- Ziggma

- Posts

- 🗞 Broadcom Jumps to Record Highs

🗞 Broadcom Jumps to Record Highs

as AI sentiment remains bullish

Market Performance

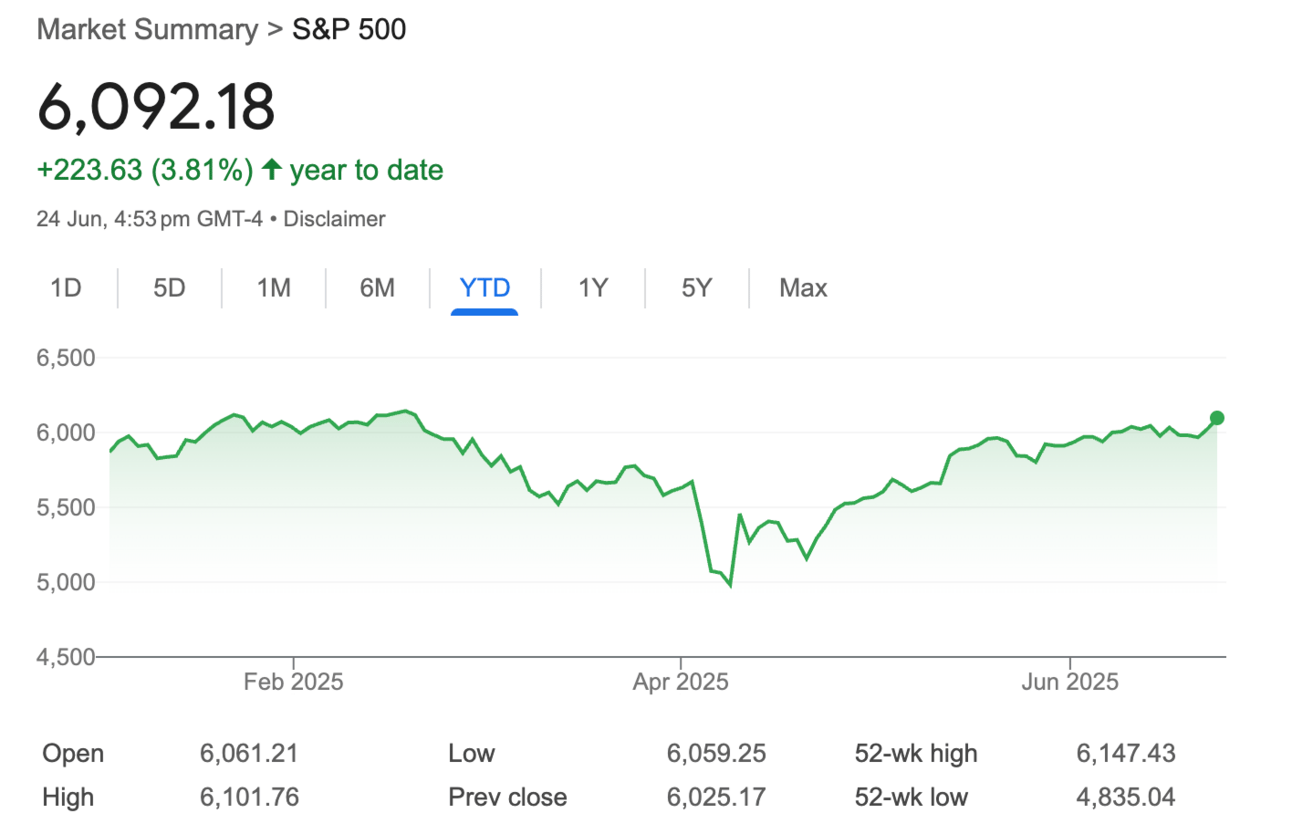

S&P 500: 6,092.18 (+1.11%)

Nasdaq: 19,912.53 (+1.43%)

Dow Jones: 43,089.02 (+1.19%)

Broadcom Hits Record High on ASIC Optimism

Broadcom (NASDAQ:AVGO) shares reached an all-time high of $265.87 on Tuesday, gaining over 3% after HSBC upgraded the semiconductor giant to "buy" from "hold."

The Wall Street firm raised its price target for AVGO stock to $400 from $240, a massive 58% upside from Monday's close.

The upgrade centers on confidence in Broadcom's Application-Specific Integrated Circuits (ASICs) business, which designs and manufactures custom chips for specific computing tasks.

"We turn positive on Broadcom as we now believe its ASIC revenues will significantly beat market expectations from better ASIC project visibility as well as ASP pricing power," HSBC analysts wrote.

This isn't just another chip story; it's about AI infrastructure at scale. Broadcom reported $4.4 billion in AI revenue last quarter and expects $5.1 billion in Q3, with CEO Hock Tan noting that hyperscale partners (think Amazon, Google, Microsoft) remain "unwavering" in their AI investments through fiscal 2026.

Our Takeaway

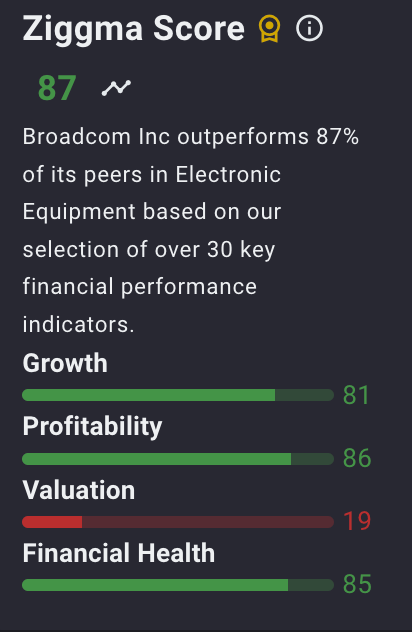

Broadcom's ASIC dominance positions it as the backbone of AI infrastructure buildout.

While the stock trades at premium valuations, the company's unique position serving hyperscalers with custom AI accelerators creates significant moats that justify the premium.

The 58% upside target reflects the market's growing recognition that AI infrastructure spending is far from reaching its peak.

Quick, hard-hitting business news.

Morning Brew was built on a simple idea: business news doesn’t have to be boring.

Today, it’s the fastest-growing newsletter in the country with over 4.2 million readers—thanks to a format that makes staying informed both easy and enjoyable.

Each morning, Morning Brew delivers the day’s biggest stories—from Wall Street to Silicon Valley and beyond—in bite-sized reads packed with facts, not fluff, and just enough wit to keep things interesting.

Try the newsletter for free and see why busy professionals are ditching jargon-heavy, traditional business media for a smarter, faster way to stay in the loop.

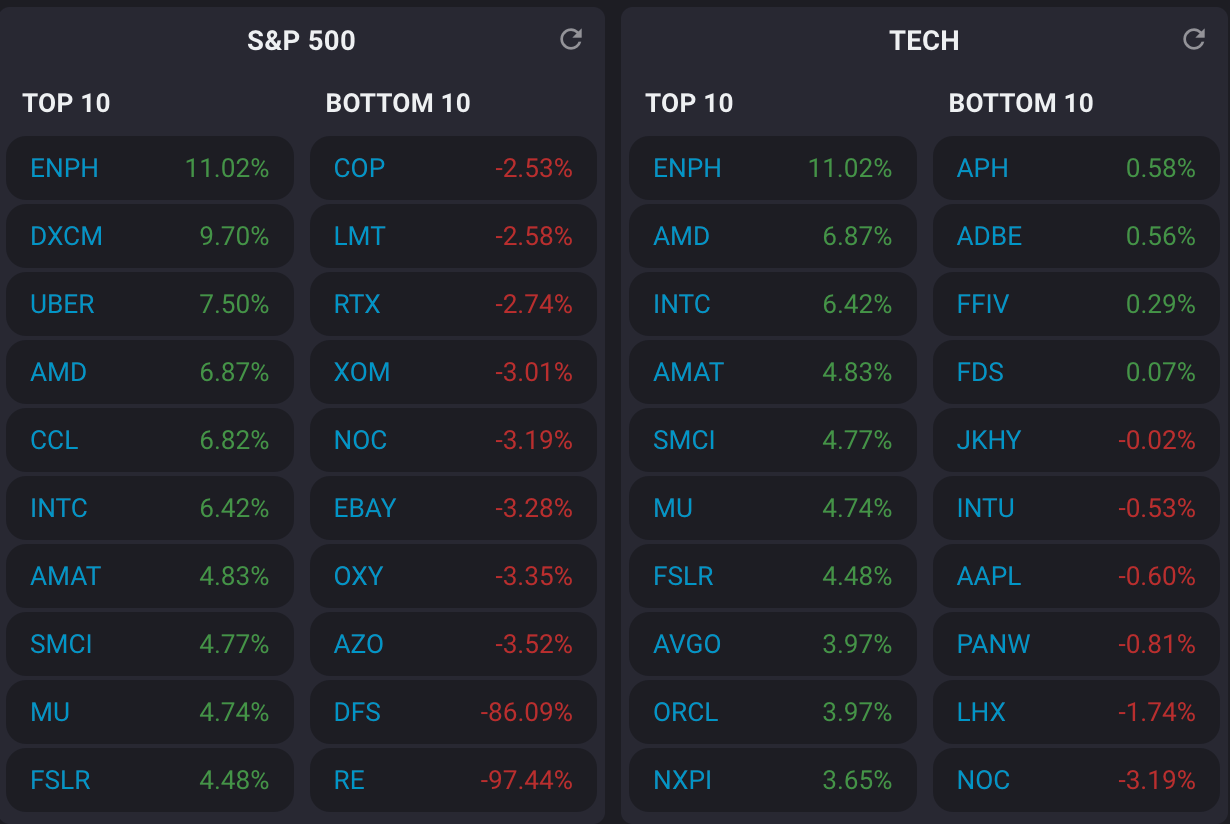

Market Overview

Markets surged on Tuesday as the fragile Iran-Israel ceasefire held, sending oil prices tumbling for the second consecutive day.

The S&P 500 climbed 1.11% while WTI crude oil plummeted 6%, extending Monday's 7% decline.

President Trump's early morning social media posts reinforced the ceasefire, declaring "THE CEASEFIRE IS NOW IN EFFECT. PLEASE DO NOT VIOLATE IT!"

The risk-on sentiment was palpable across sectors. Airline stocks rallied as jet fuel costs dropped — United Airlines and Delta both gained over 2%.

Semiconductors led the charge, with the sector up over 3%, while defensive plays, such as gold miners, retreated by more than 2%.

Fed Chair Jerome Powell's testimony before the House Financial Services Committee added another layer of optimism.

Powell signaled patience on rate cuts, noting tariff impacts "just isn't showing up yet" in consumer prices. His measured approach suggests the Fed won't rush into aggressive tightening, providing a supportive backdrop for risk assets.

The Nasdaq 100 notched its first record close since February, underlining the market's resilience despite geopolitical tensions and trade uncertainties.

Headlines You Can't Miss

NATO aims to spend 5% of GDP on defense spending targets amid growing geopolitical tensions.

Tesla robotaxi incidents caught on camera in Austin draw regulators' attention to safety protocols.

Airlines divert and cancel more Middle East flights after Iran attacks U.S. military base.

JPMorgan hits record high with shares up over 17% year-to-date.

Microsoft reaches another record high with a market cap above $3.6 trillion.

China doubles down on promoting yuan as confidence in U.S. dollar takes a beating.

Treasury yields fall even after Powell says Fed can wait to cut rates.

Consumer confidence for June misses expectations, falling 5.4 points to 93.

Trending Stocks

Carnival (CCL)

Cruise giant Carnival surged nearly 9% after demolishing Q2 expectations. The company reported earnings of $0.35 per share, exceeding the expected $0.25, with revenue reaching $6.33 billion, surpassing the estimated $6.21 billion.

Carnival's 4% net yield growth target for H2 remains intact despite macroeconomic headwinds.

CEO Quote🎤: "We also remain on track for a strong 4 percent net yield growth in the second half, consistent with what we forecasted back in December, which was before the complex macroeconomic and geopolitical backdrop we have all experienced in the last few months. Combined, this has enabled us to raise full year guidance again.”

Dollar General (DG)

Goldman Sachs downgraded the discount retailer to neutral from buy, citing limited upside after the stock's remarkable year-to-date rally of more than 50%. Analyst Kate McShane set a $116 price target, implying minimal upside.

While acknowledging management's successful "Back to Basics" program has improved comps and margins, Goldman believes the recovery story is now fully priced in.

The stock's 30% rally in Q2 has prompted investors to question whether its fundamentals justify current levels.

Analyst Quote🎤: “DG’s management team has worked hard to improve the company’s positioning through its Back to Basics program, which has resulted in better comp trends and improved margins. While we think the company still has room for margin improvement over the long term, we think the stock is now pricing in its better fundamentals.”

Chewy (CHWY)

The pet e-commerce stock dipped 1.5% after the company announced a $1 billion secondary offering, while simultaneously authorizing a $100 million share buyback.

The mixed signals reflect management's complex capital allocation priorities. With pet spending remaining resilient despite economic pressures, Chewy's long-term growth trajectory remains intact, but near-term volatility from the equity offering is expected.

CEO Quote🎤: “The pet industry continues to show remarkable resilience, and we're confident in our ability to capture market share.”

What’s Next?

Key companies reporting earnings include:

Micron Technology

Paychex

General Mills

Jefferies Financial Group

H.B. Fuller

Investors should anticipate a volatile session, given macroeconomic uncertainty and a cautious Federal Reserve policy backdrop.

Downside risks include persistent inflationary pressures, a slowing economy, and potential policy shocks.

Portfolio diversification and a focus on quality growth remain prudent strategies.

Track upcoming news and earnings with Ziggma to get personalized alerts.

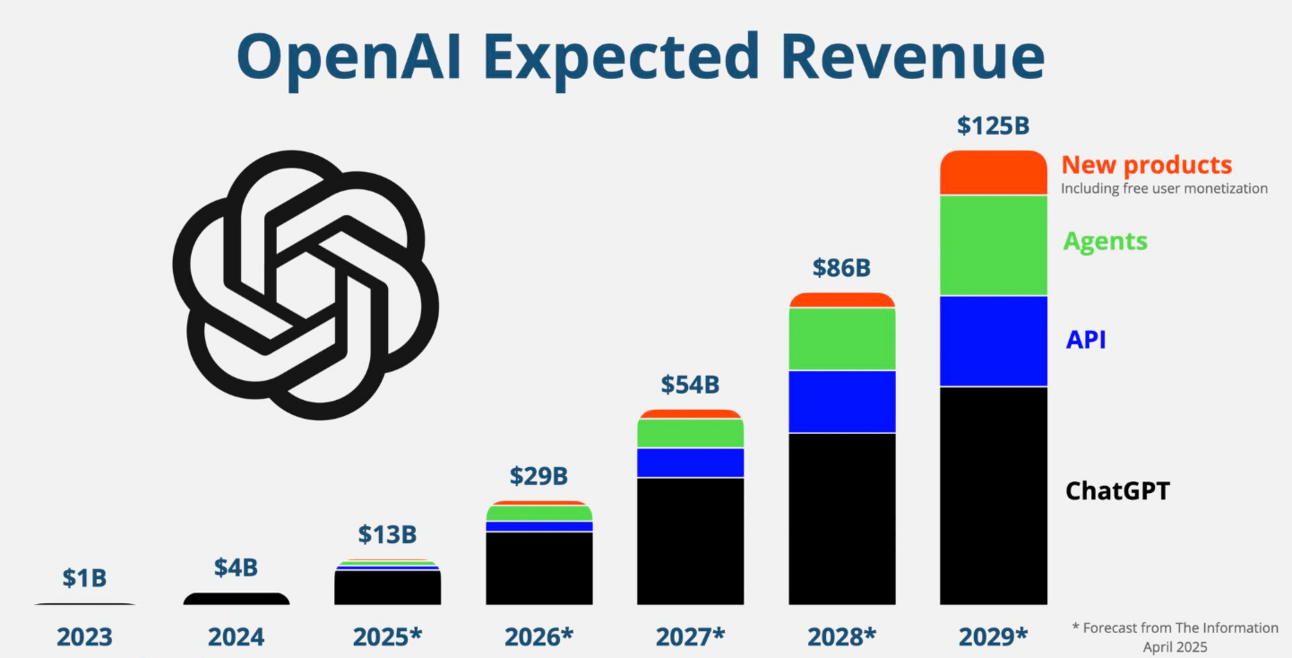

Chart of the Day

Source: App Economy Insights

Meme of the Day

Great investing starts with great information. Forward The Market Scoop to anyone who wants to stay ahead of the equity market.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.