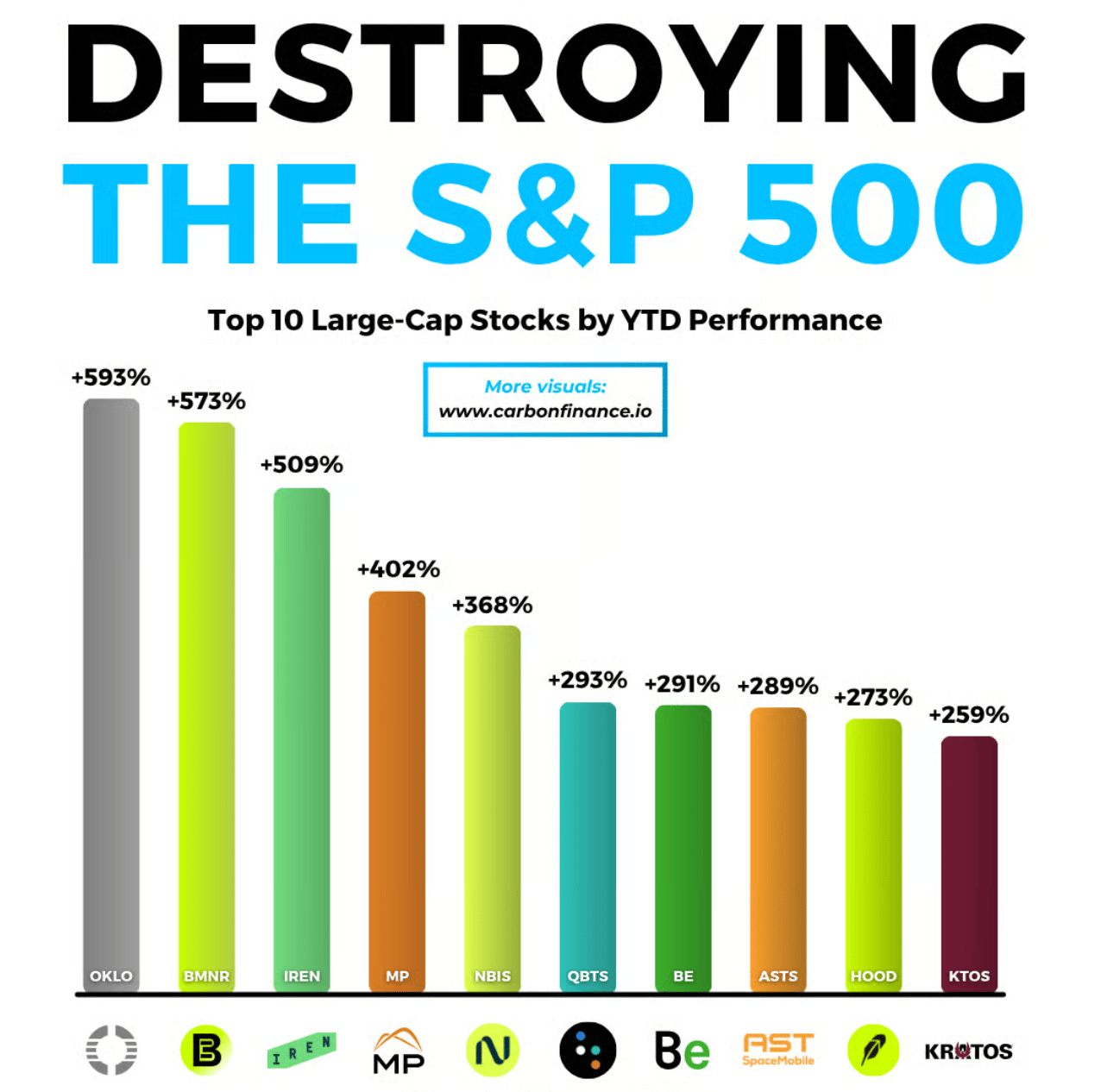

Chart of the Day

Source: Carbon Finance

Meme of the Day

Great investing starts with great information.

Forward The Market Scoop to anyone who wants to stay ahead of the market through a pertinent and entertaining newsletter format.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please exercise caution and conduct your own research.