- Ziggma

- Posts

- 🗞️ Amazon Disappoints Wall Street

🗞️ Amazon Disappoints Wall Street

AMZN, AAPL, and ALGN

Market Performance

S&P 500: 6,339.39 (-0.37%)

Nasdaq: 21,122.45 (-0.04%)

Dow Jones: 44,130.98 (-0.74%)

Amazon Tanks Despite Strong Q2 Earnings

Amazon (AMZN) delivered a classic "good news, bad news" earnings report that left investors scratching their heads.

The e-commerce giant crushed expectations on both earnings and revenue, posting $1.68 per share versus the $1.33 expected and revenue of $167.7 billion against estimates of $162.09 billion.

Yet AMZN stock tumbled over 6% in after-hours trading.

The culprit? Light operating income guidance for the current quarter.

Amazon projected $15.5-20.5 billion in operating income, falling short of the $19.48 billion analysts expected.

This guidance disappointment overshadowed strong performances across key segments, including AWS revenue of $30.87 billion and advertising revenue hitting $15.7 billion.

Our Takeaway

Amazon's massive $100 billion AI investment this year is weighing on near-term profitability, but the long-term bet could pay off handsomely.

The 18% AWS growth, while trailing Microsoft and Google, still shows Amazon maintaining its cloud leadership.

Stop Drowning in Market News. Focus On Making Money.

Every day: 847 financial headlines, 2,300 Reddit stock mentions, 156 Twitter trading threads, 12 IPO updates, 94 crypto developments.

Your problem isn't lack of information; you have too much.

While you're scanning headlines wondering what matters, profitable trades slip by. The signal gets buried in noise.

What if someone did the heavy lifting for you?

Stocks & Income reads everything:

Twitter traders

Reddit buzz

IPO announcements

Crypto insider takes

Crowdfunding opportunities

Market news

Then we send you only what can actually move your portfolio.

No fluff. No useless news. Just actionable stock insights in 5 minutes.

We track every source so you don't have to. You get the 3-5 opportunities worth your time, delivered daily.

Stop wasting time on useless “investing news” and start thinking critically about real opportunities in the stock market.

Stocks & Income is for informational purposes only and is not intended to be used as investment advice. Do your own research.

Market Overview

Thursday's session revealed a market grappling with mixed signals as mega-cap earnings couldn't overcome broader concerns.

Despite blockbuster results from Microsoft and Meta Platforms, the S&P 500 posted its third consecutive losing day, as nine of eleven sectors finished in the red.

The Federal Reserve's dovish pivot expectations took a hit this week, with many investors now questioning whether September rate cuts are realistic.

Adding to market uncertainty, President Trump's Friday tariff deadline loomed large, with updated duties ranging from 10% to 41% on various goods.

The White House also announced an additional 40% levy on transshipped goods attempting to avoid tariffs.

Despite the headwinds, tech titans showed their resilience. Microsoft soared on Azure's $75 billion annual revenue run rate, while Meta jumped 11% on upbeat third-quarter guidance.

However, this concentrated strength couldn't lift the broader market, highlighting the ongoing divergence between mega-cap tech and everything else.

Stock Moves Deciphered 📈

Align Technology (ALGN) stock crashed 37% after missing Q2 earnings expectations and cutting guidance. Morgan Stanley downgraded to equal weight, slashing price target 38% citing growth challenges.

Novo Nordisk (NVO) stock fell 5% as HSBC downgraded it to hold, calling the obesity drug market "mature." Shares down 50% year-to-date amid slowing GLP-1 growth and increased competition concerns.

Moderna (MRNA) announced a 10% workforce reduction by the end of 2025 amid slowing Covid vaccine sales. The CEO emphasized the need to "align cost structure to business realities" while continuing AI investments.

Headlines You Can't Miss

Microsoft joins exclusive $4 trillion market cap club after 8% after-hours surge on strong earnings beat.

Meta Platforms jumped 11% after issuing a rosy Q3 outlook of $47.5-50.5 billion revenue guidance.

Ford Motor fell 3% on $2 billion tariff-related headwind forecast for the 2025 earnings outlook.

Alignment Healthcare surged 20% in extended trading after second-quarter beats and solid guidance.

Trump attacks Powell, calling Fed Chair "TOO LATE, TOO ANGRY, TOO STUPID" after rate hold decision.

June inflation came in hotter than expected at 2.6% headline, 2.8% core PCE rates.

Figma IPO opened at $85 per share, more than double its $33 IPO price on NYSE debut.

Utilities sector poised for longest monthly win streak since 2009 with seventh straight positive month.

Trending Stocks

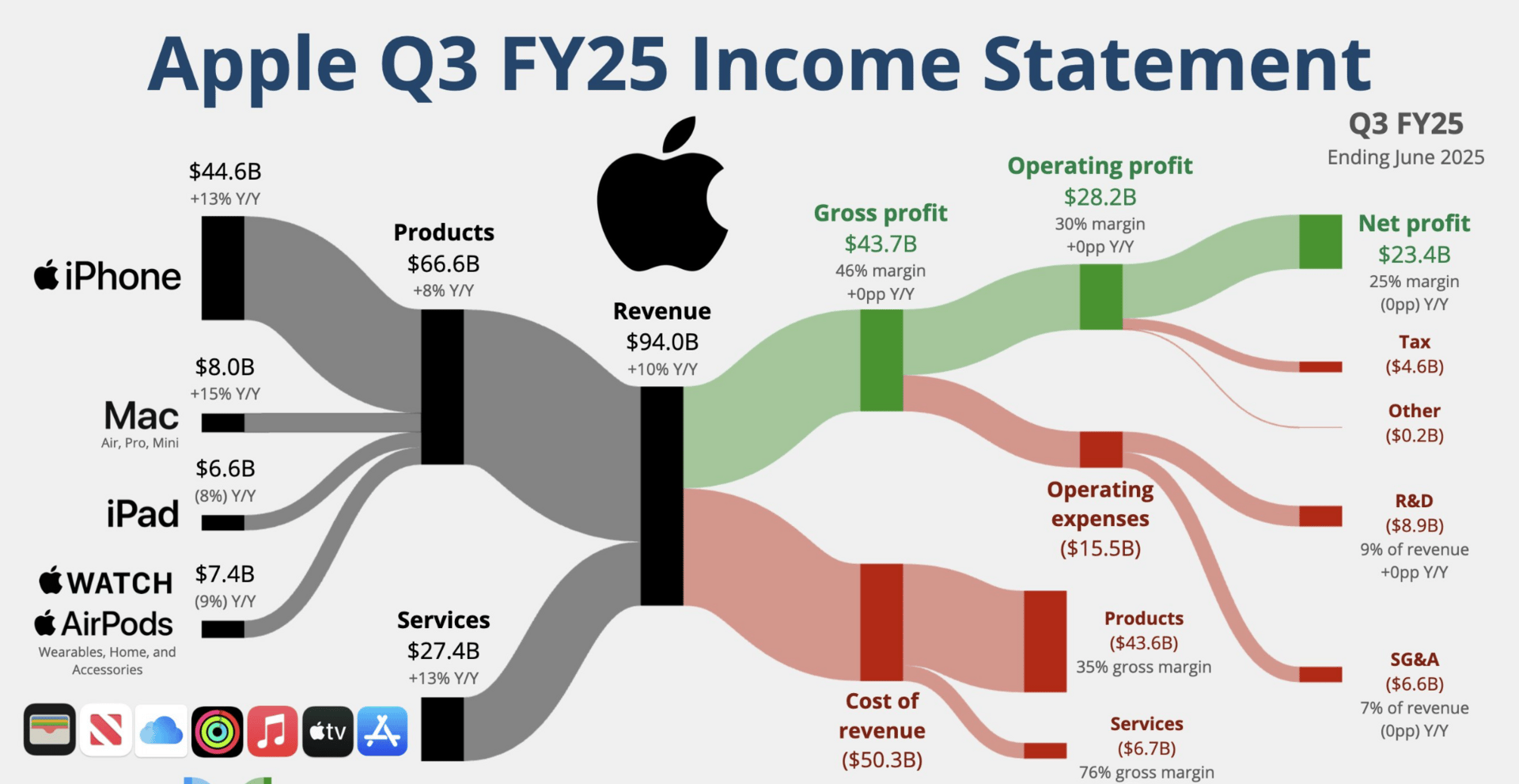

Apple (AAPL) - Shares jumped 2% after delivering an earnings and revenue beat for the second quarter.

The tech giant continues to show resilience despite potential tariff headwinds, with investors focusing on strong fundamentals rather than trade policy uncertainties.

CEO Quote🎤: “We are significantly growing our investments. We’re embedding it across our devices, across our platforms, and across the company.”

Baxter International (BAX)- Shares plunged 10% after the healthcare company reported weaker-than-expected second-quarter results.

Baxter earned 59 cents per share on revenue of $2.81 billion, missing analyst expectations of 60 cents per share and $2.82 billion in revenue. The company also lowered full-year earnings guidance.

CEO Quote🎤: “Baxter delivered performance in line with guidance while our employees across the globe continued advancing the company’s life-sustaining Mission and building on its vision to redefine healthcare delivery.”

Integra LifeSciences (IART) - The medical technology company surged 7% following a strong second-quarter beat on both top and bottom lines.

Revenue reached $415.6 million, well above the $395 million expected, while adjusted earnings of 45 cents per share exceeded consensus by 1 cent.

CEO Quote🎤: “Our strong revenue performance is a testament to our disciplined progress and the solid underlying demand trends for our portfolio of neurosurgery and tissue technology products.”

What’s Next?

Key Earnings Today 👇

Exxon Mobil (XOM): Q2 revenue forecast at $80.5 billion vs. $93 billion last year. Adjusted earnings are expected to narrow from $2.14 per share to $1.56 per share.

Chevron (CVX): Q2 revenue forecast at $45.6 billion vs. $51.2 billion last year. Adjusted earnings are expected to narrow from $2.55 per share to $1.75 per share.

Colgate-Palmolive (CL): Q2 revenue forecast at $5.03 billion vs. $5.06 billion last year. Adjusted earnings are expected to narrow from $0.91 per share to $0.89 per share.

Other Key News

Friday's jobs report expected to show a 100,000 payroll increase, unemployment rising to 4.2%

China trade negotiations continue, with a potential deal framework emerging

Fed policy reassessment ongoing after this week's rate hold decision

Track upcoming news and earnings on your portfolio companies with Ziggma.

Chart of the Day

Source: APP Economy Insights

Meme of the Day

Great investing starts with great information.

Forward The Market Scoop to anyone who wants to stay ahead of the market through a pertinent and entertaining newsletter format.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.