- Ziggma

- Posts

- 🗞️ Big Tech vs. Trump Tariffs

🗞️ Big Tech vs. Trump Tariffs

PLUS: Why is Intel rising?

Market Performance

S&P 500: 6,468.54 (⬆️ 0.03% )

Nasdaq: 21,710.67 (⬇️ -0.01%)

Dow Jones: 44,911.26 (⬇️ -0.02%)

Tech giants are cutting unprecedented deals with the Trump administration to secure tariff relief, signaling a new era of corporate-government negotiations.

Nvidia (NVDA) and AMD (AMD) agreed to pay the U.S. government 15% of their China chip sales revenues in exchange for export permissions, while Apple (AAPL) committed $600 billion in domestic investments over four years.

These arrangements highlight Big Tech's vulnerability to trade tensions. Apple, facing potential 100% semiconductor tariffs, successfully secured exemptions through its massive investment pledge.

The company previously absorbed $800 million in tariff costs during the June quarter alone.

However, the Nvidia-AMD deal has sparked concerns about government overreach and policy stability.

Analysts describe the revenue-sharing arrangement as "bizarre" and worry about arbitrary decision-making that could affect other companies.

The bigger question is whether this "hands-on" approach creates sustainable business conditions or introduces unpredictable regulatory risk.

Our Takeaway

While these deals provide immediate relief, they establish a concerning precedent where corporate strategy depends on political negotiations rather than market fundamentals.

Investors should monitor whether this approach spreads to other sectors.

Former Zillow exec targets $1.3T

The top companies target big markets. Like Nvidia growing ~200% in 2024 on AI’s $214B tailwind. That’s why the same VCs behind Uber and Venmo also backed Pacaso. Created by a former Zillow exec, Pacaso’s co-ownership tech transforms a $1.3 trillion market. With $110M+ in gross profit to date, Pacaso just reserved the Nasdaq ticker PCSO.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

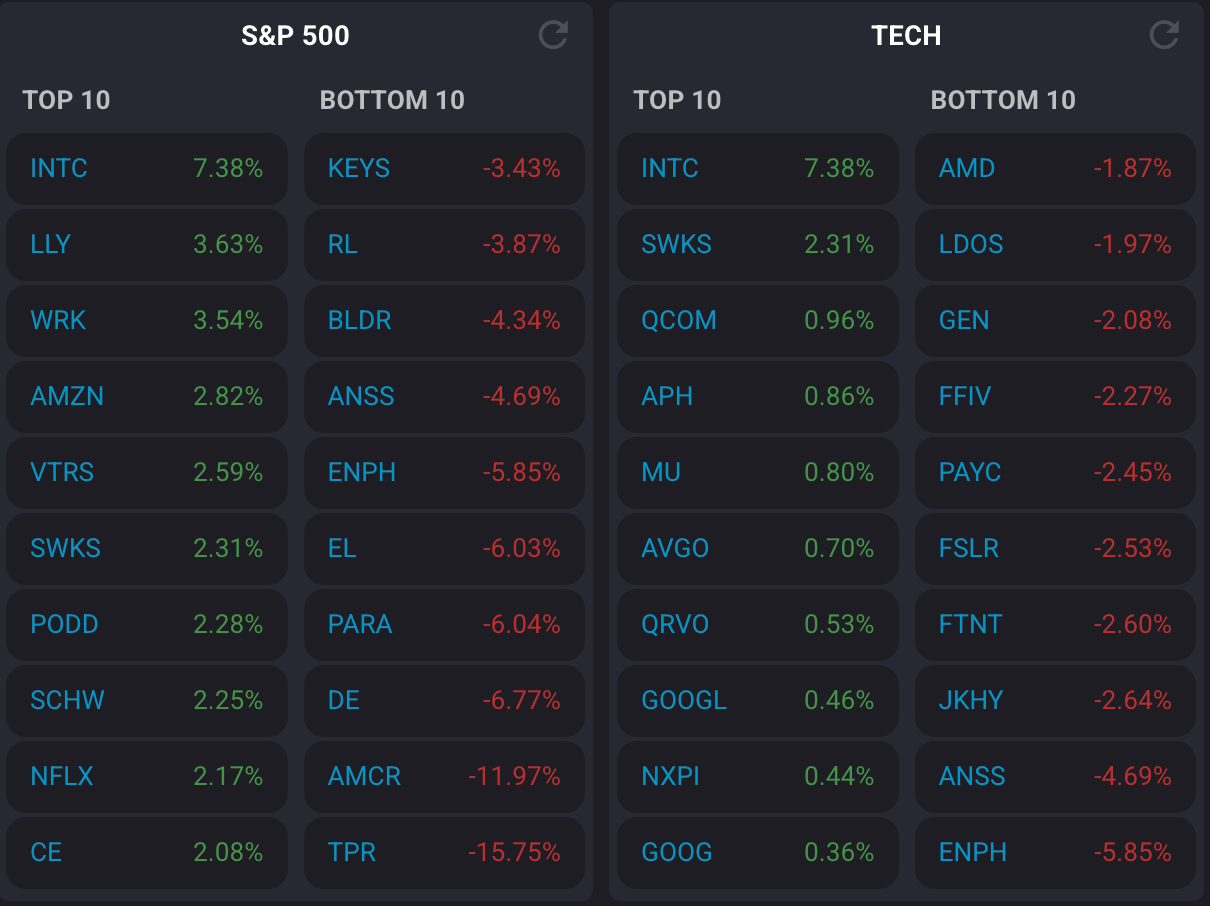

Market Overview

Stocks recovered from early losses after a disappointing wholesale inflation report, with the S&P 500 managing its third consecutive record close by the slimmest margin.

The Producer Price Index surged 0.9% in July, far exceeding the 0.2% expectation and marking the largest monthly gain since June 2022.

The resilience reflects investors' focus on specific drivers like portfolio management fees and airfare rather than broad-based price pressures.

St. Louis Fed President Alberto Musalem added to dovish sentiment, noting he's revised inflation risks lower while labor market concerns have increased.

However, he stopped short of committing to September rate-cut action, emphasizing the need for continued data assessment before the next policy meeting.

Stock Moves Deciphered 📈

Intel (INTC) — The semiconductor giant gained over 7% following Bloomberg reports that the Trump administration is considering taking a government stake in the company.

The potential investment would help fund Intel's Ohio manufacturing facilities as part of domestic chip production initiatives.

Enphase Energy (ENPH) — The solar technology company declined following news of weaker-than-expected solar product shipments.

Supply chain bottlenecks and softer regional demand contributed to the disappointing quarter, while increased renewable energy competition raised concerns about near-term growth prospects.

Amcor (AMCR) — The packaging company plummeted 14% after missing fourth-quarter estimates with earnings of $0.20 per share versus $0.22 expected.

Revenue of $5.08 billion also fell short of the $5.19 billion consensus, while full-year guidance disappointed investors.

Headlines You Can't Miss

Miami International Holdings soared 43% in its NYSE debut, pricing its IPO at $23 but closing above $31.

Paramount fell 6% after giving back some of Wednesday's stunning 37% surge following merger news.

Jobless claims declined to 224,000, down 3,000 from the prior week and below the 229,000 consensus estimate.

Wholesale inflation jumped 0.9% in July, the largest monthly gain since June 2022 and well above the 0.2% expectations.

Wells Fargo downgraded the energy sector to neutral, recommending reallocation to financials amid extended market volatility expectations.

Gold mining stocks are "rebuilding investor confidence," with the VanEck Gold Miners ETF outperforming gold by 40% year-to-date.

Trending Stocks

Brinker International (EAT)— The Chili's parent company delivered a blowout fourth quarter with adjusted earnings of $2.49 per share, beating the $2.47 consensus. Revenue hit $1.46 billion versus $1.44 billion expected.

JPMorgan praised CEO Kevin Hochman's turnaround efforts, calling it a "substance-driven" transformation not dependent on social media marketing. The analyst noted this represents an "anything is possible" message across the casual dining sector.

CEO Quote🎤: “We now have delivered a Q4 2 year sales growth of +39% and 3-year of +45%. With that sustained momentum along with a strong pipeline of initiatives, we are confident in our ability to grow sales and traffic throughout Fiscal 2026”.

Tapestry (TPR) — The Coach and Kate Spade parent plunged over 10% after disappointing full-year guidance. The company forecast earnings of $5.30 to $5.45 per share, missing analyst estimates of $5.49.

Despite strong brand performance, investors focused on the cautious outlook amid challenging consumer spending patterns in the luxury accessories market.

CEO Quote🎤: “Fiscal 2025 was a breakout year for Tapestry as our systemic approach to brand-building is capturing a new generation of consumers around the world.”

Deere (DE)— The farm equipment manufacturer dropped 6% after trimming its full-year outlook. Deere now expects net income of $4.75 billion to $5.25 billion, down from its previous range of $4.75 billion to $5.50 billion.

The revision reflects ongoing challenges in agricultural markets and softer demand for farming equipment amid economic uncertainty.

CEO Quote🎤: “By continuing to address the high levels of used equipment in the industry, we’re building a healthier market for everyone—our customers, our dealers, and our business—even in these challenging times.”

What’s Next?

Key Macro Events 👇

Fed Chair Powell's opinion on September rate cuts will carry more weight than other officials' comments.

Market pricing shows 93% odds of a quarter-point cut next month.

Continuing focus on inflation data and labor market indicators.

Track upcoming news and earnings on your portfolio companies with Ziggma.

Chart of the Day

Meme of the Day

Great investing starts with great information.

Forward The Market Scoop to anyone who wants to stay ahead of the market through a pertinent and entertaining newsletter format.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.