Market Performance

S&P 500: 6,552.71 ⬇️ 2.71%

Nasdaq: 22,204.43 ⬇️ 3.56%

Dow Jones: 45,479.60 ⬇️ 1.90%

Warren Buffett Bets Big on Japan

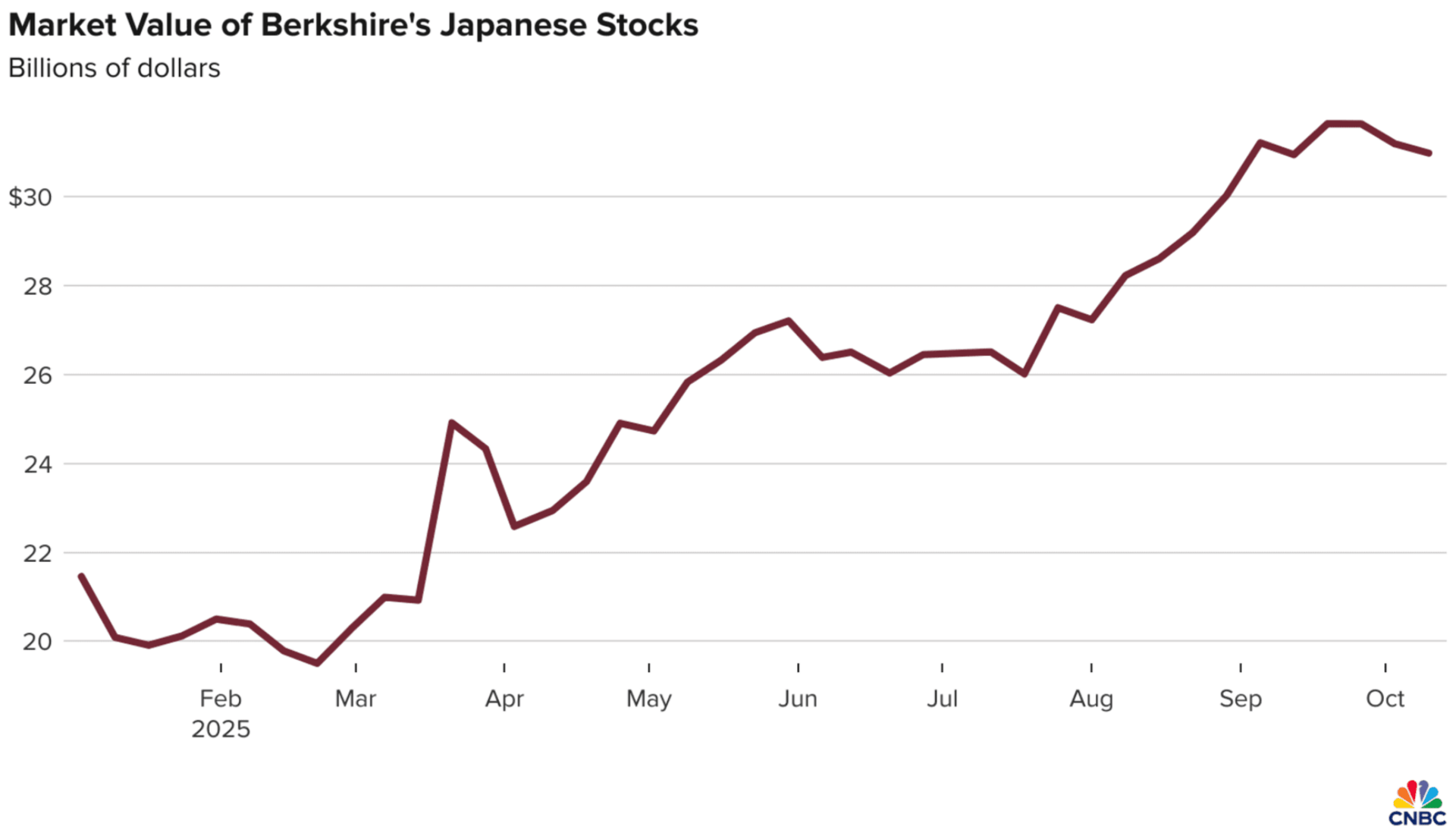

Warren Buffett's investment in Japanese trading houses has become one of Berkshire Hathaway's most successful bets in recent years.

The combined value of Berkshire's stakes in five Japanese companies has skyrocketed to over $31 billion, a staggering 392% increase from the initial $6.3 billion investment announced on Buffett's 90th birthday in 2020.

Last week, Mitsui disclosed that Berkshire's National Indemnity subsidiary now owns a 10.1% stake worth approximately $7.1 billion, making it the company's largest shareholder.

Berkshire has been steadily increasing its positions, with Mitsubishi also confirming a stake above 10% in late August.

Buffett's original thesis was simple: these companies were trading at "ridiculous prices" relative to prevailing interest rates in 2020.

His patience and conviction have been rewarded as the stocks have soared between 227% and 551%.

With permission from the companies to exceed the initial 10% ceiling, Buffett indicated shareholders will "likely see Berkshire's ownership of all five increase somewhat" over time.

Our Takeaway

This investment exemplifies Buffett's value investing principles: identifying quality businesses trading at attractive valuations and holding them for the long term.

As Buffett told shareholders this year, Berkshire plans to hold these positions for "50 years or forever," signaling his confidence in Japan's corporate landscape and these companies' fundamental strength.

The Real Traders Aren't on CNBC

Your current options for finding stock trades:

Option 1: Spend 4 hours daily reading everything online

Option 2: Pay $500/month for paywalled newsletters and pray

Option 3: Get yesterday's news from mainstream financial media

All three keep you broke.

Here's where the actual edge lives:

Twitter traders sharing real setups (not TV personalities)

Crowdfunding opportunities before they go mainstream

IPO alerts with actual timing

Reddit communities spotting trends early

Crypto insider takes (not corporate PR)

The problem? You'd need to be terminally online to track it all.

Stocks & Income monitors every corner where real money gets made. We send you only the actionable opportunities. No fluff, no yesterday's headlines.

Five minutes daily. Walk away with stock insights you can actually act on every time.

Stocks & Income is for informational purposes only and is not intended to be used as investment advice. Do your own research.

Market Overview 📈

Friday's session began with optimism as the Nasdaq hit a fresh all-time intraday high. Still, euphoria quickly turned to panic following President Trump's surprise threat of "massive" tariff increases on China.

The president accused Beijing of becoming "very hostile" with its restrictions on rare earth metals, critical resources for tech and defense industries, and canceled his planned meeting with Chinese President Xi Jinping at APEC.

The tariff threat wiped out early gains, with stocks accelerating their decline into the close.

The S&P 500's 2.71% drop marked its largest single-day decline since April 10, ending a remarkable 33-day streak without a 1% move in either direction.

Technology stocks bore the brunt of the selloff, given their significant exposure to China for both manufacturing and customers.

The VIX fear gauge spiked above 22, reaching levels not seen since June.

Adding to market concerns, the U.S. government shutdown dragged into its 10th day with no resolution in sight.

Trump administration budget chief Russell Vought confirmed that federal layoffs "have begun," while the Senate failed for a seventh time to pass funding proposals.

Stock Moves Deciphered 📈

🥤PepsiCo (PEP) ⬆️ 3.71%

The beverage and snack giant defied Friday's market carnage, surging on strong Q3 results that beat analyst expectations.

The company's robust earnings, combined with the announcement of a new CFO appointment, fueled positive sentiment among investors.

🛠️ AutoZone (AZO) ⬆️ 2.72%

AutoZone's stable sales performance and defensive market position made it a safe haven for investors fleeing riskier assets.

The company further boosted confidence by announcing a new $1.5 billion share buyback program, signaling management's commitment to returning capital to shareholders.

📉 Synopsys (SNPS) ⬇️ 9.40%

The semiconductor design software company was hit particularly hard during Friday's selloff, falling sharply as renewed U.S.-China trade fears gripped the market.

As a key player in the semiconductor industry with significant exposure to global chip manufacturing, Synopsys faced intense selling pressure following President Trump's threat of massive tariffs on Chinese products.

Headlines You Can't Miss 👀

📉 Rare earth stocks surged as MP Materials jumped 15% and USA Rare Earth soared 19% after Trump accused China of holding the world "captive" over critical minerals.

🏥 Protagonist Therapeutics spiked 33% on reports that Johnson & Johnson is in talks to acquire the biopharmaceutical company, which would add to a growing wave of pharma deals.

💊 Bristol Myers Squibb announced plans to acquire Orbital Therapeutics for $1.5 billion, while Novo Nordisk agreed to buy Akero Therapeutics for $5.2 billion on Thursday.

📊 The Labor Department is bringing back staff to prepare the September Consumer Price Index despite the government shutdown, with the Social Security Agency needing Q3 CPI data before Nov. 1.

🏠 Home construction stocks suffered their worst week of 2025, with the iShares U.S. Home Construction ETF falling 7.5% as builders like DR Horton and KB Home dropped over 10%.

🇨🇳 Chinese stocks tanked as Alibaba and Baidu fell more than 6% each, while PDD Holdings shed 4% following Trump's tariff threat against China.

⚠️ Fed Governor Christopher Waller said the central bank needs to be "cautious about" cutting rates, citing conflicting signals between strong GDP growth and weakening labor market data.

💰 Treasury Secretary Scott Bessent narrowed the Federal Reserve chair candidate list to five from 11, with Vice Chair Michelle Bowman and NEC Director Kevin Hassett still in the running.

Trending Stocks 📊

🤖 Applied Digital (APLD) ⬆️ 16%

Shares surged 16% after the datacenter builder reported revenue in its fiscal first quarter was up 84% from the comparable period in the prior year, outperforming market expectations and demonstrating strong momentum in the AI infrastructure buildout.

👖 Levi Strauss (LEVI) ⬇️ 12.6%

The denim apparel maker fell more than 7% in extended trading despite posting better-than-expected Q3 earnings of 34 cents per share on revenue of $1.54 billion.

Traders remained concerned about potential impacts from the Trump administration's tariffs on the company's business.

🚗 Stellantis (STLA) ⬇️ 7.40%

The stock fell over 7% even as the French-Italian-American automaker reported a 13% rise in third-quarter shipments.

The strong delivery numbers provided a bright spot for the automotive sector amid broader market weakness and tariff concerns.

What’s Next?

Key market and macro news 👇

💰Fastenal Earnings: Industrial supplier Fastenal reports Q3 earnings before the bell today. Investors will watch for insights into industrial demand and the manufacturing sector's health amid economic uncertainty.

🏦 Major Bank Earnings Anticipation: As major banks like JPMorgan Chase and Goldman Sachs report on Tuesday, their earnings will be closely watched, setting the tone for the financial sector this week.

🔓 U.S. Government Shutdown: The ongoing federal government shutdown is delaying key economic data releases, such as CPI and PPI, which creates uncertainty for investors and affects the Federal Reserve's future policy decisions.

🎤 Fed Chair Powell's Upcoming Speech: Fed Chair Jerome Powell is scheduled to speak on Tuesday. His comments on monetary policy and the economic outlook will be highly anticipated by the market.

🇨🇳 China Trade Data: China is expected to release its September trade data. This will provide a glimpse into the health of the world's second-largest economy and its trade relations.

Chart of the Day

Meme of the Day

Great investing starts with great information.

Forward The Market Scoop to anyone who wants to stay ahead of the market through a pertinent and entertaining newsletter format.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please exercise caution and conduct your own research.