- Ziggma

- Posts

- 🗞️ Big Banks Deliver in Q3

🗞️ Big Banks Deliver in Q3

Big Moves Decoded: BLDR, GM, and WMT

Market Performance

S&P 500: 6,644.31 ⬇️ 0.16%

Nasdaq: 22,521.70 ⬇️ 0.80%

Dow Jones: 46,270.46 ⬆️ 0.44%

Big Banks Beat Estimates in Q3

America's biggest banks kicked off earnings season with results that tell a familiar story: trading desks are thriving, deal flow is strong, but the consumer picture is getting murkier.

JPMorgan Chase (JPM) delivered a 12% jump in net income to $14.4 billion, powered by a 25% surge in trading revenues, including a 33% spike in equities. Investment banking fees climbed 16% as M&A activity picked up.

But CEO Jamie Dimon wasn't popping champagne. He warned of "heightened uncertainty" from geopolitical tensions, tariffs, and sticky inflation, even as consumer balance sheets remain solid.

JPM has a Ziggma score of 84, as it ranks highly in terms of profitability and financial health.

The banking giant has surged more than 200% in the last five years and trades at an elevated multiple.

Goldman Sachs (GS) had its best quarter in over a year, with revenue up 20% to $15.2 billion.

Investment banking fees jumped 42%, fueled by leveraged finance and merger activity. Trading was equally robust, up 17%.

The message? When volatility rises and deals heat up, Goldman wins.

Wells Fargo (WFC) saw net income rise 9% to $5.6 billion, with the strongest loan growth in years.

CEO Charlie Scharf noted that consumers are healthy, but acknowledged that economic uncertainty lingers.

BlackRock (BLK) reported record inflows of $205 billion, pushing assets under management to $13.5 trillion.

But acquisition costs—HPS Investment Partners and Preqin—kept profit growth muted despite a 25% revenue increase.

Our Takeaway

The message is clear: Wall Street is thriving, Main Street is holding steady, but caution is warranted.

Trading volatility and M&A pipelines are goldmines for these institutions, but consumer lending is showing early signs of fatigue.

If you're bullish on financial stocks, bet on those benefiting from volatility and dealmaking—not traditional lending growth.

Your career will thank you.

Over 4 million professionals start their day with Morning Brew—because business news doesn’t have to be boring.

Each daily email breaks down the biggest stories in business, tech, and finance with clarity, wit, and relevance—so you're not just informed, you're actually interested.

Whether you’re leading meetings or just trying to keep up, Morning Brew helps you talk the talk without digging through social media or jargon-packed articles. And odds are, it’s already sitting in your coworker’s inbox—so you’ll have plenty to chat about.

It’s 100% free and takes less than 15 seconds to sign up, so try it today and see how Morning Brew is transforming business media for the better.

Market Overview 📈

Tuesday was a wild ride. The S&P 500 whipsawed between gains and losses before closing down 0.2%, erasing much of its intraday comeback.

The culprit? Escalating U.S.-China trade tensions.

China imposed sanctions on five U.S. subsidiaries of South Korea's Hanwha Ocean, tightening its grip on global shipping.

President Trump then called China's decision to halt U.S. soybean purchases "an economically hostile act" and threatened cooking oil embargoes as retribution.

Markets, which had rallied earlier in the session, promptly pulled back.

The Cboe Volatility Index spiked above 22—a four-month high—signaling renewed hedging activity as investors brace for prolonged trade uncertainty.

Meanwhile, Fed Chair Jerome Powell indicated the central bank may soon pause its balance sheet reduction program but offered no signals on future rate cuts.

Despite the macro chaos, bank earnings provided a silver lining. Citigroup and Wells Fargo surged 3.9% and 7.2%, respectively, on better-than-expected results.

Tech stocks, particularly Nvidia, remained under pressure following Friday's rout.

The divergence between financials and tech underscores a market grappling with geopolitical risk, valuation concerns, and shifting sector leadership.

Stock Moves Deciphered 📈

🏡 Builders FirstSource (BLDR)

BLDR stock surged on positive housing market data, including a 12% rise in housing starts, and a new multi-year contract with a major homebuilder.

The building materials supplier is well-positioned to capitalize on residential construction momentum as housing activity rebounds.

🛒 Walmart (WMT)

WMT stock advanced after announcing a partnership with OpenAI to integrate ChatGPT, enabling a new AI-powered shopping experience for its customers.

The retail giant is leveraging artificial intelligence to enhance customer service and personalize shopping recommendations, potentially driving higher conversion rates.

🛫 Southwest Airlines (LUV)

LUV stock climbed after unveiling a new, modernized cabin interior and announcing strategic shifts in its business model, attracting investor interest.

The airline is evolving beyond its traditional no-frills approach to compete more effectively in a changing travel landscape.

Headlines You Can't Miss 👀

💰 Broadcom's OpenAI deal is valued at $100 billion by Citi, with the chipmaker expected to earn $8 billion in EPS over the coming years.

🏦 Government shutdown could extend into November, per Citi economists, with minimal pain points reducing urgency for a political compromise.

📱 Oracle Cloud to deploy 50,000 AMD GPUs starting in 2026, challenging Nvidia's dominance in AI chip infrastructure.

📊 T-Mobile upgraded to outperform by RBC with 20% upside potential, citing solid subscriber growth and value from the USCellular acquisition.

💼 Goldman Sachs to acquire VC firm Industry Ventures for $665 million in cash, plus up to $300 million in performance-based payments through 2030.

⚠️ JPMorgan CEO Jamie Dimon warns of "early signs" of lending excess, pointing to recent auto sector bankruptcies as red flags for credit quality.

Trending Stocks 📊

🚗 General Motors (GM)

GM signaled its third-quarter profits took a $1.6 billion hit from its electric vehicle business, reflecting ongoing EV market headwinds.

The charges come as the Trump administration scales back federal tax credits for EV makers—a program that had previously propelled sales and investment.

GM, an early entrant in the EV space dating back to the 1990s, had planned to invest $30 billion in EVs through 2025.

✈️ Boeing (BA)

Boeing delivered 55 aircraft in September, putting it on track for its best delivery year since 2018 as production stabilizes.

Forty of those deliveries were 737 Max planes, with customers including Ryanair (10 aircraft), Southwest Airlines, United Airlines, China Southern, and leasing firm AerCap.

The company is now eyeing increased output rates for the 737 Max, its cash-cow airplane program.

🍼 Johnson & Johnson (JNJ)

Johnson & Johnson beat third-quarter expectations with adjusted earnings of $2.80 per share on revenue of $23.99 billion, topping analyst estimates of $2.76 per share and $23.75 billion in revenue.

The healthcare giant also announced it will separate its orthopedics business, a strategic move aimed at unlocking shareholder value and allowing the division to operate more independently.

What’s Next?

Key market and macro news 👇

🤖 ASML Holding: The semiconductor equipment giant reports Q3 earnings pre-market. Its results will be closely watched after a significant earnings miss last quarter, offering insight into the tech sector's health.

💰Bank of America: Announces Q3 results. As a major financial institution, its performance in investment banking and consumer lending will signal the strength of the broader U.S. economy.

🏥 Abbott Laboratories (ABT): The medical products company's Q3 performance will provide a snapshot of the healthcare sector and consumer spending on medical devices and diagnostics.

🧑🏭 Empire State Manufacturing Index: This early indicator of manufacturing activity in New York will provide a timely read on the health of the industrial sector.

⛔️ U.S.-China Trade Tensions: New port fees and tariff threats continue to create market volatility. Investors remain on edge about a potential escalation of the ongoing trade war between the two economic powers.

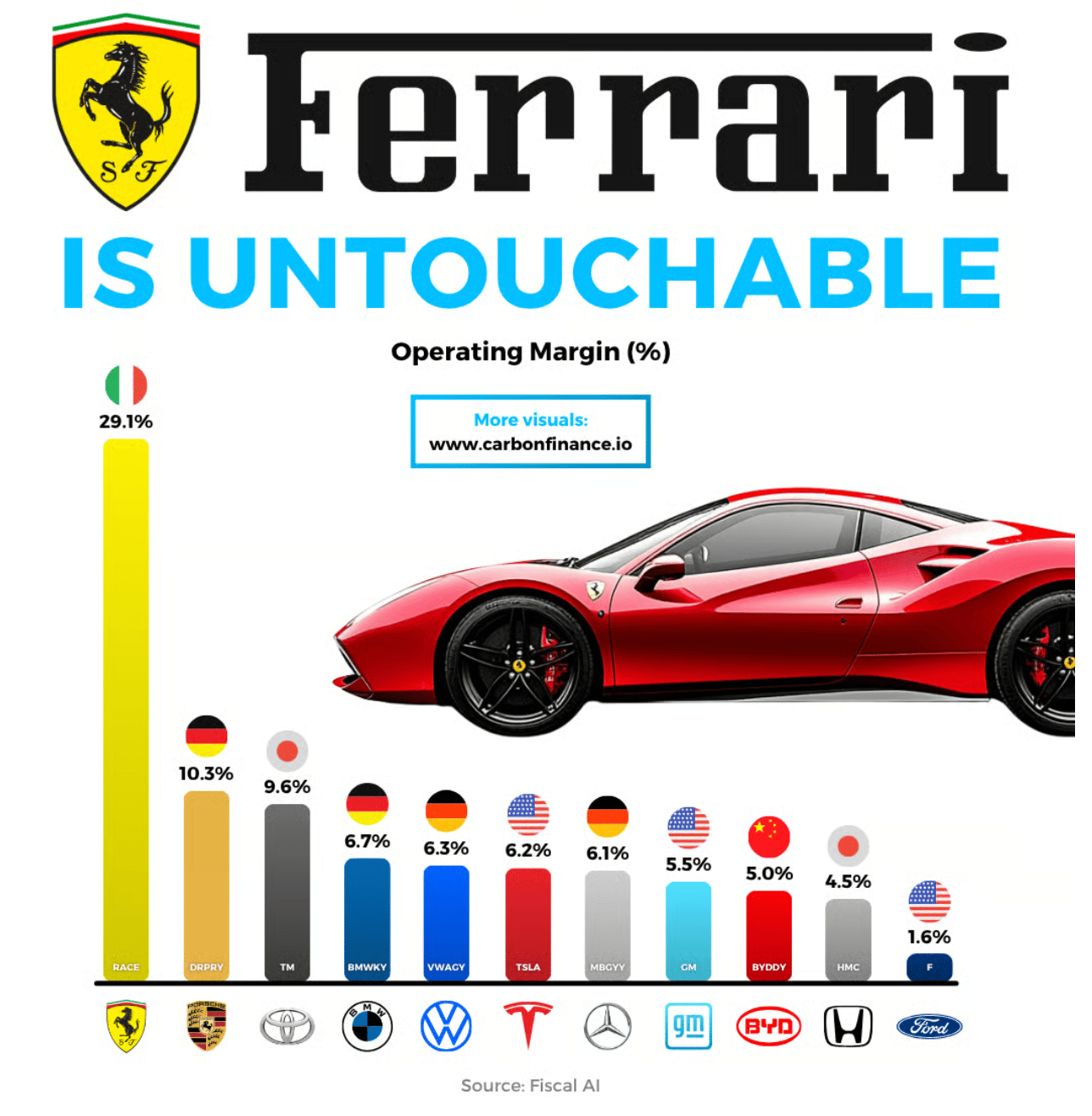

Chart of the Day

Source: Carbon Finance

Meme of the Day

Great investing starts with great information.

Forward The Market Scoop to anyone who wants to stay ahead of the market through a pertinent and entertaining newsletter format.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please exercise caution and conduct your own research.