- Ziggma

- Posts

- 🗞️ Apple's Bumper Holiday Quarter

🗞️ Apple's Bumper Holiday Quarter

PLUS: Microsoft tanks 10%

Market Performance

S&P 500: 6,969.01 ⬇️ 0.13%

Nasdaq: 23,685.12 ⬇️ 0.72%

Dow Jones: 49,071.56 ⬇️ 0.11%

Apple Crushes Expectations In Q4

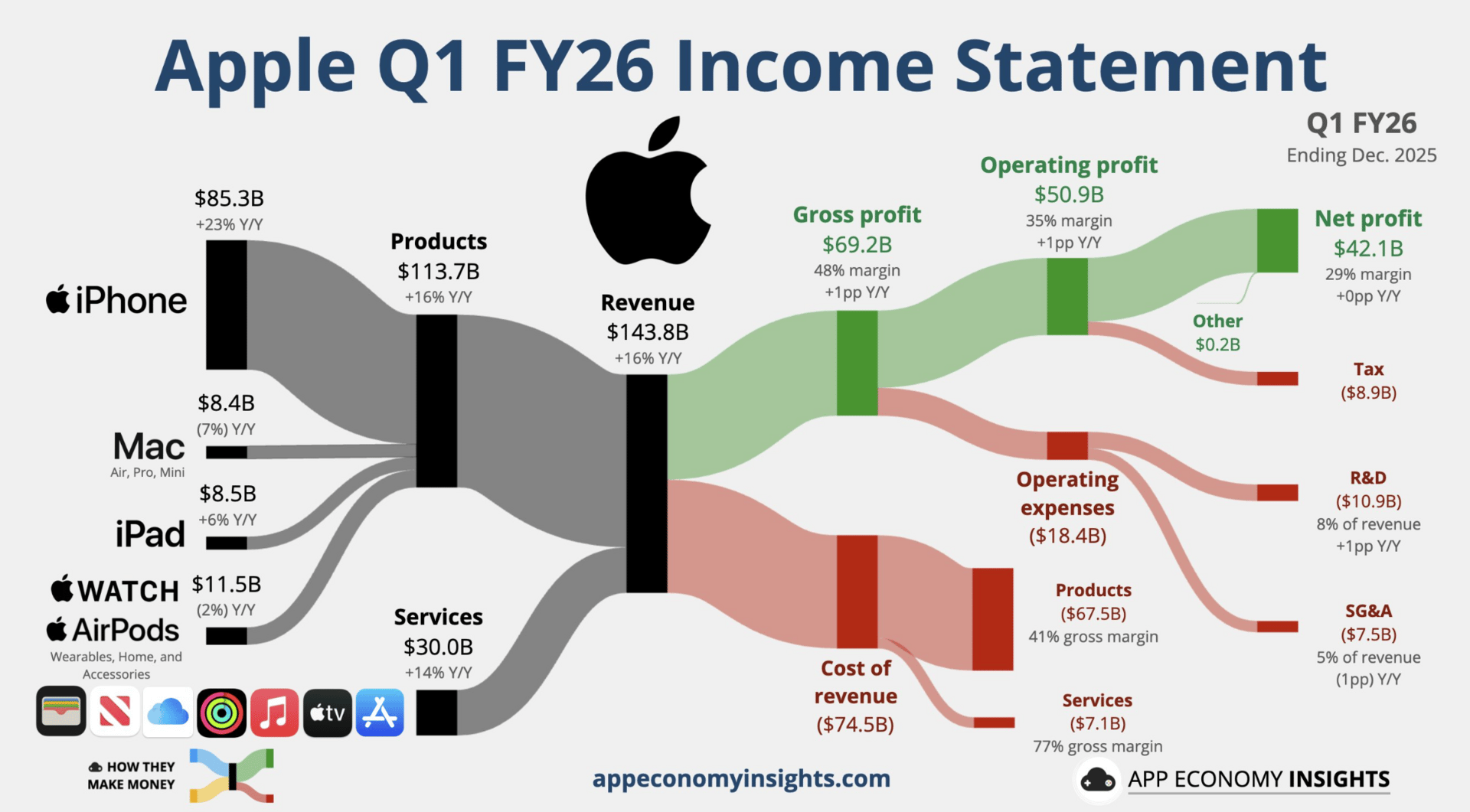

Apple delivered a stunning fiscal first-quarter performance on Thursday, with revenue surging 16% year-over-year to $143.76 billion—well above the $138.48 billion consensus.

Earnings per share came in at $2.84, beating estimates of $2.67. The star of the show?

iPhone revenue exploded 23% to $85.27 billion, driven by "staggering" demand for the iPhone 17 models.

CEO Tim Cook revealed Apple now has an active installed base of 2.5 billion devices, up from 2.35 billion last year.

Perhaps most impressive was China's performance, where sales rocketed 38% to $25.53 billion, setting all-time records for both upgraders and switchers in mainland China.

But there's a catch—and it's a big one. Apple is facing severe supply constraints that could limit how much higher this growth trajectory can climb.

The company expects iPhone supply to be constrained in the current quarter due to limited access to advanced-node chip manufacturing from TSMC, not memory issues as some feared.

Despite these challenges, Apple projects revenue growth of 13-16% this quarter.

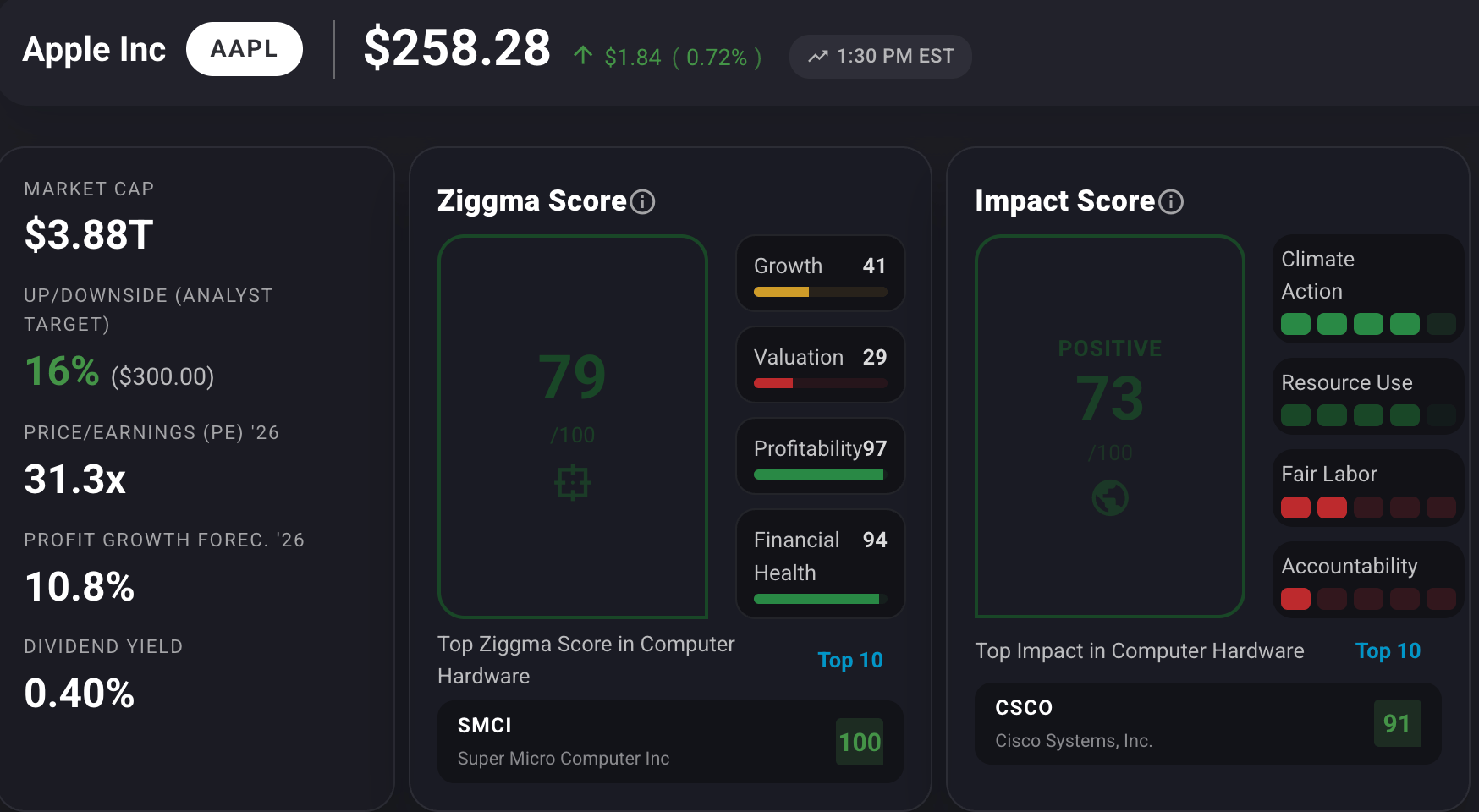

AAPL stock has a Ziggma score of 79 and trails its peers in growth and valuation.

Our Takeaway

Apple is firing on all cylinders with product demand exceeding even the company's optimistic expectations.

The resurgence in China is noteworthy, suggesting the iPhone 17 has genuine global appeal.

If they can solve the chip supply issue, we could see even more explosive growth ahead.

➡️ FREE ZIGGMA RESEARCH: MercadoLibre (MELI): Latin America’s Fastest-Growing Platform Is Scaling Commerce, Finance, and Positive Environmental Impact 🔖 Read for free on Substack 🎧 Listen to podcast

Market Overview 📈

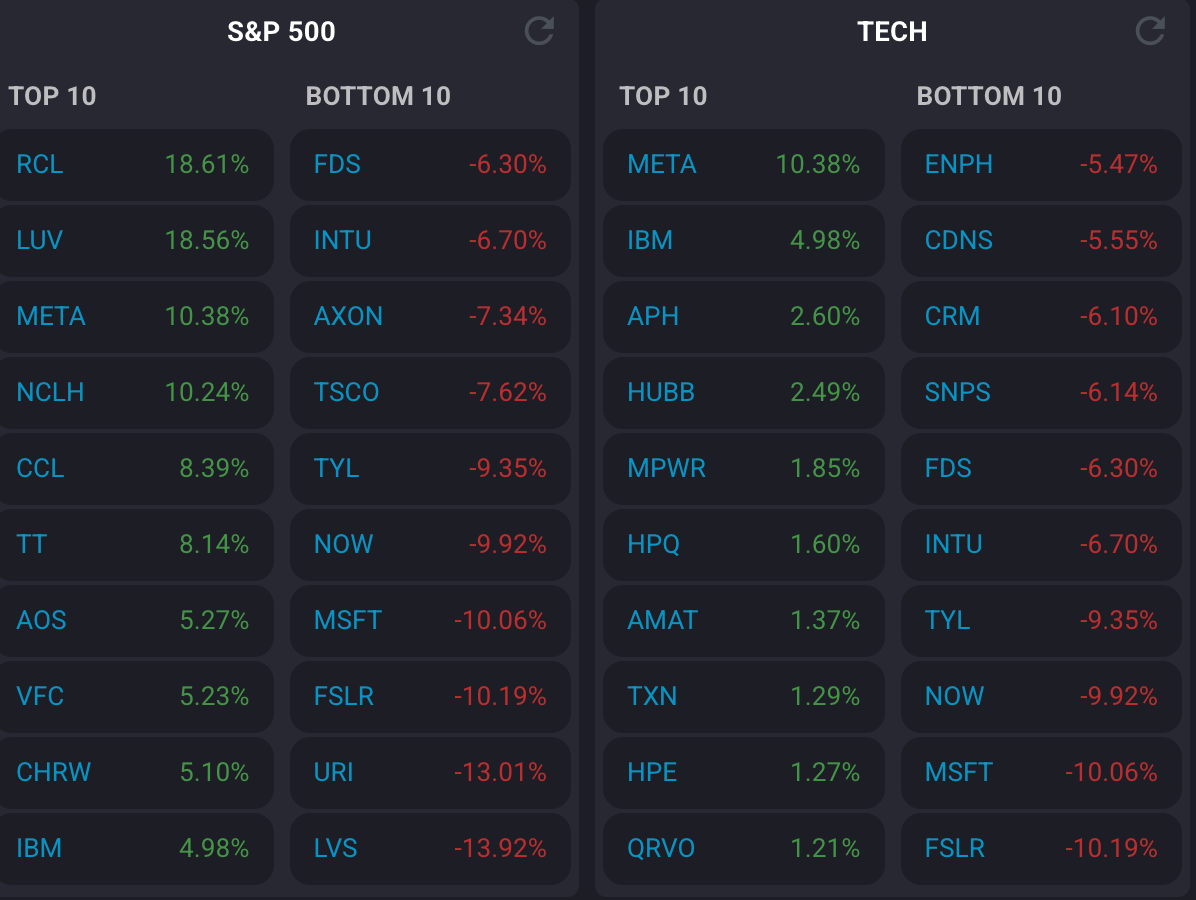

Thursday's market action reflected growing anxiety about artificial intelligence's impact on traditional software business models.

Microsoft tumbled 10%—its worst day since March 2020—after reporting cloud growth deceleration and soft operating margin guidance.

The tech giant's struggles sent shockwaves through the software sector, with the iShares Expanded Tech-Software Sector ETF plunging into bear-market territory, down 5% and 22% below recent highs.

The broader sell-off wasn't entirely tech-driven—Washington added fuel to the fire as the Senate failed to advance a government funding package, raising shutdown concerns with a Saturday midnight deadline looming.

Meanwhile, Bitcoin dropped over 5% to its lowest level since early December, touching $84,221.89 as risk assets broadly struggled.

When Is the Right Time to Retire?

Determining when to retire is one of life’s biggest decisions, and the right time depends on your personal vision for the future. Have you considered what your retirement will look like, how long your money needs to last and what your expenses will be? Answering these questions is the first step toward building a successful retirement plan.

Our guide, When to Retire: A Quick and Easy Planning Guide, walks you through these critical steps. Learn ways to define your goals and align your investment strategy to meet them. If you have $1,000,000 or more saved, download your free guide to start planning for the retirement you’ve worked for.

Stock Moves Deciphered 📈

🛳️ Royal Caribbean (RCL)

Royal Caribbean shares exploded 18% higher after delivering guidance that blew past Wall Street expectations.

The cruise operator expects first-quarter adjusted earnings between $3.18 and $3.28 per share, crushing the $2.91 consensus estimate.

Fourth-quarter results were mixed, with adjusted earnings of $2.80 per share meeting expectations while revenue of $4.25 billion slightly missed the $4.26 billion estimate.

✈️ Southwest Airlines (LUV)

Southwest Airlines soared 18% after forecasting a dramatic surge in 2026 profits that caught investors off guard.

The carrier expects to earn at a minimum $4.00 per share in adjusted earnings for 2026—significantly above the $3.19 analyst consensus.

🚀 Meta Platforms (META)

Meta shares surged 10% after the social media giant delivered a strong fourth-quarter beat and announced aggressive AI investment plans.

The company reported earnings of $8.88 per share on revenue of $59.89 billion, topping estimates of $8.23 per share and $58.59 billion.

More importantly, Meta guided first-quarter sales to $53.5- $56.5 billion, above the $51.41 billion consensus.

CEO Mark Zuckerberg revealed plans to spend $115-$135 billion on AI-related capital expenditures in 2026—nearly double last year's spending.

Headlines You Can't Miss 👀

📊 Copper prices surged 8% to an all-time high of $6.45 per pound, extending January gains to nearly 13% and marking a potential sixth straight monthly advance.

🏛️ Government shutdown looms as Senate rejected funding bill in 45-55 vote, with Democrats demanding removal of DHS funding after fatal Minneapolis shooting.

💰 Gold notched a fresh record above $5,600 per ounce before pulling back 4%, continuing its parabolic run amid geopolitical tensions and central bank demand.

🤖 Tesla is ending production of the Model S and Model X, converting Fremont factory lines to manufacture Optimus humanoid robots, as Musk declares a "honorable discharge" for aging models.

🏦 U.S. trade deficit surged 94.6% in November to $56.8 billion after hitting its lowest point since 2009, with one-third of the increase coming from the European Union.

⚖️ Trump delays Fed chair announcement until next week, with prediction markets still favoring BlackRock's Rick Rieder to replace Jerome Powell, whose term expires in May.

📈 Starbucks traffic grows for the first time in two years despite missing earnings estimates, as CEO Brian Niccol's turnaround plan shows early signs of progress.

🔌 Apple is partnering with Google to use the Gemini AI model to power Apple Intelligence software, marking a significant shift in the company's AI strategy.

Trending Stocks 📊

🤖 Microsoft (MSFT)

Microsoft posted its worst single-day decline since March 2020 despite beating earnings estimates with $4.14 per share versus the $3.97 consensus.

Revenue of $81.27 billion also topped the $80.27 billion estimate. However, investors focused on slowing cloud growth and capital expenditures that reached $37.5 billion, exceeding the $34.31 billion consensus, raising concerns about AI investment returns.

💰 IBM (IBM)

IBM shares jumped 5% after the legacy tech giant reported strong fourth-quarter results that exceeded expectations.

The company earned $4.52 per share on revenue of $19.69 billion, beating estimates of $4.32 per share and $19.23 billion.

CEO Arvind Krishna noted this "capped a strong 2025 where we exceeded expectations for revenue, profit, and free cash flow."

🧑💻 ServiceNow (NOW)

ServiceNow shares fell despite the company beating its Q4 earnings and revenue estimates. The stock was caught in a broader sell-off in the software sector.

This was fueled by investor fears that the rapid rise of artificial intelligence could disrupt traditional software business models, creating uncertainty for the future.

What’s Next?

Key market and macro news 👇

💸 The release of the Producer Price Index (PPI) for the previous month will provide insight into wholesale inflation, potentially influencing Federal Reserve interest rate decisions.

🇨🇦 Canada will release its month-over-month GDP figures. As a major trading partner, Canada's economic health can have ripple effects on the U.S. market.

📉 Following its earnings report on January 28, Microsoft's stock performance will be closely watched. The company's results and forward guidance can significantly influence the technology sector and broader market.

Chart of the Day

Meme of the Day

Great investing starts with great information.

Forward The Market Scoop to anyone who wants to stay ahead of the market through a pertinent and entertaining newsletter format.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please exercise caution and conduct your own research.