- Ziggma

- Posts

- 💰Big Tech, Big Reveal

💰Big Tech, Big Reveal

Big Moves Decoded: STX, FI, and more!

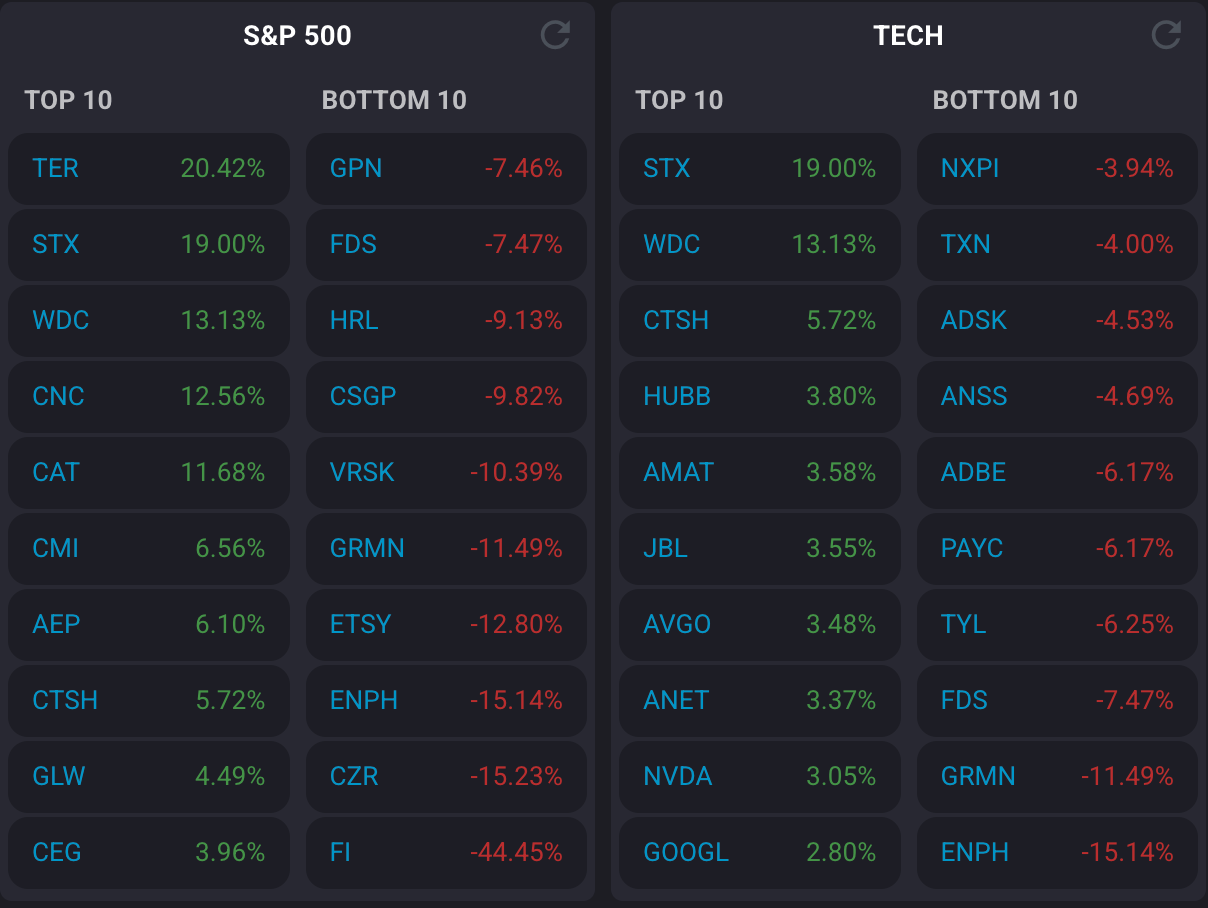

Market Performance

S&P 500: 6,890.59 ⬇️ 0.01%

Nasdaq: 23,958.47 ⬆️ 0.55% 🎉 New record close

Dow Jones: 47,632.00 ⬇️ 0.16%

Alphabet Rises While Meta and Microsoft Drop

Big Tech's earnings season kicked off on Wednesday with mixed results from three of the world's most valuable companies—and the market wasn't entirely impressed.

While all three beat revenue expectations, concerns about AI spending and future growth sent investors into a frenzy of second-guessing.

Microsoft (MSFT) reported solid fiscal Q1 results with revenue up 18% to $77.67 billion and earnings of $3.72 per share.

Azure cloud revenue jumped 40%, exceeding expectations.

But here's the kicker: CFO Amy Hood warned that capital expenditure growth will actually accelerate this fiscal year, not slow down as previously suggested.

The stock dropped nearly 4% after hours as investors digested the ballooning AI infrastructure costs—including a $3.1 billion hit from its OpenAI investment.

Alphabet (GOOGL) had the best showing of the three, with shares surging 7% after reporting $102.35 billion in revenue and beating earnings by a wide margin.

Google Cloud accelerated 35% year over year, and the company announced that Gemini AI now has 650 million monthly active users.

But there's a catch: Alphabet raised its 2025 capex guidance to $91-93 billion and expects a "significant increase" in 2026.

Source: App Economy Insights

Meta (META) was the biggest disappointment. Despite $51.24 billion in sales (up 26%), the company reported a massive $15.93 billion one-time tax charge and raised both its expense guidance and capex outlook to $70-72 billion for 2025.

Shares plummeted 9% amid concerns about the company's appetite for AI spending.

Our Takeaway

The Big Tech earnings highlight a troubling pattern: these companies are in an AI arms race with no clear finish line.

Microsoft, Meta, and Alphabet are collectively planning to spend over $200 billion next year on chips and data centers, yet monetization remains uncertain.

The circular money flow—Microsoft funding OpenAI, which buys Nvidia chips to run models on Microsoft's cloud—creates an echo chamber that obscures real AI demand.

If one player pulls back, the entire ecosystem could unravel.

This feels eerily similar to the dot-com bubble's fiber-optic buildout: massive infrastructure investment chasing promises that may take years to materialize.

Investors should watch for signs that AI revenue growth can justify these unprecedented capital expenditures.

Start investing right from your phone

Jumping into the stock market might seem intimidating with all its ups and downs, but it’s actually easier than you think. Today’s online brokerages make it simple to buy and trade stocks, ETFs, and options right from your phone or laptop. Many even connect you with experts who can guide you along the way, so you don’t have to figure it all out alone. Get started by opening an account from Money’s list of the Best Online Stock Brokers and start investing with confidence today.

Market Overview 📈

Markets opened strong on expectations of a Fed rate cut, with the Dow briefly touching a record high.

But Federal Reserve Chair Jerome Powell's afternoon comments sent shockwaves through Wall Street, erasing earlier gains and highlighting the delicate balance between inflation concerns and economic growth.

The Fed delivered its expected quarter-point rate cut, lowering the benchmark rate to 3.75%-4%—the second cut this year.

But Powell threw cold water on hopes for a December cut, stating there were "strongly differing views" on the committee and that another reduction is "not a foregone conclusion. Far from it."

The 10-year Treasury yield immediately jumped above 4% as rate-sensitive sectors tumbled.

Consumer stocks like Costco and McDonald's declined, while payment processors Visa and Mastercard also fell.

Small caps bore the brunt of the uncertainty, with the Russell 2000 sliding 0.87% as these companies are susceptible to interest rate changes.

Adding to market dynamics, Nvidia achieved a historic milestone by becoming the first U.S. company to reach a $5 trillion market capitalization, rising 3.1% and extending its winning streak to five days.

The AI chip giant's ascent—up 50% year-to-date—has single-handedly contributed nearly 20% of the S&P 500's total gains this year, underscoring markets' AI obsession.

Stock Moves Deciphered 📈

🤖 Teradyne (TER)

The semiconductor test equipment maker surged over 20% after delivering strong Q3 results and issuing a robust Q4 forecast.

Revenue grew 15% year-over-year to $891 million, beating estimates of $875 million, while adjusted earnings of $1.52 per share exceeded expectations of $1.42.

The company is experiencing exceptional demand for its test systems used in AI chip manufacturing, particularly for high-bandwidth memory and advanced computing processors.

💾 Seagate Technology (STX)

Seagate's stock soared more than 19% after reporting fiscal Q1 results that crushed Wall Street expectations.

The data storage company earned $2.61 per share on an adjusted basis—well above the $2.37 consensus—on revenue of $2.63 billion versus estimates of $2.55 billion.

The company also announced a massive $5 billion share repurchase program extending through fiscal 2028, demonstrating confidence in future cash flows.

🏥 Centene (CNC)

The health insurance giant's shares jumped after it delivered a surprise Q3 profit and raised its full-year earnings outlook, defying concerns about the Medicaid sector.

Centene earned $2.15 per share on an adjusted basis, handily beating the $1.98 estimate, on revenue of $43.2 billion.

The company raised its full-year adjusted EPS guidance to $7.20-$7.40 from $6.80-$7.20, citing better-than-expected medical cost trends and operational improvements.

🏗️ Caterpillar (CAT)

The construction equipment giant's stock jumped 11.6%—on pace for its best day since 2008—after crushing Q3 expectations.

Caterpillar earned $4.95 per share on an adjusted basis on revenue of $17.64 billion, significantly ahead of analyst forecasts of $4.59 per share and $16.77 billion.

Surging demand for energy and transportation equipment, particularly from the data center construction boom.

Headlines You Can't Miss 👀

💳 Visa reported Q4 earnings of $2.98 per share on $10.72 billion revenue, beating estimates and rising 1% after hours, as payment volumes remain resilient despite economic uncertainty.

🎵 Warner Music Group received a price target increase to $37 from Morgan Stanley, citing improved streaming revenue growth prospects from DSP pricing and VIP tier expansion in fiscal 2026.

💊 CVS Health posted mixed Q3 results: $102.87 billion in revenue, beating expectations, but shares slipped amid a net loss of $3.99 billion as the pharmacy giant faces ongoing profitability pressures.

✈️ Boeing shares fell after reporting a Q3 loss of $7.47 per share, significantly worse than the expected $4.59 loss, despite revenue of $23.27 billion exceeding estimates.

📚 Stride plunged 50% for its worst day ever on weak guidance, as the for-profit education company's Q2 and full-year outlook fell short of expectations amid softening demand.

🧪 Avantor shares tumbled by more than 17% after the pharmaceutical company slashed its full-year organic revenue outlook, despite Q3 earnings matching consensus at $0.22 per share.

🇨🇳 Trump-Xi meeting in South Korea could result in cuts to fentanyl-related tariffs on China, currently at 20%, as trade tensions show signs of easing after weekend progress.

📊 Fed ends quantitative tightening on December 1, beginning automatic bond purchases that should support risk sentiment alongside the rate cut announced Wednesday.

Trending Stocks 📊

💸 Fiserv (FI)

Shares of the financial technology company plunged a stunning 44% after reporting a massive Q3 earnings miss and slashing full-year guidance.

Fiserv earned just $2.04 per share, excluding certain items, on revenue of $4.92 billion—far below expectations of $2.64 per share and $5.35 billion.

The company cited a significant slowdown in its merchant services division, with payment volumes declining more than anticipated amid a challenging consumer spending environment.

⚡️ Enphase Energy (ENPH)

Despite beating Q3 earnings and revenue estimates with adjusted EPS of $0.65 versus $0.54 expected and revenue of $380 million versus $363 million, the solar microinverter company's stock dropped 8%.

Investors focused entirely on the company's weak Q4 forecast, which projects revenue of just $300-340 million—significantly below the $405 million consensus—and sharply lower gross margins.

🛍️ Etsy (ETSY)

The online marketplace's stock declined 12.8% despite beating Q3 earnings with $0.48 per share, versus $0.41 expected, on revenue of $662 million.

The selloff was driven by two concerns: the company announced that CEO Josh Silverman will step down at year-end (moving to executive chairman) and be replaced by Depop CEO Kruti Patel Goyal, and reported a decline in active buyers and sellers on the platform.

Gross merchandise sales fell 2.1% to $3.0 billion, indicating weakening consumer engagement.

What’s Next?

Key market and macro news 👇

💸 KLA Corporation, a major player in the semiconductor industry, is expected to report its earnings, which could impact the broader tech sector.

📈 Post-Earnings Analysis: Wall Street analysts will dissect the previous day's earnings reports for META, MSFT, and GOOGL, issuing new ratings and price targets that can drive individual stock prices.

📊 U.S. GDP Data Release: The advance estimate of third-quarter Gross Domestic Product (GDP) will be released, providing a crucial snapshot of the country's economic health and potentially influencing investor sentiment.

💂 U.S. Jobless Claims: The weekly jobless claims report will offer a timely look at the health of the labor market, a key factor in the Federal Reserve's policy decisions.

🌎 World Economic Outlook: The International Monetary Fund (IMF) is releasing its World Economic Outlook, which will provide updated global growth projections and could influence investor confidence.

Chart of the Day

Source: App Economy Insights

Meme of the Day

Great investing starts with great information.

Forward The Market Scoop to anyone who wants to stay ahead of the market through a pertinent and entertaining newsletter format.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please exercise caution and conduct your own research.