- Ziggma

- Posts

- 🗞️ ASML Disappoints Wall Street

🗞️ ASML Disappoints Wall Street

ASML, JPMorgan, Citi, and more!

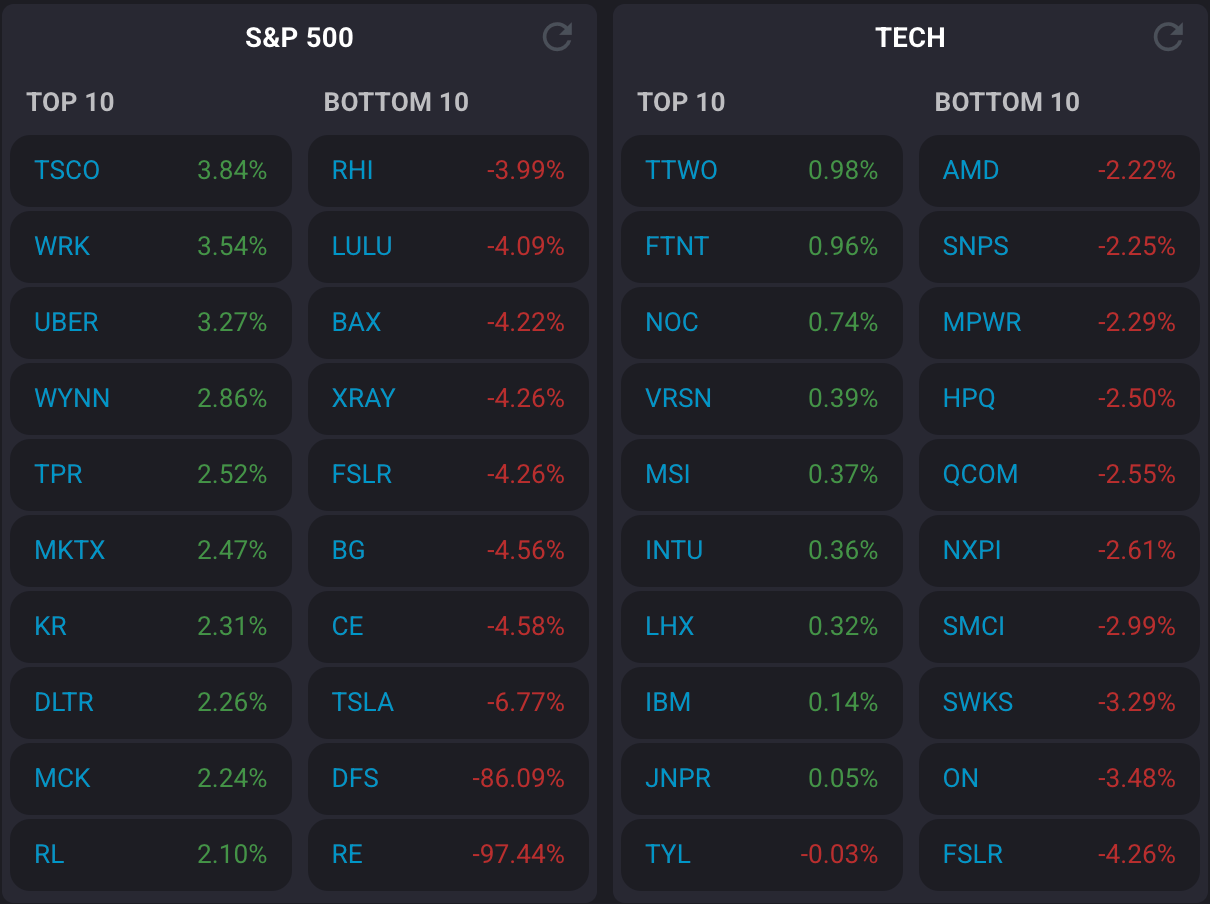

Market Performance

S&P 500: 6,243.76 (-0.40%)

Nasdaq: 20,667.80 (+0.98%)

Dow Jones: 44,023.29 (-0.98%)

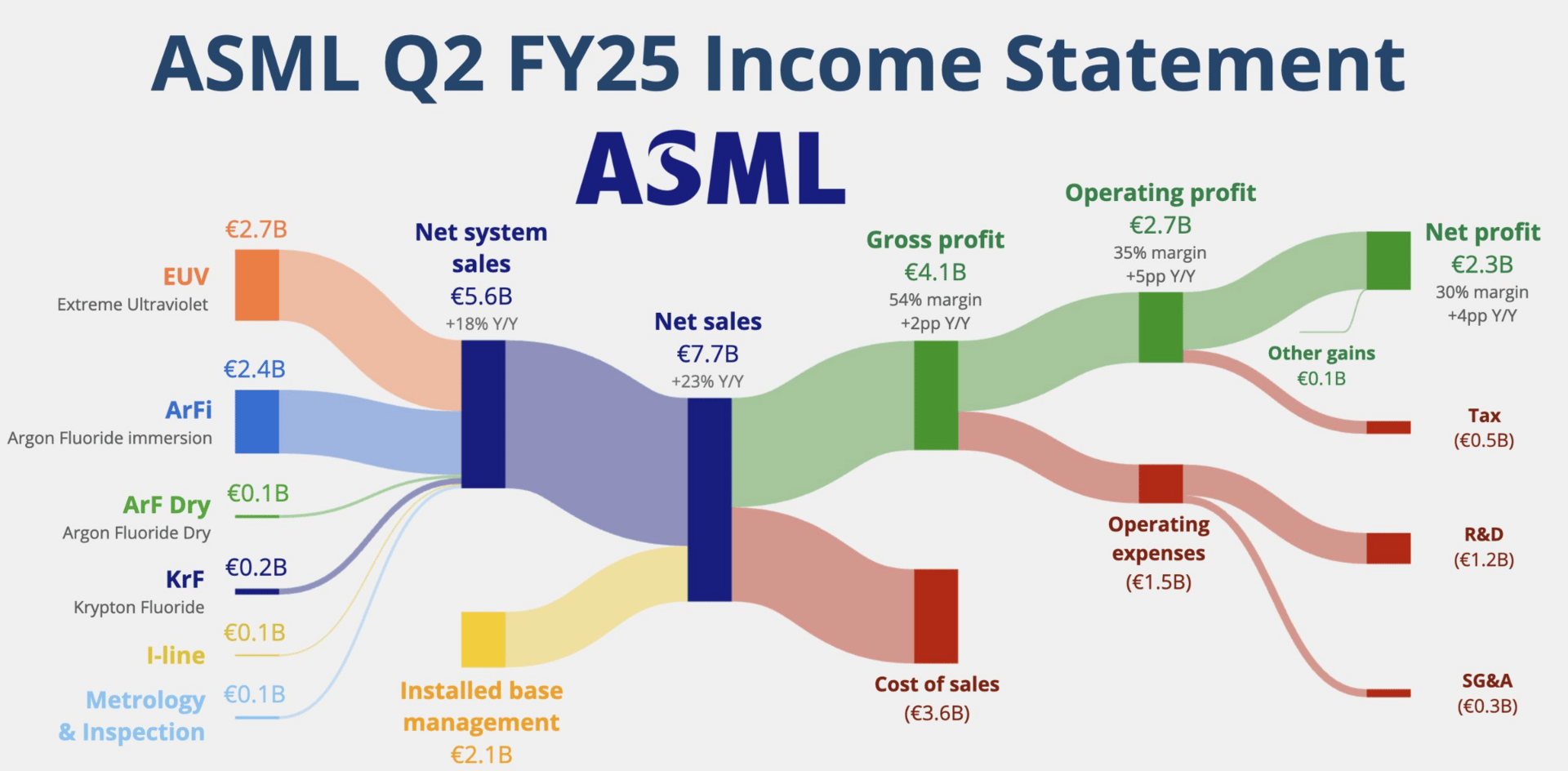

ASML Remains Cautious Despite Earnings Beat

Here's something that caught investors off guard: ASML (ASML) delivered a stellar second quarter, beating both revenue and earnings expectations, yet warned it might see zero growth in 2026.

The Dutch semiconductor giant reported €7.7 billion in net sales, slightly above the expected €7.52 billion, with net income reaching €2.29 billion, above the forecasted €2.04 billion.

Source: App Economy Insights

However, here's the kicker: CEO Christophe Fouquet stated that the chipmaker "cannot confirm" its growth for 2026 due to "increasing uncertainty driven by macro-economic and geopolitical developments."

This is significant because ASML makes the ultra-sophisticated EUV lithography machines that are essential for manufacturing the world's most advanced chips.

The market's reaction was swift and harsh - ASML stock plummeted 6.5% in Europe and is down 7.5% in pre-market trading on the NYSE.

What makes this noteworthy is that ASML sits at the epicenter of the global semiconductor supply chain, serving customers like Intel, Apple, and Taiwan Semiconductor.

A cautious outlook signals broader headwinds for the entire semiconductor industry, even as demand for AI continues to surge.

Our Takeaway

ASML's mixed signals reveal the complex reality of the semiconductor industry in 2025.

While AI continues to drive strong demand for advanced chips, geopolitical tensions and macroeconomic uncertainty are creating visibility challenges even for industry leaders.

ASML’s warning about 2026 growth, despite beating Q2 expectations, suggests that tariff policies and trade restrictions are weighing heavily on long-term planning.

However, ASML's fundamental position remains strong - they're the only company capable of producing the extreme ultraviolet lithography machines needed for cutting-edge semiconductors.

Its €5.5 billion in Q2 bookings, exceeding the €4.19 billion expected, demonstrating that underlying demand remains robust.

The €44-60 billion revenue opportunity by 2030 that management outlined at the November investor day remains intact, but the path there may be bumpier than originally anticipated.

For investors, this reinforces the need to balance the sector's long-term AI-driven growth potential against near-term execution risks and geopolitical headwinds.

Market Overview

Inflation concerns and mixed bank earnings weighed on markets Tuesday, with the Dow leading losses after falling 436 points.

The consumer price index rose 0.3% month-over-month, pushing the annual inflation rate to 2.7%, the highest since February.

This matched expectations but fueled fears about the impact of President Trump's tariffs, especially after his weekend announcement of 30% tariffs on EU and Mexican goods starting August 1.

Stock futures pointed to continued weakness, with Dow futures down 84 points and S&P 500 futures falling 0.21%.

The VIX volatility index remained elevated as investors grappled with the implications of rising rates and deficit concerns.

Treasury yields spiked, with the 30-year rate hitting its highest level since October 2023, following the House's passage of a spending bill that could increase government debt by trillions.

Headlines You Can't Miss

Nvidia to resume H20 chip sales to China after securing U.S. government licenses.

Apple may face a 25% tariff on iPhones not manufactured in the United States.

Tesla shares fell as CFO received $139M pay package in 2024, raising governance concerns.

Renault shares plunged 16% after French carmaker lowered 2025 guidance and appointed new interim CEO.

MP Materials soared 25% on $500 million rare earth magnet deal with Apple for Texas manufacturing.

Trump's crypto bills failed House procedural vote but President claims votes now secured after White House meeting.

The Trade Desk surged 14% after S&P 500 inclusion announcement effective Friday.

DoorDash downgraded to “hold” at Jefferies as stock trades at 120% premium to internet peers.

Global Payments advanced 5% after Elliott Management increased stake according to reports.

Southwest Airlines was downgraded to in-line as shares approach fair value following an 11% YTD gain.

Trending Stocks

Wells Fargo (WFC) - The bank beat Q2 earnings expectations, but shares fell more than 5% after management reduced 2025 net income guidance to roughly flat versus 2024 levels, down from the previous 1-3% growth forecast.

The guidance cut overshadowed solid quarterly results, highlighting ongoing challenges in the banking sector.

CEO Quote🎤: “We now have the flexibility to proactively grow deposits and to allocate capital to grow loans and our corporate investment bank.”

Citigroup (C) - Citi bucked the negative financial sector trend, rising over 3% after the bank topped Q2 estimates with strong trading and investment banking performance.

Markets revenue jumped 16% year-over-year, with both fixed income and equities results trending higher, demonstrating the bank's trading desk strength.

CEO Quote🎤: “We’re improving the performance of each of our businesses to take share and drive higher returns. Markets had its best second quarter performance since 2020 with a record second quarter for Equities. Banking revenues were up 18% and we continue to be at the center of some of the most significant transactions.”

JPMorgan (JPM): Shares edged lower despite beating Q2 expectations, with investment banking and trading revenue driving the outperformance. The bank's diversified revenue streams and strong balance sheet position it well, though concerns about loan loss provisions and net interest margin compression weighed on sentiment.

Analyst Quote🎤: “The U.S. economy remained resilient in the quarter. The finalization of tax reform and potential deregulation are positive for the economic outlook. However, significant risks persist – including from tariffs and trade uncertainty, worsening geopolitical conditions, high fiscal deficits and elevated asset prices.”

What’s Next?

Key Earnings Today 👇

Bank of America (BAC): Q2 revenue forecast at $26.77 billion vs. $25.38 billion last year. Adjusted earnings are expected to grow from $0.83 per share to $0.87 per share.

Goldman Sachs (GS): Q2 revenue forecast at $13.54 billion vs. $12.73 billion last year. Adjusted earnings are expected to increase from $8.62 per share to $9.68 per share.

United Airlines (UAL): Q2 revenue forecast at $15.33 billion vs. $14.99 billion last year. Adjusted earnings are expected to narrow from $4.14 per share to $3.88 per share.

Johnson & Johnson (JNJ): Q2 revenue forecast at $22.86 billion vs. $22.45 billion last year. Adjusted earnings are expected to narrow from $2.82 per share to $2.68 per share.

Macro News

June Producer Price Index (PPI) releases on Wednesday, expected up 0.2% monthly

Weekly jobless claims data on Thursday morning

Existing home sales data on Friday could signal housing market health

House continues debate on Trump's tax and spending megabill

Fed officials monitor inflation data for future rate decisions

Track upcoming news and earnings on your portfolio companies with Ziggma.

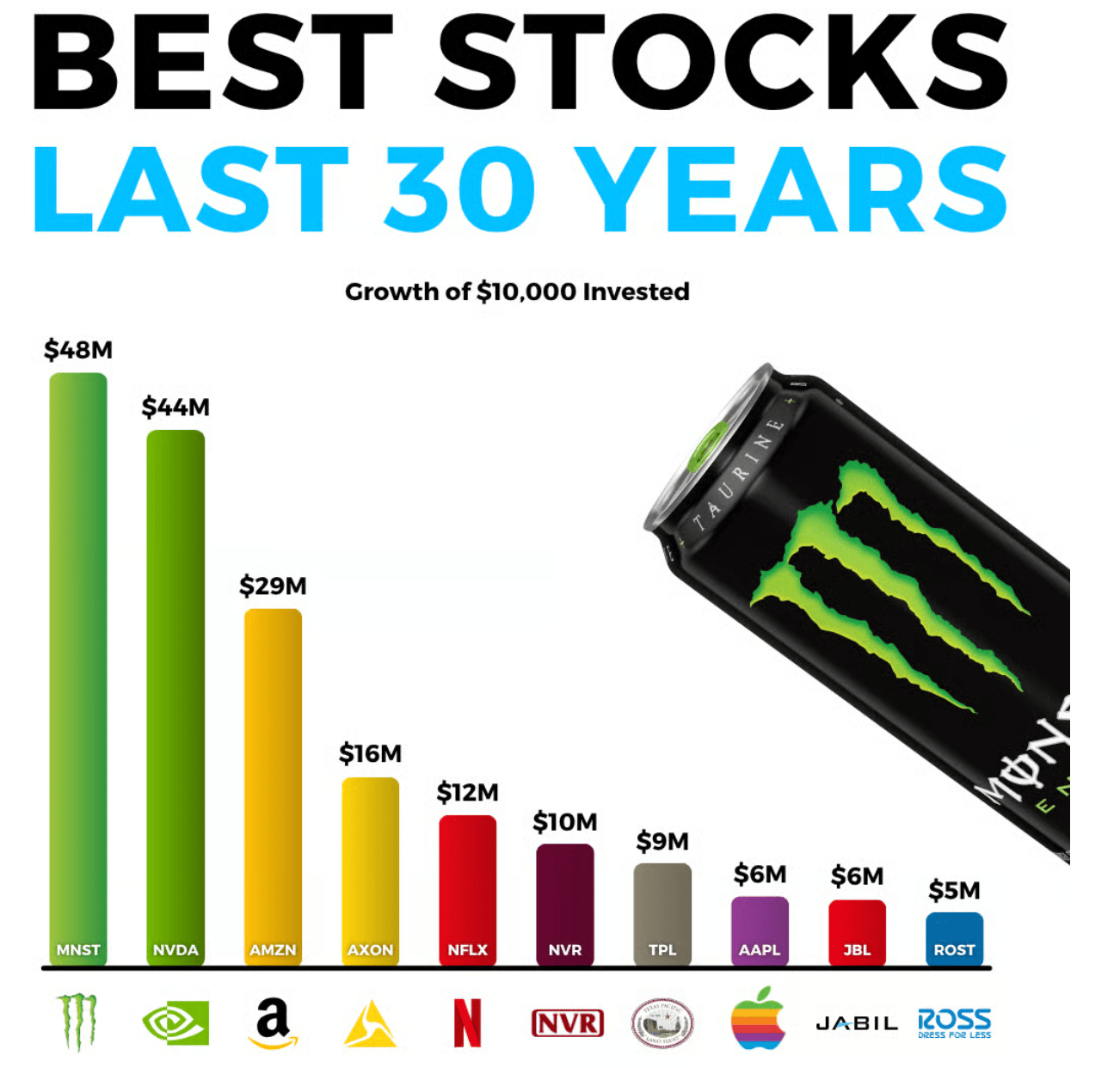

Chart of the Day

Meme of the Day

Great investing starts with great information. Forward The Market Scoop to anyone who wants to stay ahead of the market through a pertinent and entertaining newsletter format.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.