- Ziggma

- Posts

- 🚀 Applied Digital Soars 8%

🚀 Applied Digital Soars 8%

PLUS: Defense stocks rally

Market Performance

S&P 500: 6,921.46 ⬆️ 0.01%

Nasdaq: 23,480.02 ⬇️ 0.44%

Dow Jones: 49,266.11 ⬆️ 0.55%

Applied Digital's AI Infrastructure Bet Pays Off

Applied Digital (APLD) stock surged 8% after crushing Wall Street expectations with fiscal second-quarter results that showcased explosive AI infrastructure growth.

The data center operator reported revenue of $126.6 million—up 250% year-over-year and crushing analyst estimates of $81 million. Adjusted earnings came in at breakeven versus expected losses of $0.12 per share.

The High-Performance Computing Hosting Business drove most growth, generating $85 million in quarterly revenue.

The company's first building at Polaris Forge 1 became fully operational, with the Data Center Hosting Business adding another $41.6 million (up 15% year-over-year).

Here's what makes this significant: Applied Digital has secured agreements for 600 megawatts of capacity, representing approximately $16 billion in prospective lease revenue over 15 years.

CEO Wes Cummins revealed the company is in advanced discussions with another investment-grade hyperscaler for multiple additional sites.

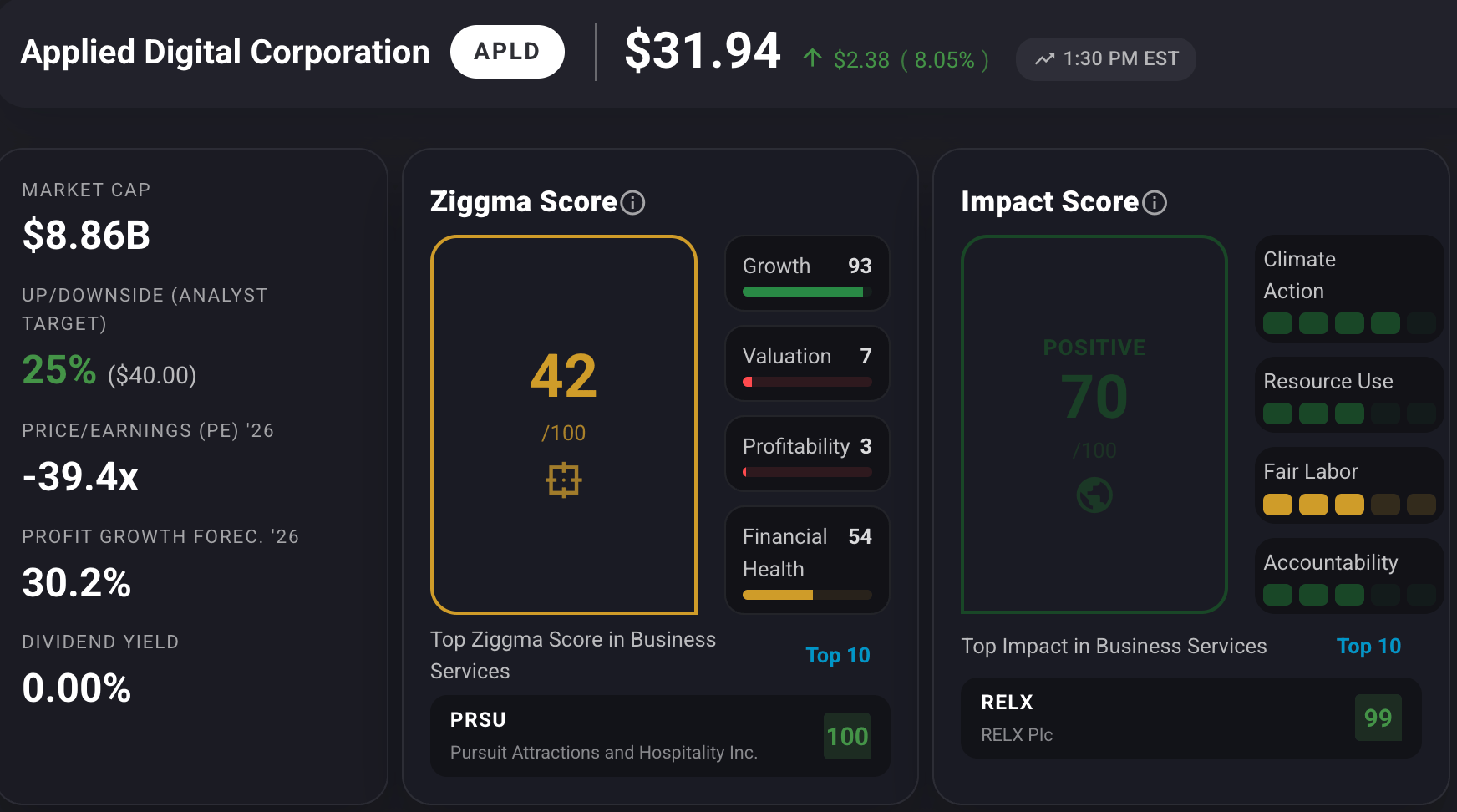

APLD stock has a Ziggma score of 42 and ranks in the top percentile in terms of growth. However, the tech stock has rallied 267% in the past year and trades at a lofty valuation.

Our Takeaway

With hyperscaler investment in AI infrastructure exceeding $400 billion annually, Applied Digital has positioned itself perfectly.

The company's first-mover advantage in the Dakotas—with their cool climate and abundant energy—combined with $2.3 billion in cash, gives them a serious runway.

Management expects to surpass its $1 billion net operating income goal within five years, faster than anticipated.

Market Overview 📈

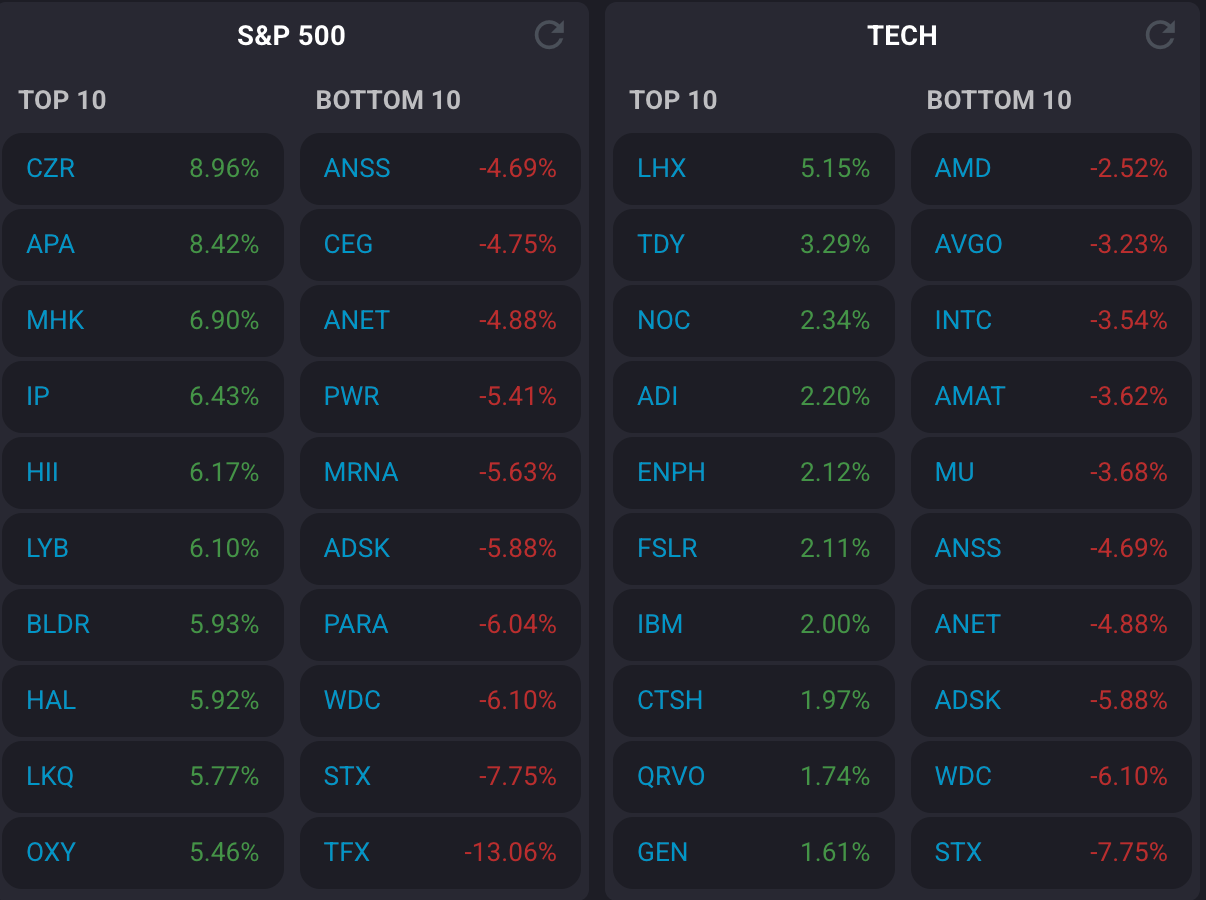

Markets showed divergence on Thursday as investors rotated out of technology stocks and into value plays, while defense stocks surged on Trump's proposed budget increase.

The iShares S&P 500 Value ETF rallied 1%, while the iShares S&P 500 Growth ETF slid 1%.

Information technology was the day's laggard, falling more than 1%. AI darlings Nvidia and Oracle both pulled back nearly 2%, while Apple notched its seventh consecutive day of losses.

Defense stocks stole the spotlight after President Trump called for a $1.5 trillion defense budget in 2027—a massive increase from the $901 billion approved for 2026.

Lockheed Martin gained over 4%, Northrop Grumman jumped more than 2%, and Kratos Defense popped nearly 14%.

Auto stocks rallied after Treasury Secretary Scott Bessent announced tax deductions on vehicle loan interest for U.S.-built vehicles purchased from 2025 to 2028, with up to $10,000 annually deductible.

Ford and General Motors reached new 52-week highs, rising 5% and 3% respectively.

Oil prices rebounded more than 4% after sliding on Wednesday on Trump's announcement that Venezuela would turn over 30-50 million barrels to the U.S.

Stock Moves Deciphered 📈

🃏 Caesars Entertainment (CZR)

The casino operator jumped approximately 9% to a six-week high after Susquehanna upgraded the stock from Neutral to Positive.

Analysts raised their price target to $31, citing a favorable 2026 outlook and suggesting 24% upside from current levels.

⚡️ Apache Corporation (APA)

Shares rose on positive sentiment in the energy sector, driven by favorable oil prices and broader market trends.

Technical indicators showed strong buying momentum, though analysts noted overbought conditions and advised caution.

While specific company news was limited, the stock benefited from the day's 4% rebound in crude prices.

🏥 Teleflex (TFX)

The medical device company plunged by more than 11% following an unexpected leadership transition and a downward revision to revenue.

The sudden departure of CEO Liam Kelly, combined with lowered full-year guidance, spooked investors, triggering a sharp sell-off and significantly elevated trading volume in the stock.

Headlines You Can't Miss 👀

🏭 Trade deficit plunged to $29.4 billion in October—the lowest since mid-2009—as exports rose 2.6% while imports fell 3.2%.

🚀 Alphabet's market cap surpassed Apple's for the first time since 2019, closing at $3.888 trillion versus Apple's $3.847 trillion.

📊 Productivity jumped 4.9% in Q3 while unit labor costs tumbled 1.9%, far exceeding expectations for improvement.

💼 Layoff announcements in December hit 35,553—the lowest level since July 2024, a 50% drop from November.

📦 Costco rose 5% after reporting December net sales of $29.9 billion, an 8.5% increase from last year's $27.5 billion.

🛡️ iShares US Aerospace & Defense ETF surged to a record high, marking its fifth consecutive intraday high.

🤖 Serve Robotics popped 17% after deploying over 2,000 autonomous delivery robots—the largest sidewalk delivery fleet in the U.S.

🛢️ Venezuela will purchase only American-made products with revenue from oil sales, including agricultural products, medicine, and energy equipment.

Trending Stocks 📊

⬆️ Alphabet (GOOGL)

The upgrade came as Google announced additional Gemini AI features for Gmail, reinforcing its AI strategy that made it 2025's best-performing Magnificent Seven stock.

👚 Gap (GAP)

The retailer moved 4% higher after UBS upgraded it to buy, citing an inflection in sales and earnings growth.

Despite recent tariff concerns that could impact the bottom line by millions of dollars, analysts see improving fundamentals ahead for the apparel company.

⛏️ Alcoa (AA)

The aluminum producer shed 2.6% after JPMorgan downgraded it to underweight from neutral, despite raising the price target to $50.

The downgrade came after shares surged 74% over the past year, with analysts citing uncertainty around tariffs and relative valuation concerns as reasons for stepping to the sidelines.

What’s Next?

Key market and macro news 👇

💰 Constellation Brands (STZ) Earnings: Beer segment sales growth during the holiday season and margin dynamics are critical. Strong holiday demand and maintained guidance could support consumer discretionary stocks, while disappointing results or reduced guidance could pressure beverage and consumer staples sectors broadly.

💊 Walgreens Boots Alliance (WBA) Earnings: Pharmacy chain comparable sales and cost-cutting progress matter for the retail sector.

💸 TSMC (TSM) December Revenue Report: Semiconductor demand indicator forecasting Q4 results. Strong chip demand signals strength in the technology sector and AI momentum, supporting semiconductor and tech stocks.

📊 U.S. December Nonfarm Payrolls: Labor market data is the primary driver of the market. Strong job creation could signal economic resilience but may increase expectations of Fed tightening, pressuring bonds and high-growth stocks.

👩💼 U.S. December Unemployment Rate: Rising unemployment could ease inflation concerns and support stock market sentiment by reducing expectations for further interest rate increases.

Chart of the Day

Meme of the Day

Great investing starts with great information.

Forward The Market Scoop to anyone who wants to stay ahead of the market through a pertinent and entertaining newsletter format.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please exercise caution and conduct your own research.