- Ziggma

- Posts

- ✈️ Boeing Beats Q4 Estimates

✈️ Boeing Beats Q4 Estimates

PLUS: Healthcare stocks drive sell-off

Market Performance

S&P 500: 6,978.60 ⬆️ 0.41%

Nasdaq: 23,817.10 ⬆️ 0.91%

Dow Jones: 49,003.41 ⬇️ 0.83%

Boeing's Turnaround Takes Flight

Boeing (BA)reported fourth-quarter revenue that soared past Wall Street expectations, marking a significant milestone in the aerospace giant's multi-year recovery effort.

The company brought in $23.9 billion—a 57% jump from last year—as airplane deliveries hit their highest level since 2018.

CEO Kelly Ortberg's turnaround strategy is clearly gaining altitude.

Boeing delivered 600 aircraft in 2025, nearly double the previous year's total, and generated $400 million in cash flow—twice what analysts anticipated.

The company projects a positive free cash flow of $1-3 billion for 2026, a crucial step toward its ultimate $10 billion target.

But here's the reality check: Boeing still burned through roughly $40 billion since 2019's twin 737 Max crashes.

The company faces significant hurdles, including FAA approval for production increases beyond 42 Max aircraft monthly and certification delays for the 737 Max 7, Max 10, and 777X models.

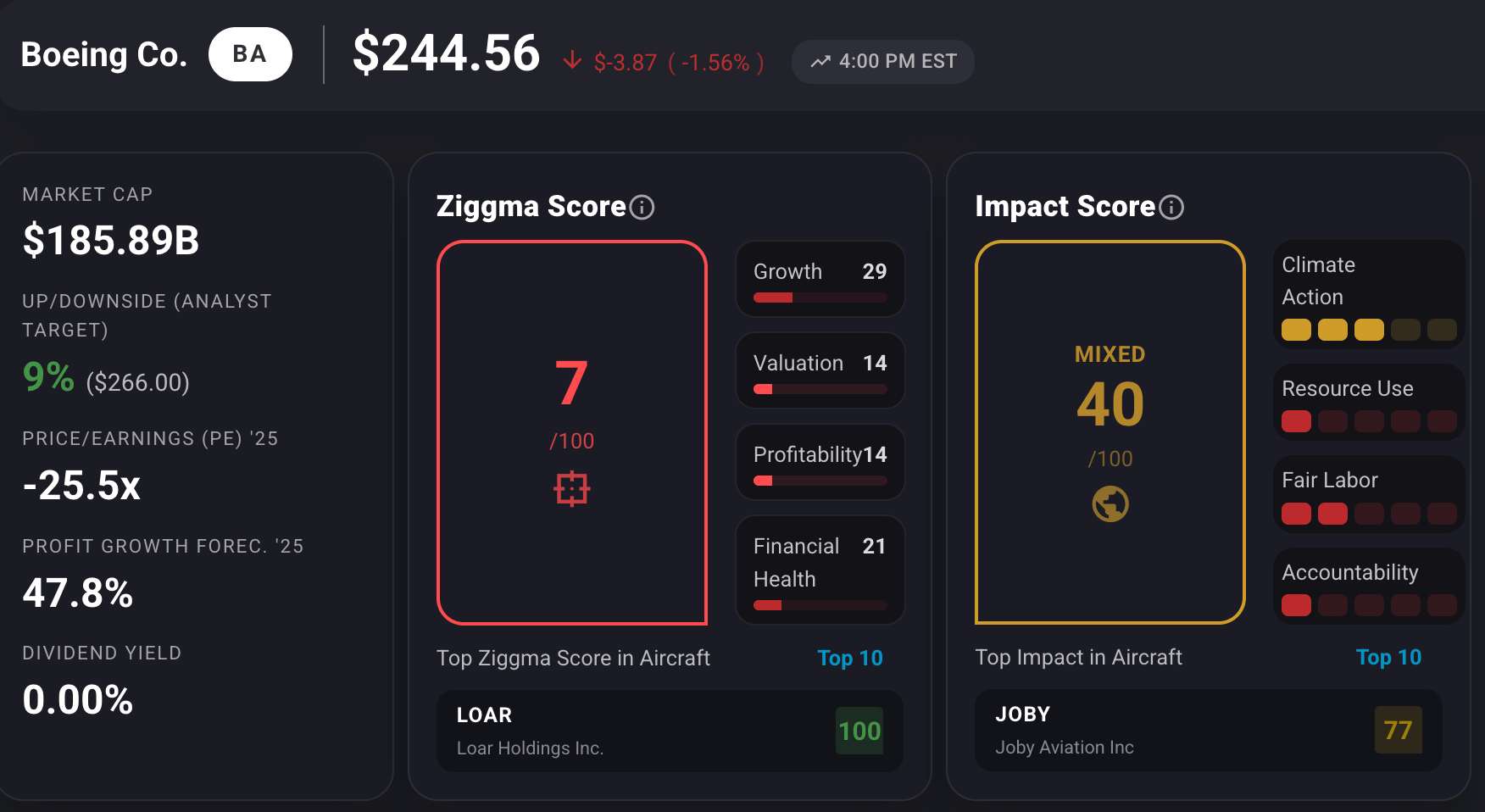

Boeing stock has a Ziggma score of 7 and trails its peers in growth, profitability, financial health, and valuation.

Our Takeaway

Boeing's strong quarter proves the turnaround is real, not just talk. With 1,173 net orders in 2025 (beating Airbus) and major customers like Alaska Airlines and Delta securing delivery slots into the 2030s, demand is robust.

However, regulatory constraints and defense delays mean Boeing's path to sustained profitability remains bumpy. For patient investors, this looks like an inflection point worth watching.

➡️ FREE ZIGGMA RESEARCH: Moody’s (MCO) - Sitting At an All-Time High, Is MCO Still a GoodStock? 🔖 Read for free on Substack or 🎧 listen to podcast.

Market Overview 📈

The S&P 500 clinched a fresh all-time closing high on Tuesday, powered by Big Tech strength as investors positioned ahead of major earnings from Meta, Microsoft, and Tesla.

Tech stocks led the charge, with Apple advancing by more than 1% and Microsoft climbing by more than 2%, driving the Nasdaq Composite up 0.91%.

Investors are laser-focused on AI commentary and capital expenditure plans from the Magnificent Seven companies reporting this week.

The Dow Jones, however, struggled—dropping 408 points—weighed down by a collapse in the healthcare sector.

Meanwhile, the Federal Reserve's first policy decision of 2026 looms on Wednesday. The central bank is expected to hold rates steady at 3.5%-3.75%, but traders will scrutinize Chair Jerome Powell's comments for clues on future cuts.

Fed funds futures still price in two quarter-point reductions by year-end.

What Will Your Retirement Look Like?

Planning for retirement raises many questions. Have you considered how much it will cost, and how you’ll generate the income you’ll need to pay for it? For many, these questions can feel overwhelming, but answering them is a crucial step forward for a comfortable future.

Start by understanding your goals, estimating your expenses and identifying potential income streams. The Definitive Guide to Retirement Income can help you navigate these essential questions. If you have $1,000,000 or more saved for retirement, download your free guide today to learn how to build a clear and effective retirement income plan. Discover ways to align your portfolio with your long-term goals, so you can reach the future you deserve.

Stock Moves Deciphered 📈

🛩️ American Airlines (AAL) - Down 7%

American Airlines tumbled after missing Q4 earnings estimates, hurt by a government shutdown and severe winter storm that caused widespread cancellations.

Despite the quarterly miss, the carrier projected strong 2026 performance with 7-10% Q1 revenue growth and nearly $2 improvement in adjusted EPS, driven by its premium-focused strategy and strong demand from high-spending travelers.

🏥 UnitedHealth Group (UNH) - Down 20%

UnitedHealth suffered a brutal day, plunging nearly 20% on a double blow: the Trump administration's proposed 0.09% Medicare Advantage rate increase for 2027 (far below the expected 4-6%) and disappointing 2026 revenue guidance.

As the nation's largest Medicare Advantage provider, the company faces significant margin pressure from the unexpectedly low government payment rates.

🚗 General Motors (GM) - Up 9%

General Motors surged after delivering a stellar Q4 beat and optimistic 2026 outlook that exceeded analyst forecasts.

The automaker earned $2.51 per share (vs. $2.20 expected) on revenue of $45.29 billion, and announced a 20% dividend increase plus a $6 billion buyback program, demonstrating confidence in its ability to navigate tariff and EV headwinds.

Headlines You Can't Miss 👀

📊 Consumer confidence collapsed to 84.5 in January, hitting its lowest level since May 2014 and missing expectations of 90.0, as concerns about both present conditions and future outlook deepened.

🏦 Third Point launched an activist campaign against CoStar, sending shares up 3% as Dan Loeb demanded board replacements and divestiture of the residential real estate business.

🥈 Silver ETF trading hit record volumes, with 300 million shares of SLV traded Monday—nearly matching S&P 500 ETF volumes—as BTIG warned of a potential "blow-off top" ahead.

🔌 Deutsche Bank upgraded CoreWeave to buy with a $140 price target after Nvidia invested $2 billion to help accelerate the buildout of 5 gigawatts of AI factories by 2030.

🏛️ Government shutdown odds rose above 70%, according to Jeremy Siegel, as Democrats threatened to oppose funding beyond January 30 over ICE enforcement actions—a potential headwind for markets.

Trending Stocks 📊

🚚 United Parcel Service (UPS)

UPS announced plans to cut an additional 30,000 jobs this year as it unwinds its Amazon partnership and executes a multiyear turnaround.

CFO Brian Dykes said the company will reduce operational hours by 25 million, accomplished through attrition and a second voluntary separation program for drivers, while closing 24 buildings in H1 2026.

⬆️ Meta Platforms (META)

Bernstein reiterated its outperform rating with an $870 price target (29% upside) on Meta, arguing the market is overly focused on model performance debates.

The firm highlighted Meta AI's 1 billion monthly users and its product-heavy DNA, positioning it well for AI monetization despite concerns about frontier models that have kept shares flat year-to-date.

💰 Affirm Holdings (AFRM)

Needham upgraded Affirm to buy from hold with a $100 price target, citing the company's Nevada bank charter application as a meaningful long-term catalyst.

The proposed Affirm Bank would operate as an independent industrial loan company subsidiary, potentially transforming the buy-now-pay-later company's business model and competitive positioning.

What’s Next?

Key market and macro news 👇

🎤 Microsoft, Meta, and Tesla Earnings Reports: These tech giants are scheduled to release their fourth-quarter and full-year 2025 financial results. Their performance and future guidance will significantly influence the technology sector and overall market sentiment.

💸 IBM and ASML Holding N.V. Earnings: The earnings reports from these established technology and semiconductor companies will provide insights into corporate IT spending and the health of the global chip market, respectively.

📞 AT&T Earnings Announcement: As a major telecommunications company, AT&T's earnings will offer a glimpse into consumer spending on communication services and the company's progress in its 5G and fiber network deployments.

Chart of the Day

Meme of the Day

Great investing starts with great information.

Forward The Market Scoop to anyone who wants to stay ahead of the market through a pertinent and entertaining newsletter format.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please exercise caution and conduct your own research.