- Ziggma

- Posts

- 🍎 Apple 🤝 Google Gemini

🍎 Apple 🤝 Google Gemini

PLUS: Bank stocks tumble

Market Performance

S&P 500: 6,977.27 ⬆️ 0.16%

Nasdaq: 49,590.20 ⬆️ 0.17%

Dow Jones: 23,733.90 ⬆️ 0.26%

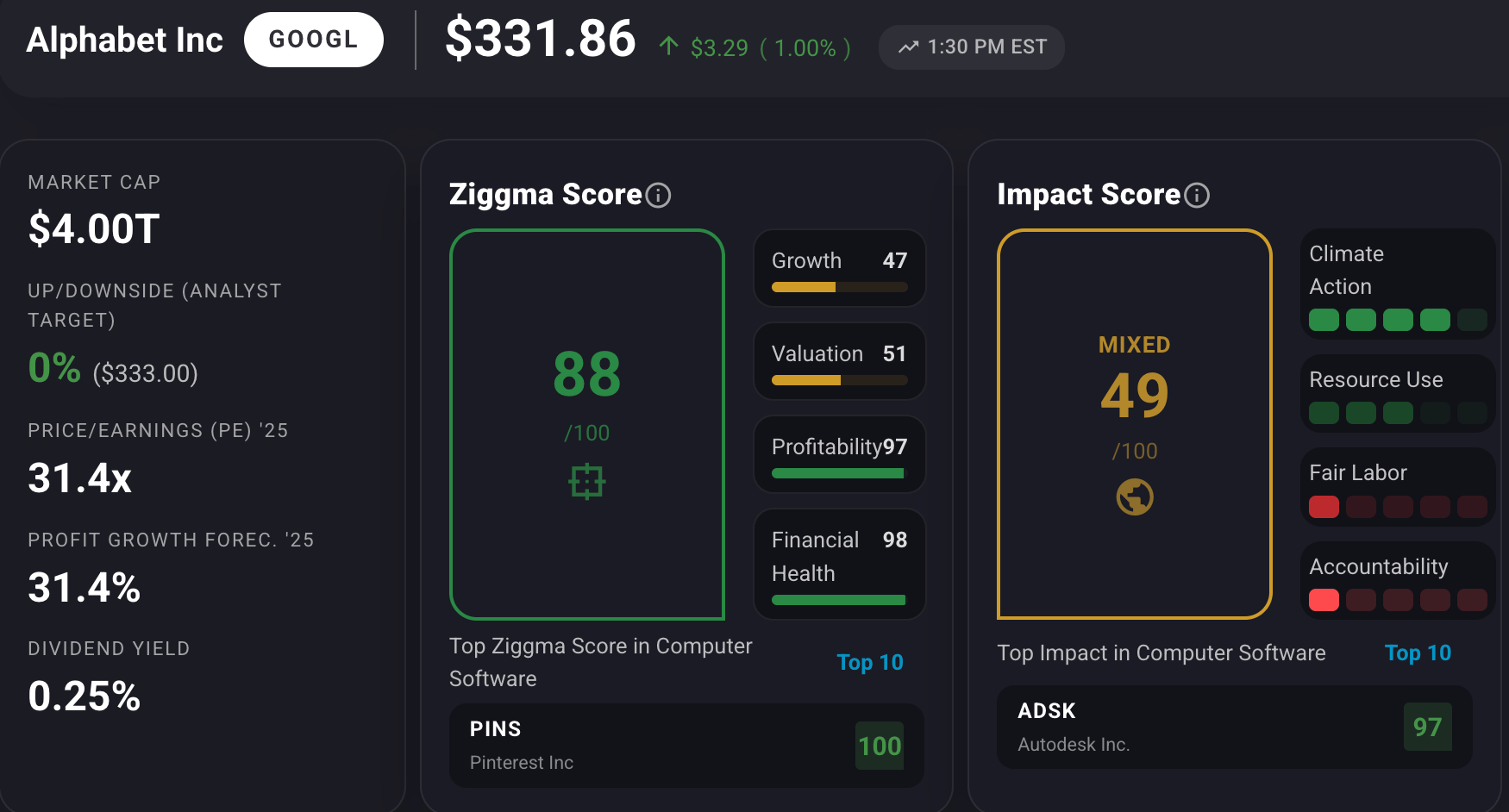

Alphabet Joins the $4 Trillion Club

Google parent company Alphabet has become the fourth member of the exclusive $4 trillion club, joining tech giants Nvidia, Microsoft, and Apple at this elite valuation milestone.

Alphabet shares climbed 1% Monday after Apple announced a multi-year partnership to power its AI features—including the next generation of Siri—with Google's Gemini models.

The stock closed at $331.86, pushing Alphabet's market cap just over $4 trillion.

This milestone caps an extraordinary year for the search giant, which saw its shares surge 65% in 2025—the sharpest rally since 2009.

The company has successfully navigated AI disruption concerns by launching competitive products like Ironwood (its seventh-generation tensor processing unit) and the acclaimed Gemini 3 model.

Despite competitive pressure from OpenAI's ChatGPT, Alphabet has demonstrated its AI prowess.

Analysts note that 70% of Google Cloud customers already use its AI products, while the company maintains advantages across multiple layers of the AI tech stack.

Citi recently named Google a top internet pick for 2026, citing its chip capabilities, infrastructure capacity, and strong market position.

GOOGL stock has a Ziggma score of 88 and ranks in the top percentile for profitability and financial health.

However, the tech stock has rallied 260% in the past three years and trades at a lofty valuation in 2026.

Our Takeaway

Alphabet's entry into the $4 trillion club validates its AI comeback strategy. The Apple partnership is particularly significant—it gives Google distribution across billions of devices while generating substantial licensing revenue.

For investors seeking AI exposure with diversified revenue streams, Alphabet offers a compelling combination of search dominance, cloud growth, and AI innovation.

Market Overview 📈

The S&P 500 and Dow Jones hit fresh all-time highs on Monday despite opening lower after the Department of Justice announced a criminal investigation into Federal Reserve Chair Jerome Powell.

The major indices rebounded from session lows, with the Dow recovering from a nearly 500-point decline.

Powell confirmed in a Sunday evening video statement that federal prosecutors opened an investigation related to his Senate testimony on the $2.5 billion Fed headquarters renovation.

He characterized this as another attempt by President Trump to influence monetary policy, stating he would not bow to pressure despite his term ending in May.

The stock market largely shrugged off the political turmoil, focusing instead on upcoming economic data and earnings.

"The impact of Chairman Powell being under investigation is likely a long-term impact," said Jim Lebenthal of Cerity Partners, noting it won't change interest rates or inflation in the near term.

Bank stocks were the session's biggest losers after Trump proposed capping credit card interest rates at 10% for one year.

Critics warn this could restrict lending and hurt both consumers and bank profitability.

Meanwhile, gold futures surged 2.5% to a record close of $4,614.70 as investors sought hedges against potentially diminished Fed independence.

The precious metal rally reflected concerns that political pressure on the central bank could hamper its ability to combat inflation.

Investor-ready updates, by voice

High-stakes communications need precision. Wispr Flow turns speech into polished, publishable writing you can paste into investor updates, earnings notes, board recaps, and executive summaries. Speak constraints, numbers, and context and Flow will remove filler, fix punctuation, format lists, and preserve tone so your messages are clear and confident. Use saved templates for recurring financial formats and create consistent reports with less editing. Works across Mac, Windows, and iPhone. Try Wispr Flow for finance.

Stock Moves Deciphered 📈

🛒 Walmart (WMT)

Walmart shares surged 3.% following two major catalysts. First, the retail giant will join the tech-focused Nasdaq-100 index later this month, which could fuel institutional demand as the index is tracked by the popular Invesco QQQ Trust ETF.

Second, Walmart announced a partnership with Google to integrate Gemini AI into a new shopping assistant, signaling its strategic shift toward technology and innovation.

The stock has climbed 23% over the past 12 months, and analysts expect the Nasdaq-100 inclusion to drive additional buying pressure from index funds and ETF rebalancing.

📖 Duolingo (DUOL)

Duolingo plummeted 8.45% to $161.74, marking its worst single-day decline since early November when it dropped 25.5%.

The language-learning platform announced that CFO Matt Skaruppa will step down, effective February 23, creating leadership uncertainty.

While fourth-quarter daily active users grew approximately 30% year-over-year—slightly above consensus—the market focused on management changes and concerns about the company prioritizing product investment over near-term profitability.

👕 Abercrombie & Fitch (ANF)

Abercrombie shares cratered 17.70% to $102.78 after the retailer reported disappointing holiday sales and slashed its full-year sales growth forecast.

The announcement ended the stock's impressive rally and caught investors off guard, who had expected continued momentum from the brand's successful turnaround.

The sharp decline reflects how quickly sentiment can shift in retail when companies miss elevated expectations, particularly during the critical holiday shopping season.

Headlines You Can't Miss 👀

📊 Lloyd Blankfein called Powell's criminal investigation an attempt at "murder-suicide," warning it damages both the Fed's independence and the Justice Department's credibility.

💰 Gold and silver futures hit all-time highs in premarket trading, with gold crossing $4,600/ounce and silver reaching $85.55 as investors fled to safe havens.

🏦 Buy-now-pay-later stocks like Affirm jumped 4% as traders bet consumers may shift away from credit cards if banks restrict lending due to Trump's proposed 10% rate cap.

🌍 International markets outperformed the S&P 500 on Monday, with the MSCI ACWI ex-US ETF gaining 0.8% versus the S&P's 0.2% rise.

🎯 Palantir rose 1% on an upgrade from Citi, leading gains in select tech stocks alongside AMD and Oracle.

📈 29 stocks in the S&P 500 hit new 52-week highs on Monday, including Walmart, Ross Stores, Micron, Alphabet, and Freeport-McMoRan.

₿ Crypto custodian BitGo announced plans for a nearly $2 billion valuation IPO, aiming to raise up to $201 million through share sales priced between $15-$17.

Trending Stocks 📊

🤖 Applied Materials (AMAT)

Applied Materials climbed 2% to close around $307, hitting a fresh 52-week high of $309.50 during Monday's session.

Susquehanna International Group issued a bullish rating, noting that wafer fab equipment (WFE) spending is resetting at a structurally higher level.

Analyst Mehdi Hosseini projects the WFE supply chain should anticipate "well above" $150 billion in annual spending as global semiconductor revenues trend toward $1 trillion.

⛏️ Critical Metals Corp (CRML)

Critical Metals stock has skyrocketed 116% since the start of 2026 as tech investors assess rare-earth-mining opportunities in Greenland.

CEO Tony Sage reported that tech investors had asked how a potential U.S. acquisition of the self-governing Danish territory would affect the company's mining project development.

Greenland has become central to a geopolitical firestorm as the U.S. threatens annexation, citing national security concerns, with commercial opportunities for critical minerals also in the spotlight.

🏦 Capital One (COF)

Capital One shares declined to $233.20 despite receiving an increase in the price target from analysts.

The credit card issuer fell 6% during the session as bank stocks broadly retreated following President Trump's proposal to cap credit card interest rates at 10% for one year.

Critics warn the policy could restrict lending and hurt both consumers and bank profitability, creating significant headwinds for credit card-focused financial institutions.

What’s Next?

Key market and macro news 👇

💸 JPMorgan reports Q4 earnings with a consensus EPS forecast of $5.01, representing 4.16% increase year-over-year.

🛩️ Delta reports Q4 earnings with a consensus EPS forecast of $1.53, representing 17.30% decrease year-over-year.

📊 December CPI data will show monthly inflation at expected 0.3% and year-over-year at 2.7%. Core inflation is expected at 0.2% on a monthly basis and 2.6% on an annual basis.

🏡 New home sales data for shows housing market strength. The previous month saw 20.5% month-over-month change and 0.8 million units.

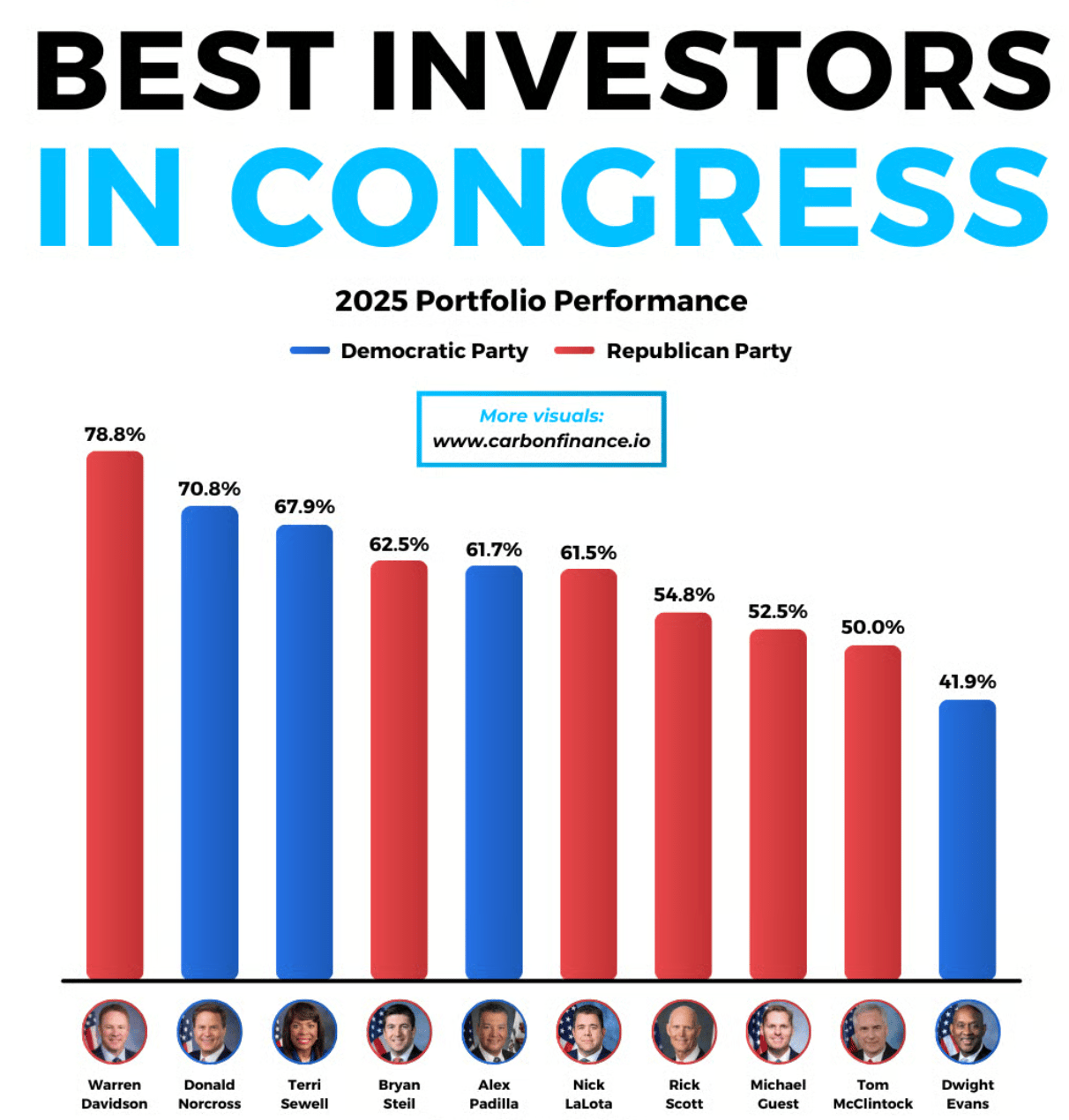

Chart of the Day

Meme of the Day

Great investing starts with great information.

Forward The Market Scoop to anyone who wants to stay ahead of the market through a pertinent and entertaining newsletter format.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please exercise caution and conduct your own research.