- Ziggma

- Posts

- 🗞️ AMD Tumbles 8%

🗞️ AMD Tumbles 8%

PLUS: Walmart surpasses $1 trillion market cap

Market Performance

S&P 500: 6,917.81 ⬇️ 0.84%

Nasdaq: 23,255.19 ⬇️ 1.43%

Dow Jones: 49,240.99 ⬇️ 0.34%

AMD's AI Growth Story Hits a Speed Bump

Advanced Micro Devices (AMD) delivered a stellar fourth-quarter earnings beat, with EPS of $1.53 versus $1.32 expected and revenue of $10.27 billion, crushing the $9.67 billion estimate.

Net income soared to $1.51 billion from $482 million a year ago, while overall revenue jumped 34% annually.

But here's the catch: AMD's first-quarter guidance of $9.8 billion (plus or minus $300 million) disappointed some analysts expecting more aggressive forecasts amid the AI spending frenzy. The stock tumbled 8% in extended trading.

The real story?

AMD's data center segment grew 39% to $5.4 billion, driven by both CPUs and AI GPUs.

CEO Lisa Su highlighted major wins with OpenAI and Oracle, as well as upcoming Helios server systems launching later this year.

The company recorded $390 million in China MI308 chip sales despite export controls, though that's expected to drop to $100 million this quarter.

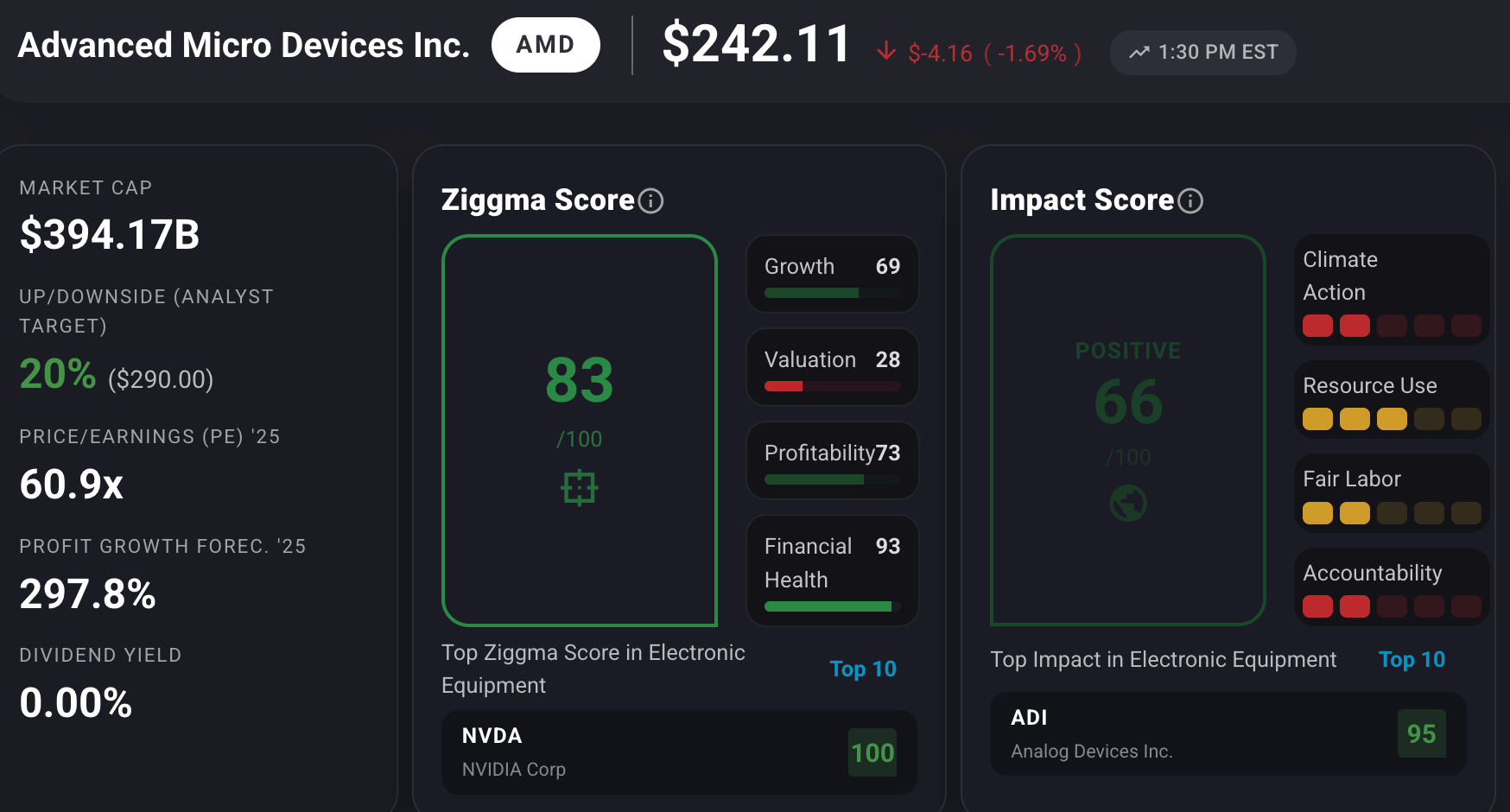

AMD stock has a Ziggma score of 84, driven by profitability and financial health but severely penalized by a valuation score of 28 - thanks to an elevated price-to-earnings multiple of 43x.

Our Takeaway

AMD's fundamentals remain rock-solid, but investors wanted more aggressive AI guidance.

The company is clearly gaining ground against Nvidia in AI chips while maintaining its gains in CPU market share versus Intel.

This pullback could be a buying opportunity for patient investors betting on the multi-year AI infrastructure buildout.

➡️ FREE ZIGGMA RESEARCH: Host Hotels & Resorts (HST): 5% Dividend Yield, Iconic Hotels, and Real Sustainability Progress 🔖 Read for free on Substack 🎧 Listen to podcast

Market Overview 📈

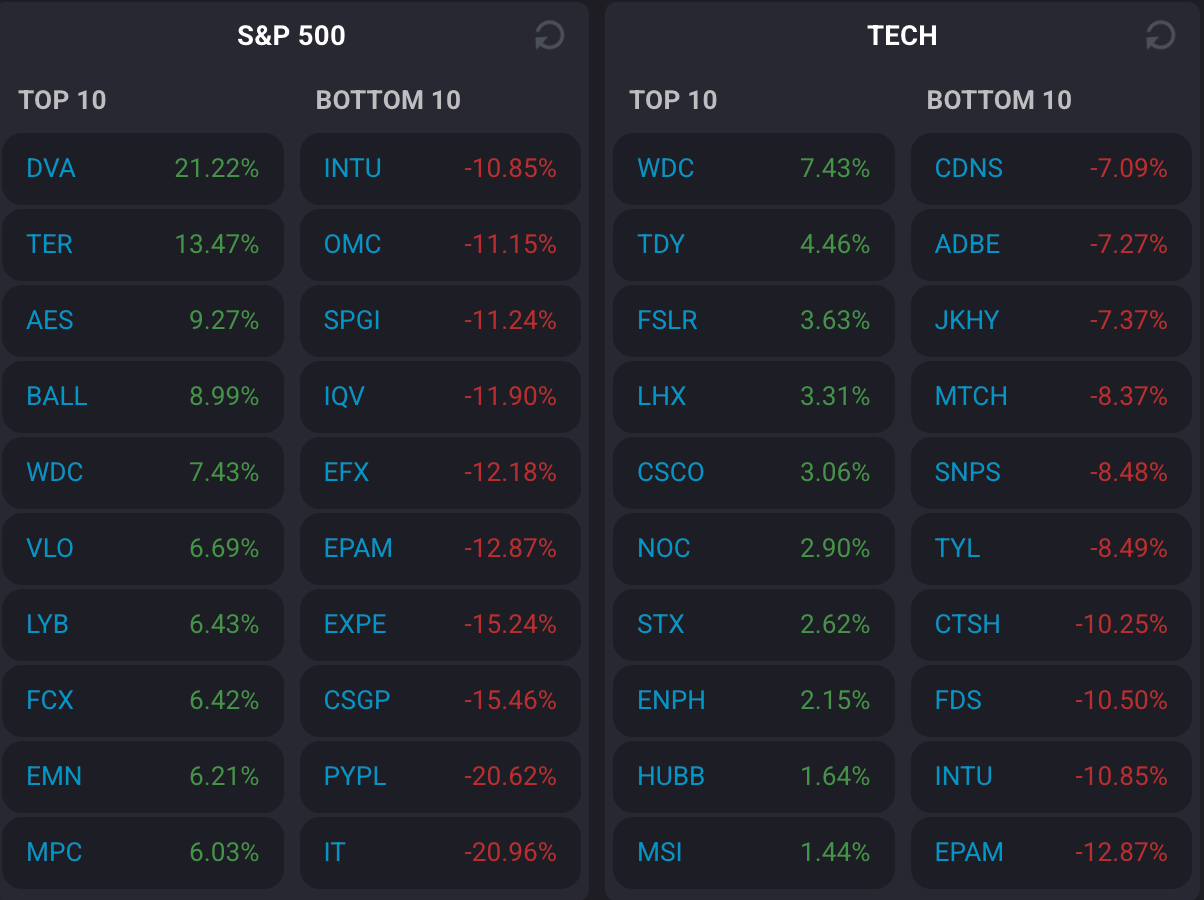

Tuesday's session showcased a clear rotation away from technology as investors dumped high-flying software stocks and sought refuge in economically sensitive sectors.

The software sector experienced brutal selling pressure, with the iShares Software ETF plunging 5% and now down 28% from recent highs.

ServiceNow and Salesforce each dropped nearly 7%, while the "Magnificent Seven" saw widespread declines—Microsoft and Meta fell over 2%, and Nvidia slumped nearly 3%.

Bitcoin added to risk-off sentiment, touching its lowest level since November 2024 by falling below $74,000.

Meanwhile, precious metals rebounded sharply with gold surging 6% and silver up 7% after last week's historic selloff, providing some relief to battered retail traders.

Start learning AI in 2026

Everyone talks about AI, but no one has the time to learn it. So, we found the easiest way to learn AI in as little time as possible: The Rundown AI.

It's a free AI newsletter that keeps you up-to-date on the latest AI news, and teaches you how to apply it in just 5 minutes a day.

Plus, complete the quiz after signing up and they’ll recommend the best AI tools, guides, and courses — tailored to your needs.

Stock Moves Deciphered 📈

🚑 DaVita (DVA)

DaVita shares surged over 21% after reporting blowout fourth-quarter earnings that crushed Wall Street expectations.

The kidney dialysis provider beat on both revenue and earnings per share while raising its full-year profit forecast for 2026, signaling a strong turnaround after facing headwinds in 2025.

Berkshire Hathaway sold 1.66 million shares through a Thursday transaction but remains DaVita's largest institutional investor with nearly 45% ownership.

💸 PayPal (PYPL)

PayPal collapsed 20% in a brutal session following disappointing fourth-quarter results, weak 2026 profit guidance, and the unexpected CEO departure announcement.

The digital payments giant missed financial targets as competitive pressures intensified and transaction growth slowed.

Trading volume exploded to nearly eight times the daily average as investors fled, pushing shares to their lowest level in over two years and raising serious questions about the company's strategic direction.

✂ Intuit (INTU)

Intuit shares tumbled more than 11% after receiving multiple analyst downgrades and price target cuts from prominent Wall Street firms.

The financial software maker, known for TurboTax and QuickBooks, faced intensifying concerns about AI disruption to its core business model.

Analysts cited concerns that generative AI tools could automate tax preparation and bookkeeping, potentially threatening Intuit's subscription revenue streams and long-term growth trajectory.

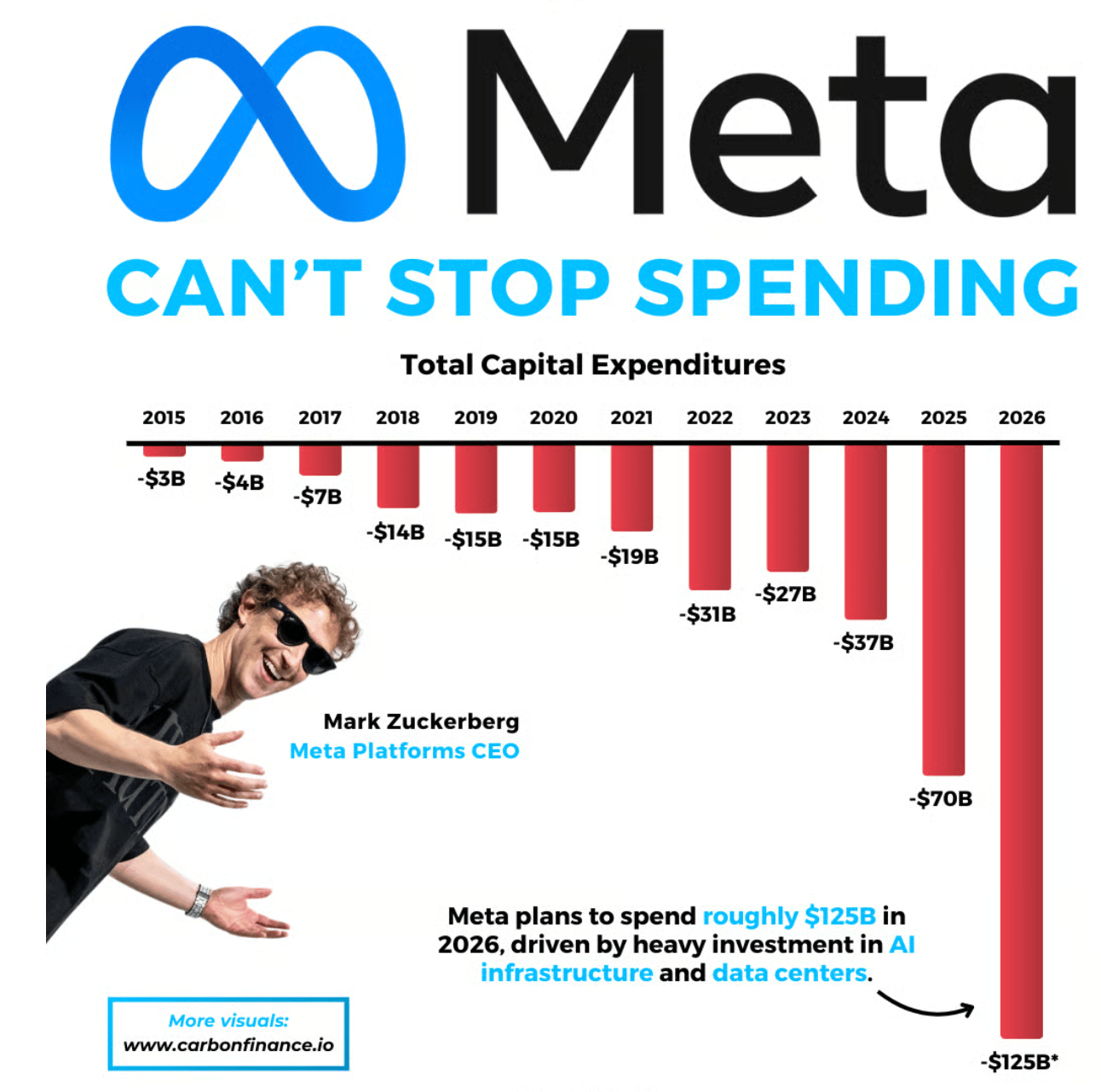

Headlines You Can't Miss 👀

📱 Apple supplier Foxconn will invest $1.5 billion in its India unit as part of the company's ongoing expansion strategy to diversify manufacturing away from China.

🚗 Alphabet's Waymo raised a massive $16 billion funding round that values the self-driving car unit at $126 billion post-money—more than double its October 2024 valuation of $45 billion.

🚀 Elon Musk's SpaceX acquired xAI to prepare for a possible IPO, with the combined entity valued at $1.25 trillion. Musk stated, "space-based AI is obviously the only way to scale."

⚡ Blackstone agreed to acquire utility company TXNM Energy in an $11.5 billion deal, expanding the private equity giant's infrastructure portfolio.

💊 Novo Nordisk plunged 12% after the Danish drugmaker said it expects sales to fall between 5% and 13% for 2026, with particular weakness anticipated in U.S. operations.

🏥 Regeneron announced it will acquire genetic testing company 23andMe for $256 million, gaining access to valuable genetic data for drug development research.

🏛️ Federal Reserve's Thomas Barkin said the central bank still has "some distance to travel" to bring inflation back to target, though he sees the labor market and inflation drifting lower.

🇮🇳 India-U.S. trade deal could trigger a short-term rally in Indian equities if tariffs drop from 50% to 18%, according to Bernstein analysts who called for a "trading buy" on India.

Trending Stocks 📊

🛒 Walmart (WMT)

Walmart crossed the historic $1 trillion market capitalization threshold, surging 3% on strong momentum from its digital business growth and successful customer acquisition strategy.

The retail giant continues to gain market share across multiple categories while demonstrating pricing power in an inflationary environment.

Jefferies analysts highlighted Walmart as the best-positioned to benefit from anticipated price cuts by major food brands such as PepsiCo.

🥤 PepsiCo (PEP)

PepsiCo beat fourth-quarter expectations with strong performance across its business segments, sending shares up nearly 5% to fresh 52-week highs.

CEO Ramon Laguarta noted "sequential acceleration in reported and organic revenue growth, with improvements in both North America and International businesses."

The company announced plans to cut prices on popular snacks like Lay's and Doritos by up to 15%, signaling a strategic shift toward volume growth.

🤖 Teradyne (TER)

Teradyne rocketed 13% after issuing spectacular first-quarter guidance calling for $1.15-$1.25 billion in revenue versus analyst expectations of just $935 million.

Fourth-quarter results also crushed estimates with adjusted EPS of $1.80 on $1.08 billion in revenue.

The semiconductor testing equipment maker is benefiting from surging demand related to AI chip production and data center expansion.

What’s Next?

Key market and macro news 👇

💉 Eli Lilly – Q4 2025 earnings with consensus $6.99 EPS, representing 31.39% year-over-year growth. Trading at a 43.98 P/E ratio versus the industry's 17.20. Pharmaceutical sector bellwether; miss could pressure healthcare stocks broadly.

🚕 Uber Technologies- Q4 2025 earnings with consensus $0.79 EPS, down 75.39% year-over-year. Consistent quarterly beats suggest strong operational execution. Results impact tech-sector sentiment and the gig-economy narrative, affecting broader market positioning.

🧑✈️ ADP National Employment Report (January) – Private sector job growth indicator. Critical labor market data influences expectations of Fed policy and investor risk appetite.

📊 ISM Non-Manufacturing PMI (January) – The services sector activity index measures business activity, new orders, and employment. Significant divergence from manufacturing PMI could signal economic imbalances affecting market sentiment.

Chart of the Day

Meme of the Day

Great investing starts with great information.

Forward The Market Scoop to anyone who wants to stay ahead of the market through a pertinent and entertaining newsletter format.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please exercise caution and conduct your own research.