- Ziggma

- Posts

- 🗞 Boeing vs. Airbus

🗞 Boeing vs. Airbus

Plus: The Fed maintains interest rates

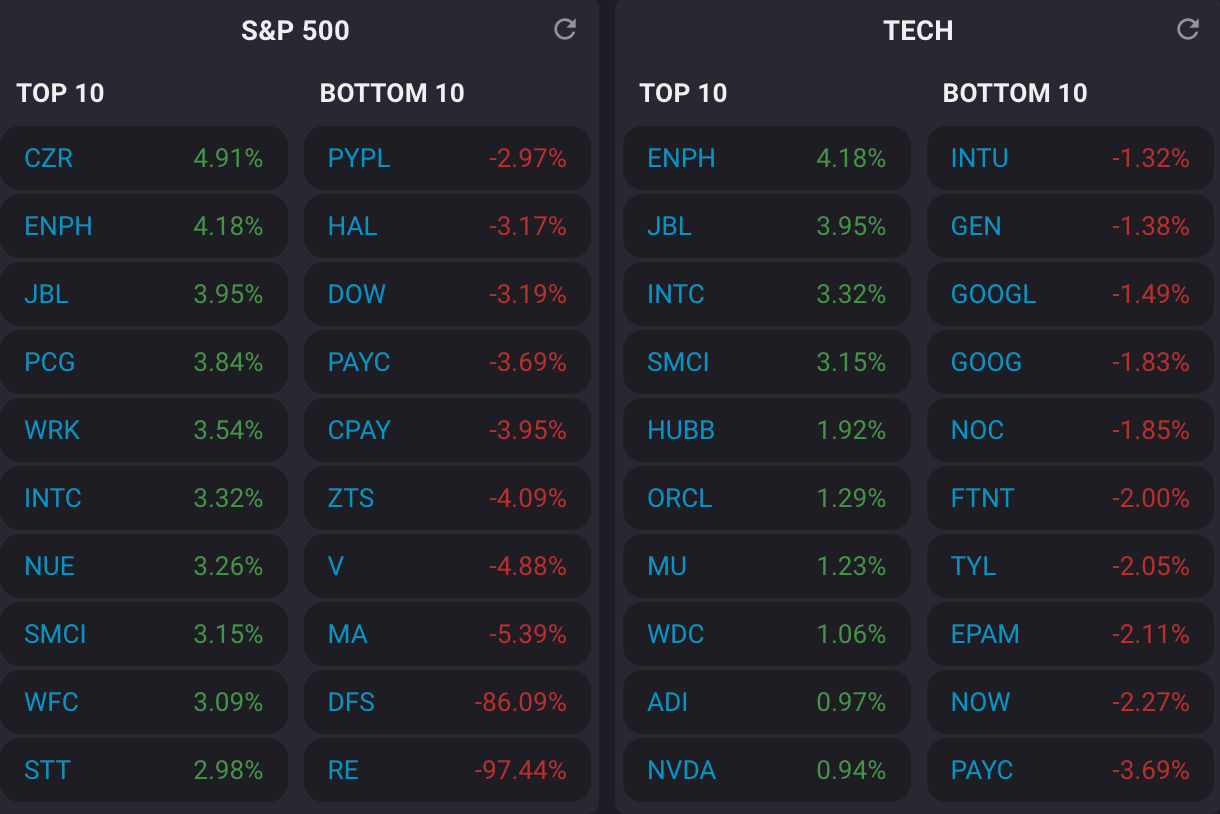

Market Performance

S&P 500: 5,980.37 (-0.031%)

Nasdaq: 19,546.27 (+1.52%)

Dow Jones: 42,171.66 (-0.10%)

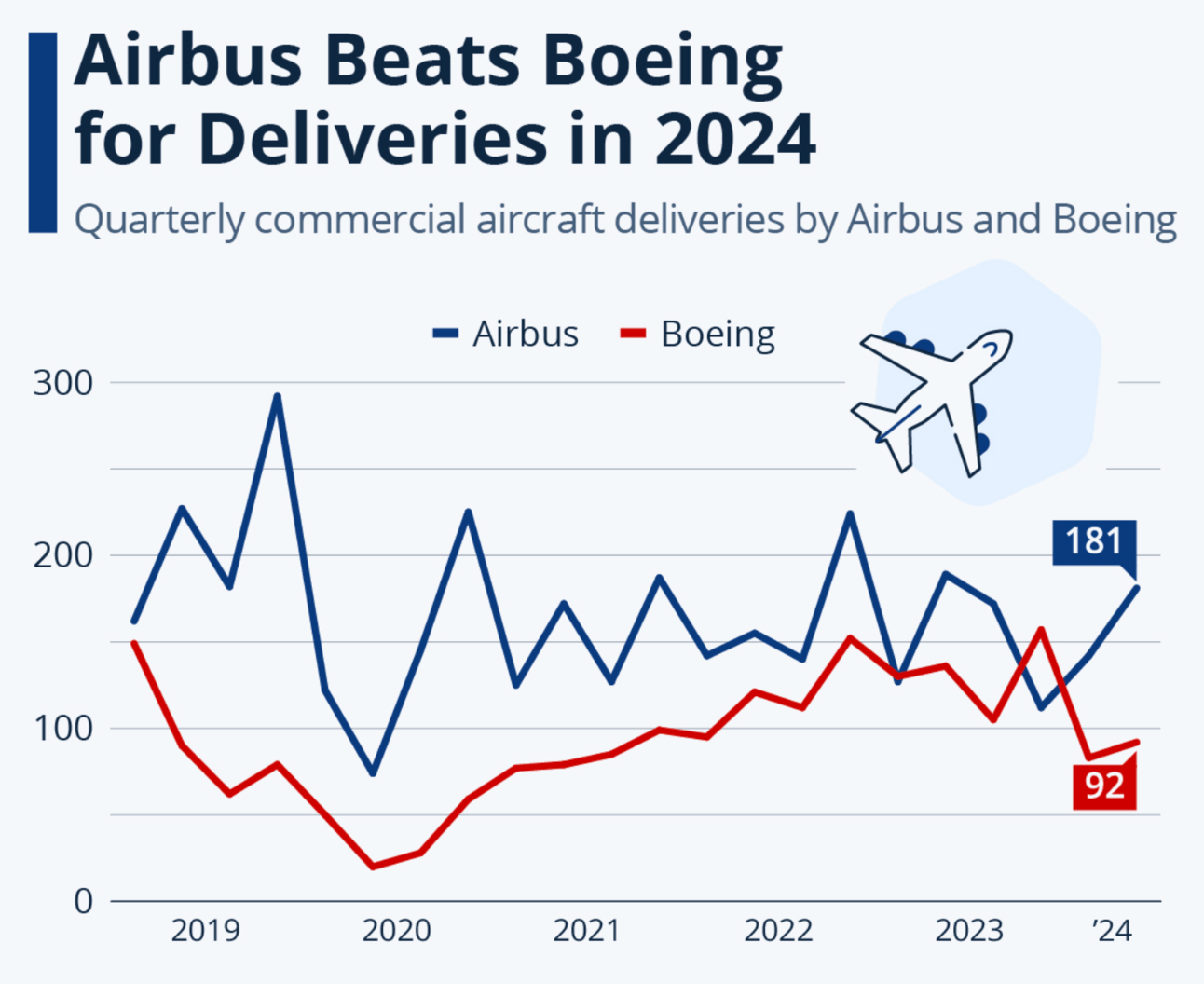

Airbus Dominates Paris Air Show

Here's something that perfectly captures the current state of aviation 👇

Airbus secured nearly $21 billion in orders at the Paris Air Show, while Boeing (NYSE:BA) made virtually no announcements and maintained an unusually low profile.

The contrast couldn't be starker. Airbus bagged 132 firm orders on Monday alone from major customers, including Saudi Arabia's AviLease, Japan's ANA, and Poland's LOT.

Source: Statista

Meanwhile, Boeing managed 41 orders and then went completely silent for the following two days. Even Brazil's Embraer outpaced Boeing's momentum with strategic wins.

What's driving this? Boeing's self-imposed exile isn't about weak demand—both manufacturers have backlogs stretching to 2031-2032.

This is about a company still grappling with crisis after crisis. From the 737-Max disasters starting in 2019, to quality control issues, delivery delays, and now the recent Air India Dreamliner crash that forced CEO Kelly Ortberg to skip the show entirely.

Our Takeaway

Airbus is capitalizing on Boeing's reputational struggles to cement its market leadership.

With airlines desperate to replace aging fleets and travel demand surging, this Paris Air Show may mark a pivotal moment where Airbus pulls decisively ahead in the commercial aviation race.

Learn AI in 5 minutes a day

This is the easiest way for a busy person wanting to learn AI in as little time as possible:

Sign up for The Rundown AI newsletter

They send you 5-minute email updates on the latest AI news and how to use it

You learn how to become 2x more productive by leveraging AI

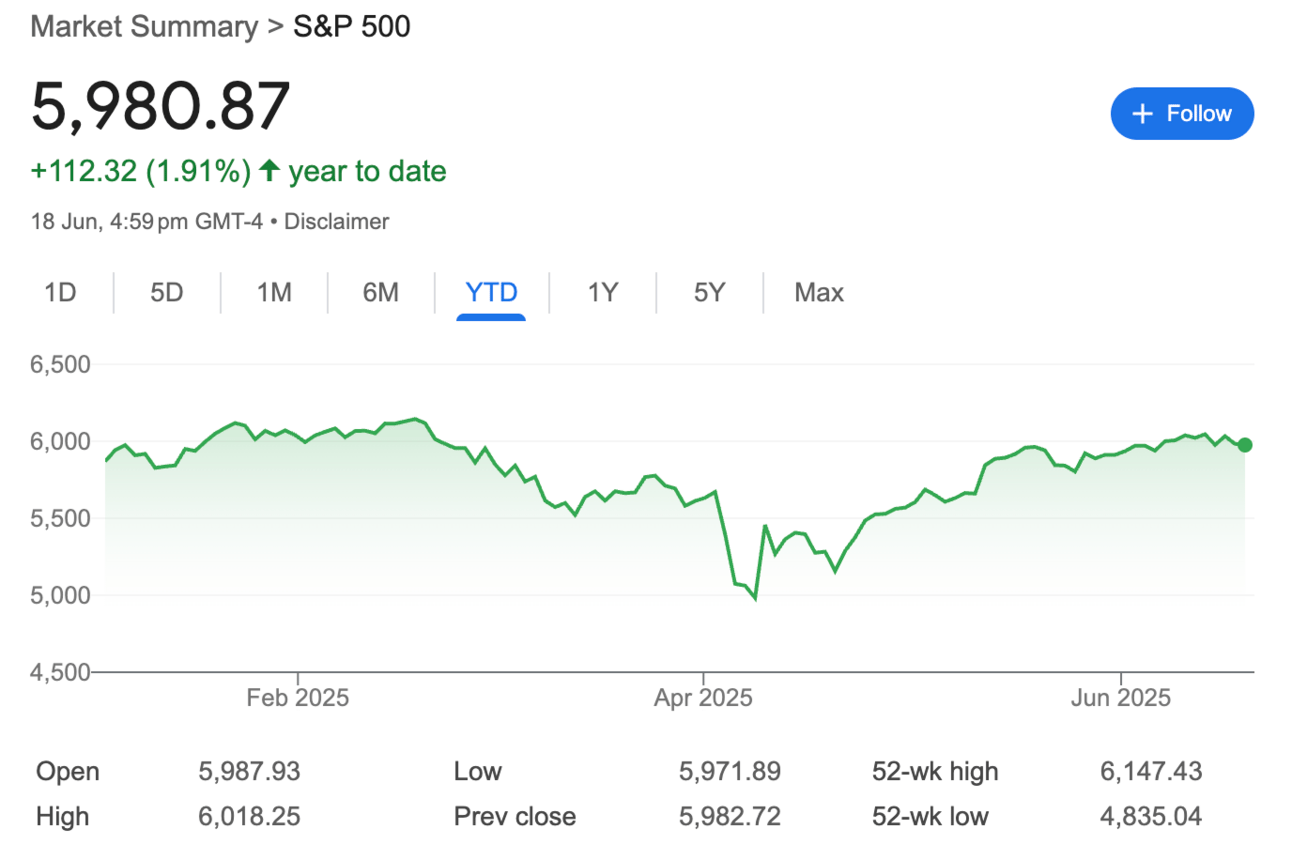

Market Overview

The S&P 500 closed nearly flat on Wednesday as investors digested a mixed bag from the Federal Reserve's latest policy meeting.

The central bank kept rates unchanged at 4.25%-4.5% as expected, but delivered conflicting signals that left markets uncertain about the path forward.

While the Fed maintained its forecast for two rate cuts this year, policymakers simultaneously raised concerns about the risks of stagflation.

Fed Chair Jerome Powell acknowledged that the effects of tariffs are "beginning to show" in economic data, but emphasized that the Fed is "well positioned to wait" before making rate adjustments.

Adding to market jitters, escalating tensions between Israel and Iran continued to weigh on sentiment.

The disconnect between the Fed's dovish rate outlook and hawkish economic projections, combined with geopolitical uncertainty, created a cautious trading environment that's likely to persist until clearer signals emerge on both fronts.

Headlines You Can't Miss

Take-Two Interactive reached an all-time high, trading at record levels since its 1997 initial public offering.

Jeffrey Gundlach predicts that gold could reach $4,000 as institutions increase buying amid geopolitical uncertainty.

Silver futures reached the highest level since February 2012, hitting $37.405 per ounce.

U.S. Steel ceased NYSE trading following the completion of Nippon Steel's acquisition deal.

Housing starts hit a five-year low at a 1.256 million annual rate, down 9.8% in May.

CERo Therapeutics plunged 42% after Tuesday's 188% surge on FDA orphan drug designation news.

Caris Life Sciences opened 36% above the IPO price at $28.69 versus $21 pricing.

Korn Ferry jumped after Q4 earnings beat on top and bottom lines.

Trump called Fed Chair Powell "stupid," saying he's costing the country a fortune by not cutting rates.

Iran's Supreme Leader threatened "irreparable damage" if the U.S. enters the Israel conflict.

Trending Stocks

Cava Group (NYSE:CAVA): The restaurant stock is down 35% so far in 2025, but Stifel sees an opportunity in the dip. The firm reiterated a buy rating for CAVA while trimming its price target to $125 from $175, implying 70% upside potential.

The investment firm believes average unit volumes will expand faster than anticipated as brand awareness grows, similar to other successful growth concepts in the industry.

Analyst Quote🎤: "Of the three key factors to the longer-term valuation (AUV [average unit volume] growth, margin expansion, and unit growth), we believe AUVs will likely expand at a faster rate than anticipated, similar to other growth concepts in the industry that have seen new unit performance improve as brand awareness grows.”

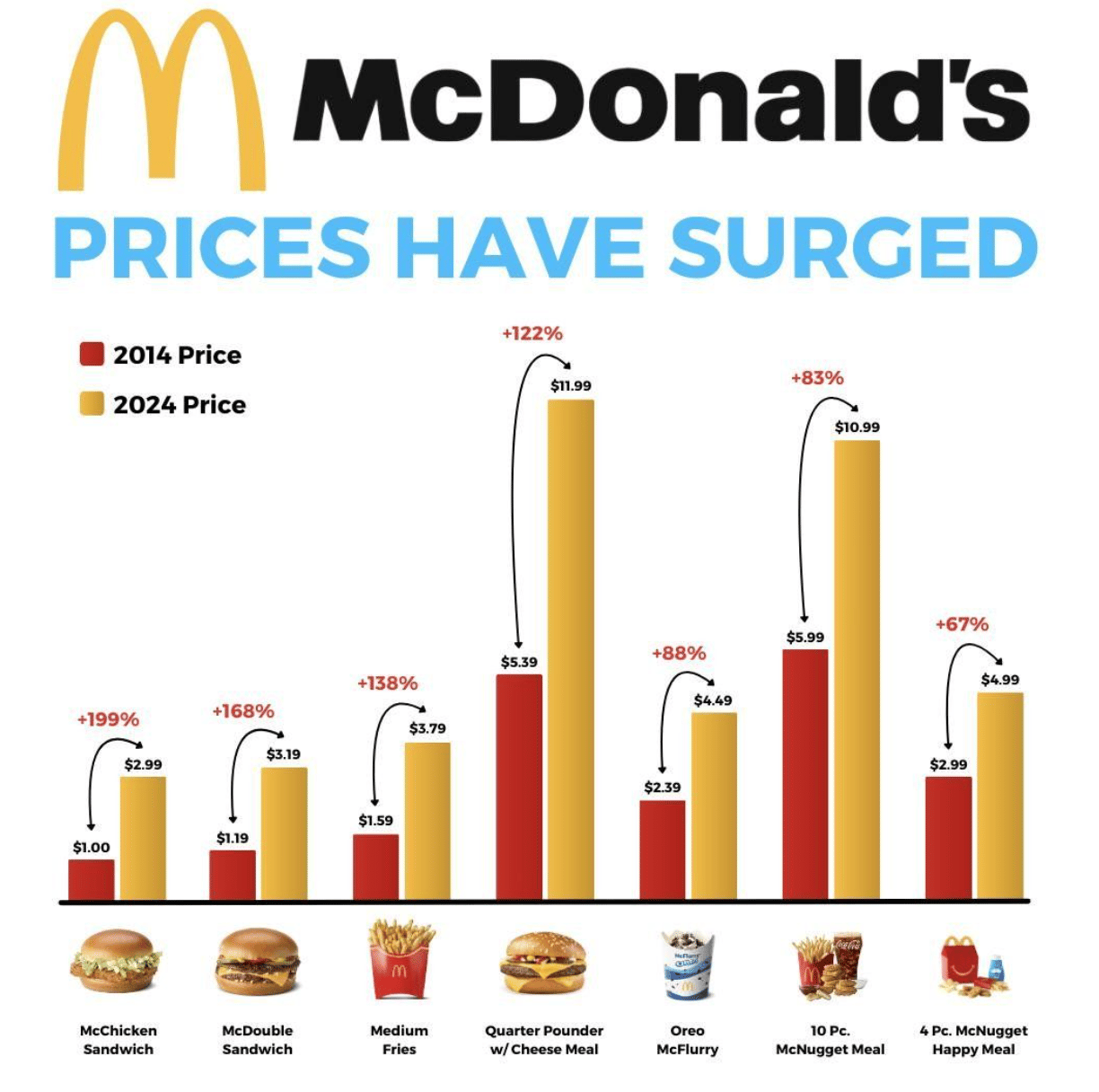

McDonald’s (NYSE:MCD) - The fast-food giant is struggling with its fourth consecutive daily decline and fifth straight weekly loss, marking its largest monthly retreat since September 2022.

Shares fell to their lowest level since early February, breaking below the 200-day moving average. The stock is down 9% over the past month, compared to the S&P 500's 1% gain.

Source: Carbon Finance

The relative strength index dropped to 24, its lowest since May 2024, indicating oversold conditions.

CEO Quote🎤: “Consumers today are grappling with uncertainty, but they can always count on McDonald’s for both exciting new menu items and delicious favorites for exceptional value, from a brand they love".

Sunrun (NASDAQ:RUN) - Solar stocks, including Sunrun, were quite volatile following an RBC Capital Markets downgrade to sector perform from outperform.

The stock recorded its biggest one-day loss in company history on Tuesday amid a broader sell-off in solar names.

The downgrade reflects growing concerns about the solar industry's outlook amid potential policy changes and market headwinds affecting the renewable energy sector.

Analyst Quote🎤: “While tax credits would still be preserved for storage systems, which represent approximately 70% of Sunrun’s customer base, Sunrun faces significant challenges to achieve positive cash generation under the current industry cost structure.”

What’s Next?

Powell maintains a data-dependent approach amid tariff uncertainty.

Two rate cuts are still projected for 2025, despite concerns about stagflation.

GDP growth outlook slashed to 1.4%, core inflation raised to 3.1%.

Trump is weighing a direct U.S. military strike on Iran within the next two weeks.

Oil prices are up 3% on escalation fears.

Track upcoming news and earnings with Ziggma to get personalized alerts.

Chart of the Day

Source: Visual Capitalist

Meme of the Day

Great investing starts with great information. Forward The Market Scoop to anyone who wants to stay ahead of the equity market.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.