- Ziggma

- Posts

- 🗞️ Broadcom Leads Tech Sell-off

🗞️ Broadcom Leads Tech Sell-off

Big Moves Decoded: LULU, ANET, and more!

Market Performance

S&P 500: 6,827.41 ⬇️ 1.07%

Nasdaq: 23,195.17 ⬇️ 1.69%

Dow Jones: 48,458.05 ⬇️ 0.51%

Broadcom Tanks 11% Despite Strong Results

Broadcom's (AVGO) quarterly results sailed past Wall Street estimates. It didn't matter.

The chipmaker's shares plummeted 11% on Friday, their worst day since January, as investors fled the AI trade.

The selloff came despite Broadcom reporting 28% revenue growth and a staggering 74% increase in AI chip sales to $18.02 billion—easily beating the $17.49 billion estimate.

CEO Hock Tan delivered more good news: AI chip sales are expected to double this quarter to $8.2 billion, driven by custom chips and AI networking semiconductors.

The company also revealed a massive $73 billion backlog of AI orders over the next 18 months, including $21 billion from newly disclosed customer Anthropic.

So why the selloff? Margin compression concerns spooked investors. CFO Kirsten Spears acknowledged that gross margins will be lower on some AI chip systems due to higher upfront costs for server rack components.

Additionally, Tan tempered expectations for OpenAI revenue, stating, "We do not expect much in '26" despite their multibillion-dollar agreement announced in October.

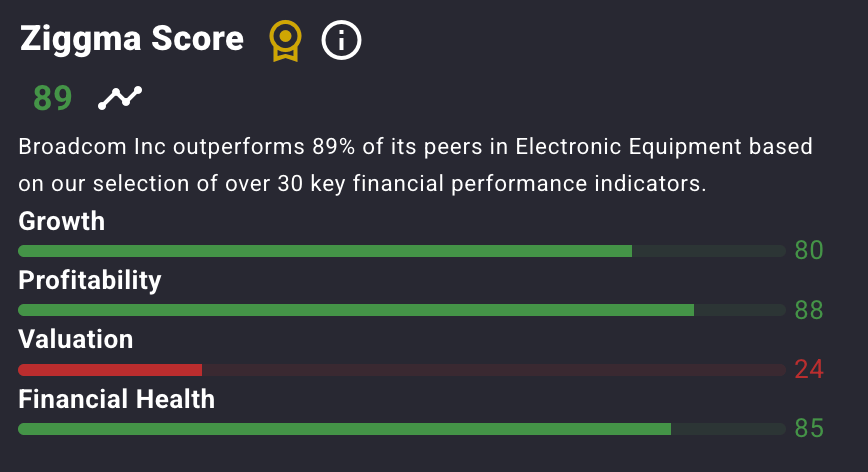

Broadcom stock has a Ziggma score of 89 and ranks above most peers in terms of profitability, growth, and financial health.

The chip giant has returned close to 2,400% in the past decade and trades at a steep valuation in December 2025.

Our Takeaway

The AI infrastructure story isn't broken—it's experiencing growing pains. Broadcom's $73 billion backlog and doubling AI chip sales prove demand remains robust.

However, investors are recalibrating expectations around margins and near-term revenue recognition.

This rotation away from high-flying tech into value stocks is healthy market behavior, not a fundamental shift in AI's long-term trajectory.

Smart investors should view this pullback as a potential entry point for companies with proven AI revenue streams.

Market Overview 📈

U.S. equities retreated on Friday as investors continued rotating out of technology stocks and into value-oriented areas of the market.

The rotation intensified following the Federal Reserve's third interest rate cut this year on Wednesday.

Investors poured into cyclical stocks—financials, healthcare, and industrials—sensitive to economic growth, while taking profits from AI-linked growth names.

Visa, Mastercard, UnitedHealth Group, and GE Aerospace led the charge among value stocks.

Small-cap companies particularly benefited from the lower-rate environment, with the Russell 2000 jumping 1.2% for the week despite Friday's 1.51% decline.

The index hit multiple all-time highs this week as investors pressed into market segments most impacted by lower rates.

The week's action underscored a clear bifurcation: the Dow gained 1.1% while the S&P 500 and Nasdaq lost 0.6% and 1.6% respectively.

Goldman Sachs led Dow gains with a 5% weekly advance, while Alphabet and Meta suffered the steepest Magnificent Seven losses, down 3.6% and 4.1%.

"Today is a value-outperforms-growth day," said Jed Ellerbroek of Argent Capital Management.

"Investors are definitely skittish as it relates to AI—not outright pessimistic, but just kind of cautious and nervous and hesitant."

Stock Moves Deciphered 📈

👕 Lululemon Athletica (LULU)

Lululemon shares surged nearly 10% after the athletic retailer announced CEO Calvin McDonald's departure effective January 31, following more than a year of underperformance.

The company also beat third-quarter expectations with revenue rising 7% to $2.6 billion and announced a $1.0 billion increase in its stock repurchase program.

Earnings of $2.73 per share exceeded analyst estimates, while comparable sales grew 2%. The board is working with a leading executive search firm to identify a replacement.

🌾 The Mosaic Company (MOS)

Mosaic climbed as investors engaged in bargain-hunting following recent weakness. The fertilizer producer reported a remarkable 300% year-over-year increase in Q3 net income, driven by strong production levels and improved pricing power.

Net earnings reached $145 million compared to $36 million in the prior-year period, while potash production volumes increased significantly.

Broader positive sentiment in the agricultural commodities sector also contributed to the stock's upward momentum as global demand for fertilizers remains robust.

🛫 General Electric (GE)

GE's stock rose after Citigroup initiated coverage with a "Buy" rating and a compelling price target, citing the company's aerospace division as a key growth driver.

Positive developments included a favorable FAA directive regarding engine maintenance protocols and a newly announced partnership in China to expand aerospace manufacturing capabilities.

The company's transformation into a focused aerospace and energy business continues to resonate with investors, with the stock benefiting from strong demand in commercial aviation and defense spending trends.

Headlines You Can't Miss 👀

🏛️ Chicago Fed's Goolsbee explains rate cut dissent, saying he's "uncomfortable front-loading too many rate cuts" despite optimism that rates could be lower in 2026.

💼 Philadelphia Fed's Paulson views the labor market as a bigger threat than inflation, suggesting room for more rate cuts if unemployment weakness emerges going forward.

📈 UBS forecasts the S&P 500 could reach 7,700 by the end of 2026, driven by Magnificent Seven profitability and accelerating investment themes in AI, power, and longevity.

🏢 Texas data center demand creating potential bubble, with experts warning inflated forecasts could leave investors stuck with excess infrastructure as speculative projects clog grid connections.

✈️ American Airlines upgraded to buy by UBS with $20 price target, citing corporate revenue recovery and loyalty income expansion opportunities ahead; shares rose 1%.

🏗️ Quanex Building Products surged 9% after posting fiscal Q4 earnings of 83 cents per share on $789.8 million revenue, crushing estimates of 52 cents and $470.7 million.

💊 Lantheus gained 6% following Truist upgrade to buy from hold, with analysts seeing compelling Q4 2026-2027 growth and profit reacceleration prospects justifying early positioning.

Trending Stocks 📊

🚬 Tilray Brands (TLRY)

Tilray shares exploded 44% on Friday after reports emerged that President Donald Trump is expected to issue an executive order as early as Monday to reclassify marijuana from Schedule I to Schedule III.

This reclassification would allow cannabis companies to fall under different tax regulations and encourage institutional investment in the sector, potentially unlocking billions in capital.

🤖 Oracle (ORCL)

Oracle shares fell over 4%, extending weekly losses to more than 12%, despite the company denying a Bloomberg report claiming delays in OpenAI data center projects.

A spokesperson told CNBC there have been "no delays to any sites required to meet our contractual commitments."

Oracle's $300 billion five-year deal with OpenAI for computing power starts in 2027, but investor concerns persist about revenue timing and debt financing.

💸 Wealthfront (WLTH)

Fintech startup Wealthfront opened at $14 per share on the Nasdaq on Friday, in line with its IPO price, as the robo-advisor went public.

Led by CEO David Fortunato, Wealthfront manages $88.2 billion in assets for 1.3 million customers.

The IPO makes it the latest fintech to go public this year alongside Klarna and Chime, signaling continued investor appetite for automated investing platforms.

What’s Next?

Key market and macro news 👇

📊 NY Fed Manufacturing Index to release which measures regional industrial production trends and business sentiment in critical economic region.

🏠 NAHB Housing Market Index for December reflects builder sentiment on housing demand; a strong reading supports homebuilder stocks and construction sector valuations.

🇨🇦 Canadian CPI Data for November will be released, and inflation readings could pressure expectations for Bank of Canada policy.

🇪🇺 European Industrial Production October data affects European equity markets and signals the trajectory of global manufacturing demand.

💬 Federal Reserve Governor Stephen Miran delivers a speech on monetary policy and economic outlook, influencing rate expectations and equity valuations.

🇮🇳 India WPI Inflation data for November impact commodity prices, emerging-market currencies, and U.S. multinational earnings from Asian operations.

🇧🇷 Brazil Economic Activity Index for October at 12:00 PM UTC measures Brazilian economic performance; weakness signals emerging market slowdown affecting U.S. corporations and commodities.

Chart of the Day

Source: App Economy Insights

Meme of the Day

Great investing starts with great information.

Forward The Market Scoop to anyone who wants to stay ahead of the market through a pertinent and entertaining newsletter format.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please exercise caution and conduct your own research.