- Ziggma

- Posts

- 💰 Berkshire Bets on Google

💰 Berkshire Bets on Google

Big moves decoded: MSTR, WMT, and more!

Market Performance

S&P 500: 6,734.11 ⬇️ 0.05%

Nasdaq: 22,900.59 ⬆️ 0.13%

Dow Jones: 47,147.48 ⬇️ 0.65%

Berkshire Invests in Google

Warren Buffett's Berkshire Hathaway (BRK.B) just made its biggest Q3 purchase, and it's a tech stock.

Berkshire acquired over 17.8 million shares of Alphabet (GOOGL), valued at approximately $4.9 billion, marking the largest addition to its portfolio in the last quarter.

This is remarkable considering Buffett has traditionally avoided tech stocks, famously calling himself out at the 2019 shareholder meeting for "sitting there sucking our thumbs" instead of buying Google earlier when shares traded around $59.

The mystery deepens because we don't know who made the call. It could be incoming CEO Greg Abel, who's been taking on more responsibilities, or portfolio managers Ted Weschler and Todd Combs.

Alphabet shares surged 3.5% in after-hours trading on the news.

Meanwhile, Buffett continues to trim his mega-positions—Apple was cut by another 15% (now down 74% since selling began), and Bank of America decreased by 6.1%.

But both remain massive holdings at $64.9 billion and $29.9 billion, respectively.

Our Takeaway

The Alphabet investment signals a potential strategic shift at Berkshire as leadership transitions.

Whether it's Abel's influence or portfolio managers taking bigger swings, the old guard's tech hesitancy may be fading.

Watch how this position develops—it could define the post-Buffett era.

Tackle your credit card debt by paying 0% intro APR until 2027

Did you know some credit cards can actually help you get out of debt faster? Yes, it sounds crazy. But it’s true.

The secret: Find a card with a “0% intro APR" period for balance transfers or purchases. This could help you fund a large purchase or transfer your debt balance and pay it down as much as possible during the intro period. No interest means you could pay off the debt faster.

Market Overview 📈

The S&P 500 ended near flat on Friday after wild intraday swings saw the index down as much as 1.4% before recovering.

Investors grappled with mounting concerns about AI valuations and uncertainty surrounding Federal Reserve policy.

Technology stocks led the volatility, with the sector rebounding 0.5% Friday after Thursday's brutal 2% selloff—the worst single-day performance since October 10.

AI giants like Nvidia, Oracle, Palantir, and Tesla all reversed course from their previous session losses.

However, concerns about stretched valuations and soaring AI capital expenditures continue to weigh on sentiment.

The Fed picture grew murkier as Kansas City Fed President Jeffrey Schmid reiterated opposition to further rate cuts, joining a growing chorus of hawks.

Market pricing for a December rate cut plummeted from 95% odds a month ago to below 50%, dampening investor enthusiasm for risk assets.

Notably, mentions of tariffs in S&P 500 earnings calls declined 33% quarter-over-quarter, though they remain the fourth-highest over the past decade, according to FactSet.

Separately, the U.S. secured a trade deal with Switzerland to lower tariffs to 15%, while Iran seized an oil tanker in the Strait of Hormuz—pushing crude oil nearly 3% higher.

Stock Moves Deciphered 📈

StubHub (STUB)

The ticket reseller plummeted 21% after CEO Eric Baker announced the company wouldn't guide for the current quarter during its conference call.

While StubHub exceeded analysts' second-quarter revenue expectations in its first report since its September IPO, it posted a net loss of $1.33 billion, reflecting a one-time stock-based compensation charge.

Baker did indicate that StubHub plans to provide 2026 guidance when fourth-quarter results are released, but investors weren't waiting around—shares closed down 21%.

Walmart (WMT)

Shares fell marginally after the retail giant announced CEO Doug McMillon will retire effective February 1, ending his transformative tenure that saw Walmart successfully pivot to e-commerce and compete with Amazon.

John Furner, currently President and CEO of Walmart U.S., will succeed McMillon as the company's chief executive. McMillon led Walmart through a massive digital transformation, expanding online grocery delivery and launching Walmart+ to compete with Amazon Prime.

The leadership transition comes as retailers face ongoing challenges from tariff concerns and shifting consumer spending patterns.

Warner Bros. Discovery (WBD)

The parent company of HBO and CNN rose 4% after The Wall Street Journal reported that Paramount, Skydance, Netflix, and Comcast are preparing bids for the media company.

Warner Bros. Discovery has set an initial deadline of November 20 for first-round bids, according to sources familiar with the matter.

The potential acquisition interest arises as traditional media companies face intense pressure from streaming competition and the growing trend of cord-cutting.

Headlines You Can't Miss 👀

🏛️ JPMorgan Chase secured deals with fintech firms covering 95%+ of data requests (including Plaid, Yodlee, Morningstar) to get paid for customer data access via third-party apps.

🤝 The U.S. and Switzerland reached a trade deal lowering tariffs to 15%, announced by Trade Representative Jamieson Greer.

🛢️ Iran seized oil tanker in Strait of Hormuz on Friday—first such incident in months, raising concerns about global oil supply disruptions through this critical chokepoint.

⚡ Russia's Black Sea port of Novorossiysk halted oil exports due to Ukrainian strikes, contributing to crude oil jumping nearly 3% to over $60 per barrel.

🏥 Scholar Rock jumped 23% after completing a constructive FDA Type A meeting for apitegromab spinal muscular atrophy treatment—Novo's Catalent facility ready for reinspection by year-end.

💰 Merck agreed to acquire Cidara Therapeutics for approximately $9.2B in cash, sending Cidara shares up 103% while Merck fell 1% on the announcement.

Trending Stocks 📊

Applied Materials (AMAT)

The semiconductor equipment maker rose 1% after exceeding fourth-quarter expectations, earning $2.17 per share (adjusted) on $6.8 billion revenue versus estimates of $2.09 EPS on $6.67 billion revenue.

Applied Materials forecasted higher demand in the second half of 2026 but warned that China spending might be weaker, tempering investor enthusiasm despite the earnings beat.

The company's cautious outlook for China reflects ongoing geopolitical tensions and export restrictions that are affecting semiconductor equipment sales.

Strategy (MSTR)

The Bitcoin treasury stock plunged over 17% for the week—its worst weekly performance in a year—as the bitcoin pullback intensified.

Trading around $200 per share, near its 52-week low of $194.56, Strategy's decline mirrors bitcoin's drop below $95,000 earlier this week to its lowest price since early May.

CEO Michael Saylor told CNBC's "Squawk Box" that the company is buying "quite a lot" of bitcoin at current levels, reaffirming its strategy despite market weakness.

Figure Technology (FIG)

The lending platform and stablecoin issuer exceeded third-quarter expectations, posting $0.34 EPS (excluding items) on $156.4 million in revenue, versus analyst estimates of $0.16 EPS on $119.4 million in revenue.

Shares fell 5% despite the company's strong results, even as it demonstrated an ability to scale its blockchain-based lending operations.

Figure Technology has been positioning itself at the intersection of traditional finance and cryptocurrency, offering home equity lines of credit and other lending products on blockchain infrastructure.

What’s Next?

Key market and macro news 👇

👩💼 September jobs report likely next week, though timing is uncertain as Labor Department updates calendar.

📊 Consumer sentiment and inflation data releases are pending updates to the Commerce Department's schedule.

₿ Bitcoin volatility continues impacting crypto-related stocks as the token struggles below $100,000.

💸 AI valuation concerns persist, with investors questioning stretched multiples and soaring capex commitments.

⛽️ Oil prices are sensitive to geopolitical tensions after the Iran tanker seizure and the Russia port disruptions.

Chart of the Day

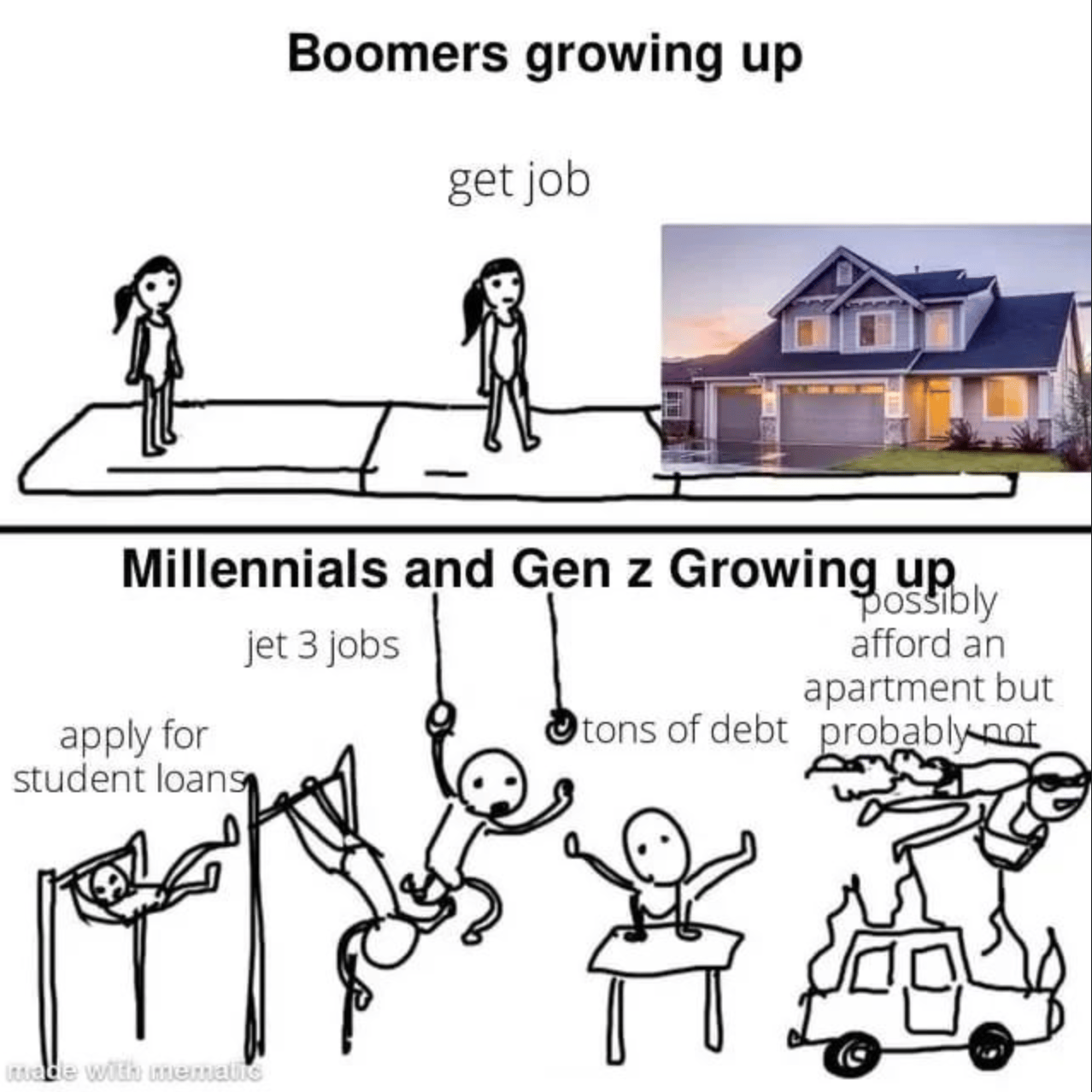

Meme of the Day

Great investing starts with great information.

Forward The Market Scoop to anyone who wants to stay ahead of the market through a pertinent and entertaining newsletter format.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please exercise caution and conduct your own research.