- Ziggma

- Posts

- 🗞️ Berkshire Acquires OxyChem

🗞️ Berkshire Acquires OxyChem

Big moves decoded: AMAT, HUM, and WYNN

Market Performance

S&P 500: 6,715.79 ⬆️ 0.01%

Nasdaq: 22,780.51 ⬇️ 0.28%

Dow Jones: 46,758.28 ⬆️ 0.51%

Berkshire Pays $9.7 Billion to Acquire OxyChem

Last week, Warren Buffett’s Berkshire Hathaway announced it was acquiring Occidental Petroleum's (OXY) petrochemical unit, OxyChem, for $9.7 billion in cash, the conglomerate's largest deal since buying insurer Alleghany for $11.6 billion in 2022.

Berkshire is already holding a massive 28.2% stake in Occidental itself, and Buffett has repeatedly stated that he wouldn't take complete control of the Houston-based oil company.

Yet here he is, carving out a strategic piece of the business in classic Buffett fashion: buying quality assets at what he presumably sees as attractive valuations.

The deal also marks Buffett's second major bet on chemicals, following Berkshire's 2011 acquisition of Lubrizol for a similar $10 billion.

For Occidental CEO Vicki Hollub, this transaction solves a critical problem: debt reduction.

The company plans to use $6.5 billion of the proceeds to pay down debt, which will finally allow it to restart share buybacks—something shareholders have been waiting for.

With Berkshire sitting on $344 billion in cash and Greg Abel set to take over as CEO in 2026, this acquisition signals the company's willingness to deploy capital into industrial businesses with strong cash flows and proven management teams.

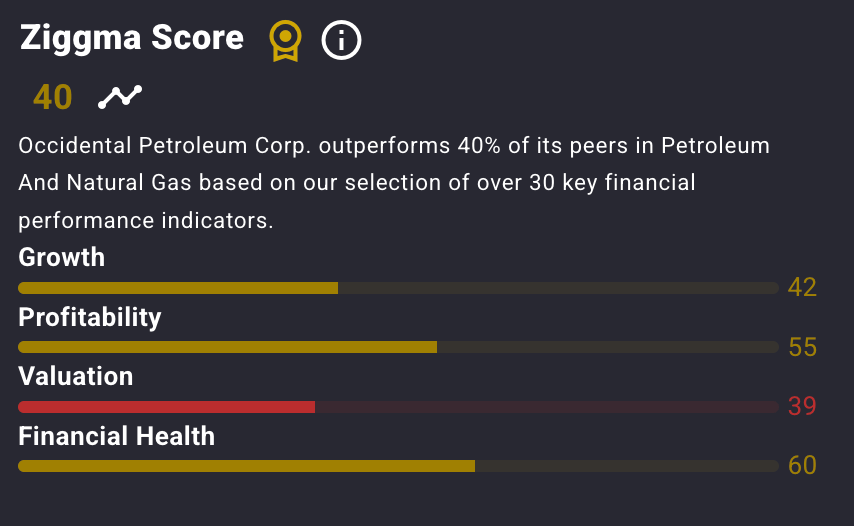

OXY stock currently has a Ziggma Stock Score of 40, ranking in the bottom half percentile in terms of valuation and growth.

Our Takeaway

The market's 7% selloff in OXY shares suggests that investors may be concerned about the company's strategic direction.

Still, Hollub's focus on debt reduction and returning capital to shareholders could prove wise in the long term.

For Berkshire, it's a classic Buffett move: buying quality at scale.

Market Overview 📈

Major indexes posted mixed results on Friday as stocks retreated from record highs, though all three major benchmarks secured positive weekly gains.

The S&P 500 rose approximately 1.1% for the week, while the Nasdaq gained 1.3% and the Dow added 1.1%. The small-cap Russell 2000 outperformed, gaining nearly 2% weekly.

Technology stocks led the decline on Friday afternoon, with Palantir plummeting 7.5%, while Tesla and Nvidia dropped more than 1% each.

Despite these pullbacks, investors largely shrugged off concerns about the ongoing government shutdown, now in its third day, with Wall Street expecting a short-lived impact on the economy and minimal disruption to the momentum in the artificial intelligence trade.

The shutdown created an economic data blackout, blocking the release of September's nonfarm payrolls report on Friday.

While this removed potential pressure on stocks, it also limited the Federal Reserve's data inputs ahead of its October meeting.

Markets continue to price in a quarter-point rate cut at that meeting, according to the CME FedWatch tool.

Adding to labor market concerns, ADP reported private payrolls posted their biggest decline since March 2023 in September, reinforcing evidence of a weakening employment picture.

Treasury Secretary Scott Bessent warned that the shutdown could deliver a "a hit to GDP, growth, and working America," with the Congressional Budget Office estimating that 750,000 federal workers would be furloughed daily.

Meanwhile, the 30-year Treasury yield remained elevated near levels not seen since late 2023, as bond markets digest fiscal policy uncertainties.

Stock Moves Deciphered 📈

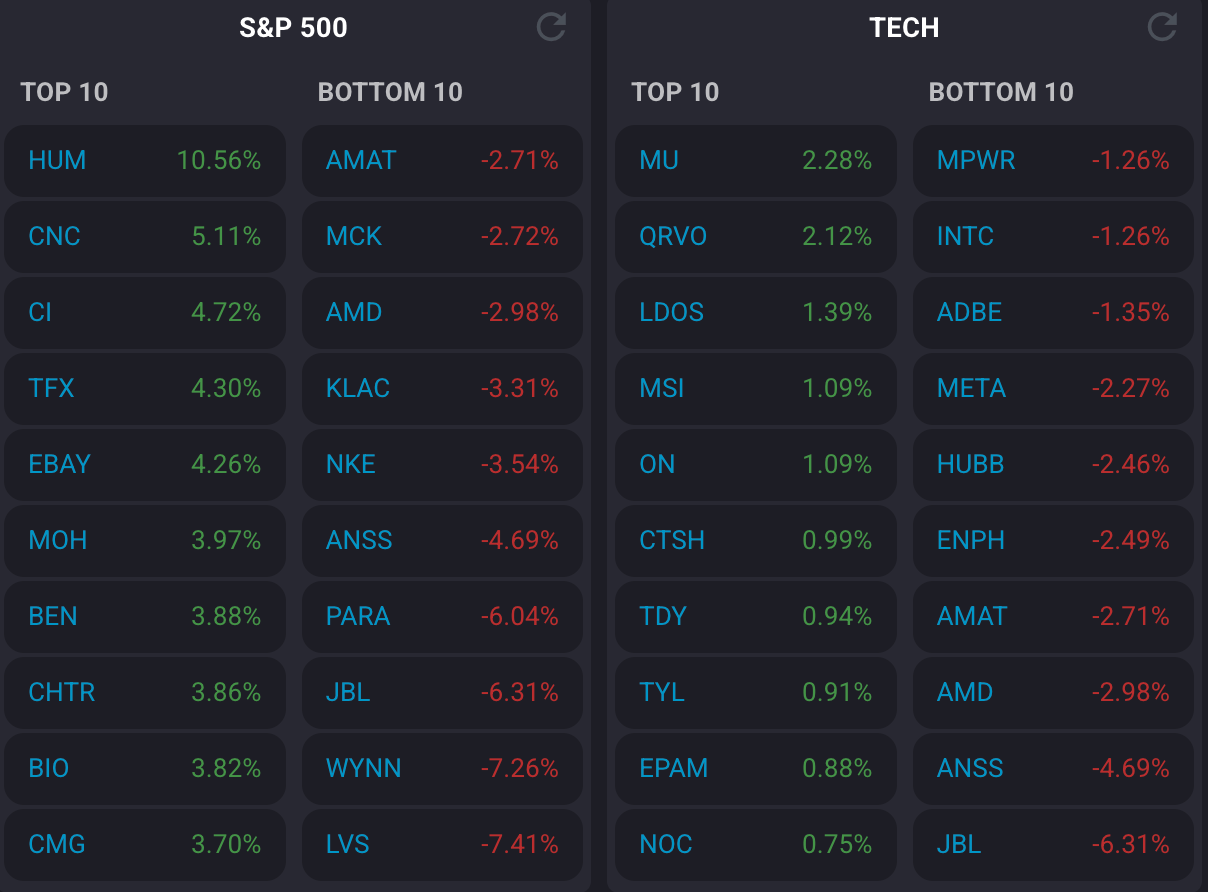

💊 Humana (HUM) — The health insurer emerged as the S&P 500's top performer, surging 11% after affirming its outlook following an inadvertent government data release regarding Medicare Advantage plans, reducing regulatory uncertainty around reimbursement structures.

🏨 Wynn Resorts (WYNN) — Shares declined more than 7% as Tropical Cyclone Matmo threatened Macau during the critical Golden Week holidays, compounded by weaker-than-expected Chinese travel data highlighting the sector's vulnerability to external disruptions.

🤖 Jabil (JBL) — The manufacturing services provider declined 6.31% to $202.08, pressured by substantial insider selling as Executive Chairman Mark Mondello sold 20,000 shares for approximately $4.3 million, raising valuation concerns.

🥙 Chipotle Mexican Grill (CMG) — The fast-casual chain received an analyst upgrade from BWG Global moving to "Positive" outlook, though shares continue trading well below 52-week highs after management cut full-year guidance twice during 2025.

Headlines You Can't Miss 👀

📊 Goldman raises Amazon target to $275, citing underappreciated cloud and advertising growth opportunities, implying 23% upside potential.

⚡ Quantum computing stocks surge double-digits as Rigetti secures $5.7M in orders while Danish government invests €300M in quantum venture fund.

🏥 Health care sector heads for best week since 2022, surging over 7% week-to-date with Bio-Techne and Charles River leading gains of 20%+.

⚠️ Goldman CEO David Solomon warns of market 'drawdown' in next 12-24 months, comparing current AI frenzy to dotcom bubble dynamics.

💊 Wells Fargo upgrades Johnson & Johnson to overweight, raising price target to $212 on strong pharma outlook and reduced tariff risks.

📉 Service sector activity unexpectedly stalls in September, with ISM services PMI dropping to 50.0%, missing estimates as production hits pandemic-era lows.

🎮 GameStop files to sell undisclosed mix of stock and debt securities, sending meme stock down 2.7% in premarket trading.

🚗 Ferrari initiated as a “buy” at Berenberg, with analysts noting significant investor interest and high-quality compounder characteristics; shares up 18.7% YTD.

Trending Stocks 📊

⚡️ Peabody Energy (BTU)

The coal producer surged 9% after initiating arbitration proceedings against Anglo American over the canceled purchase of steelmaking coal assets.

The move signals Peabody's aggressive stance in securing strategic assets to strengthen its metallurgical coal portfolio, which is particularly important given that steel production remains a key driver of industrial demand despite the energy transition.

💾 SanDisk (SNDK)

The solid-state drive manufacturer jumped over 3%, extending its remarkable rally that has seen shares soar 170% over the past six months.

The surge reflects growing demand for high-performance storage solutions driven by AI applications and data center expansion, positioning SanDisk as a key beneficiary of the broader technology infrastructure buildout.

💸 Applied Materials (AMAT)

Shares dipped 3% following the disclosure that new U.S. export restrictions will significantly impact revenue.

The chipmaker estimates the Commerce Department's "BIS Affiliates Rule" will reduce Q4 revenue by approximately $110 million and slash fiscal 2026 revenue by roughly $600 million, as restrictions limit exports to China-based customers.

Despite the headwind, shares remain up 37% year-to-date; however, the announcement raises concerns about the ongoing U.S.-China technology tensions potentially impacting semiconductor equipment makers.

What’s Next?

Key earnings and macro news 👇

💸 Constellation Brands reports earnings: The beverage giant's financial results will provide insight into consumer spending trends and could impact the broader consumer staples sector.

📣 VCI Global announces financial results: The consulting firm's first-half 2025 performance may impact investor sentiment in the professional services industry and signal trends in business investment.

🛢️ OPEC+ ministerial meeting concludes: Decisions on oil production quotas from this meeting will directly influence global energy prices and the stock performance of companies in the oil and gas sector.

📊 Eurozone retail sales data release: This key economic indicator will provide insight into the health of European consumers, which can have a ripple effect on global markets and multinational corporations.

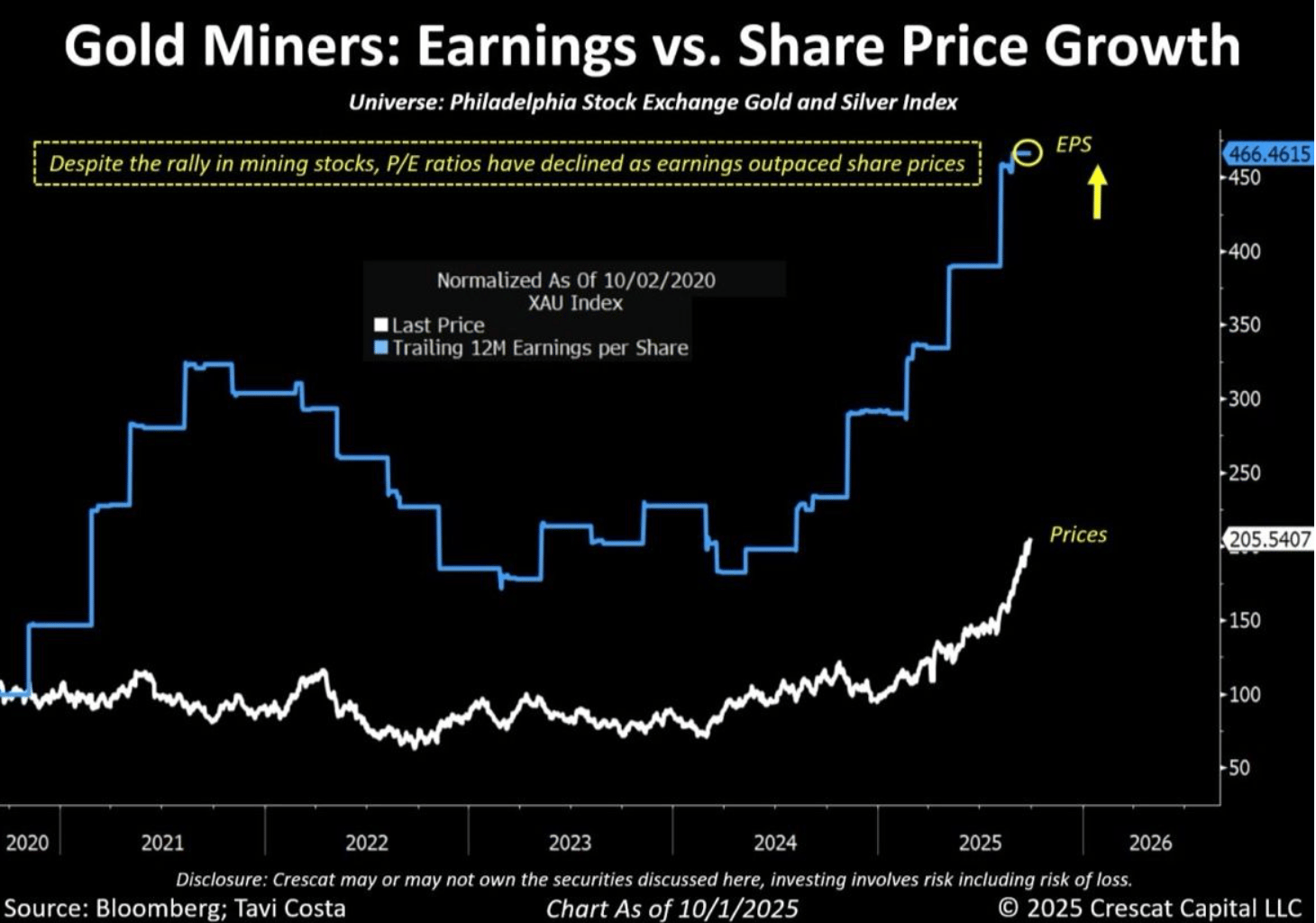

Chart of the Day

Meme of the Day

Great investing starts with great information.

Forward The Market Scoop to anyone who wants to stay ahead of the market through a pertinent and entertaining newsletter format.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please exercise caution and conduct your own research.