- Ziggma

- Posts

- 🗞️ Amazon Ads Is Booming

🗞️ Amazon Ads Is Booming

Amazon, Datadog, and Shake Shack

Market Performance

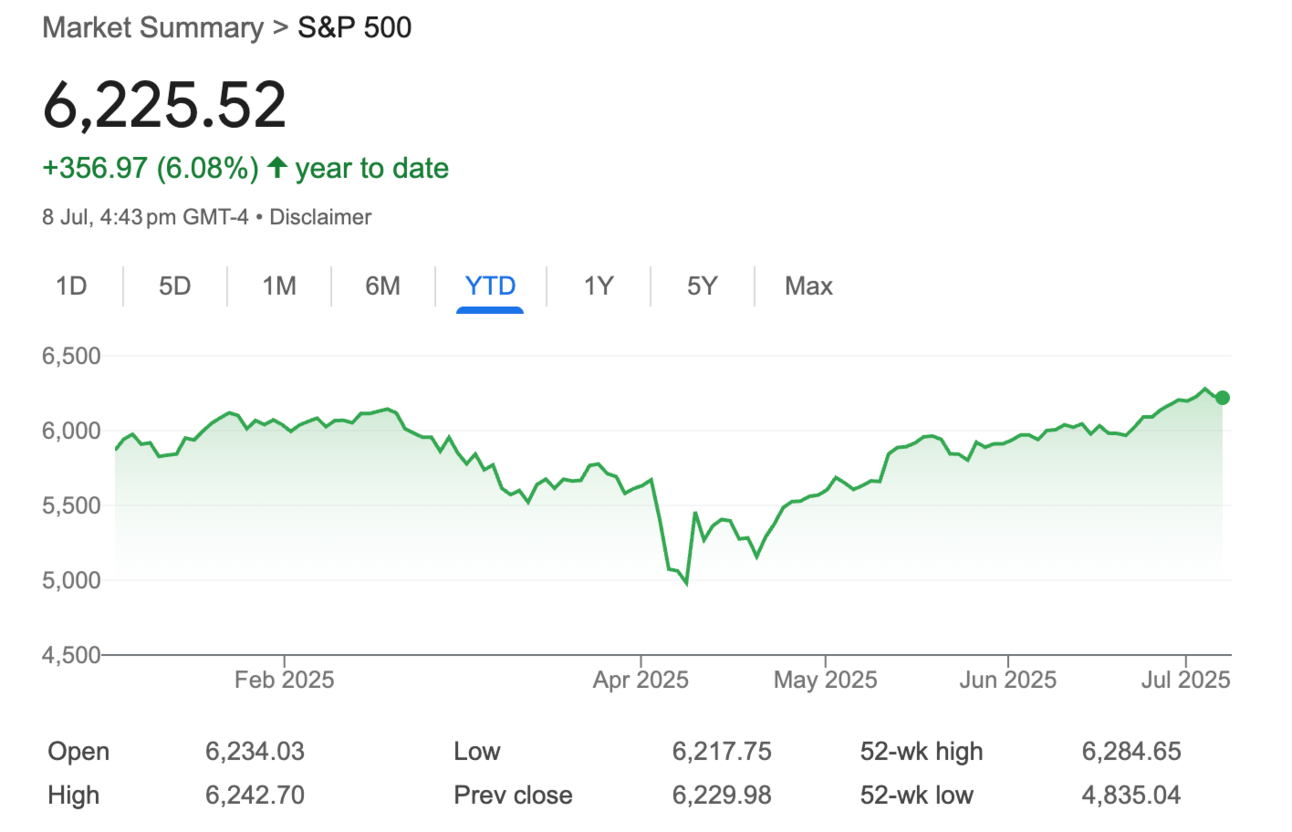

S&P 500: 6,225.52 (-0.07%)

Nasdaq: 20,418.46 (+0.03%)

Dow Jones: 44,240.76 (-0.37%)

Amazon's Advertising Empire Takes Center Stage

Here's something that might surprise you: while everyone's obsessing over Trump's tariff drama, Amazon (AMZN) just delivered a masterclass in building an advertising juggernaut that's flying under the radar.

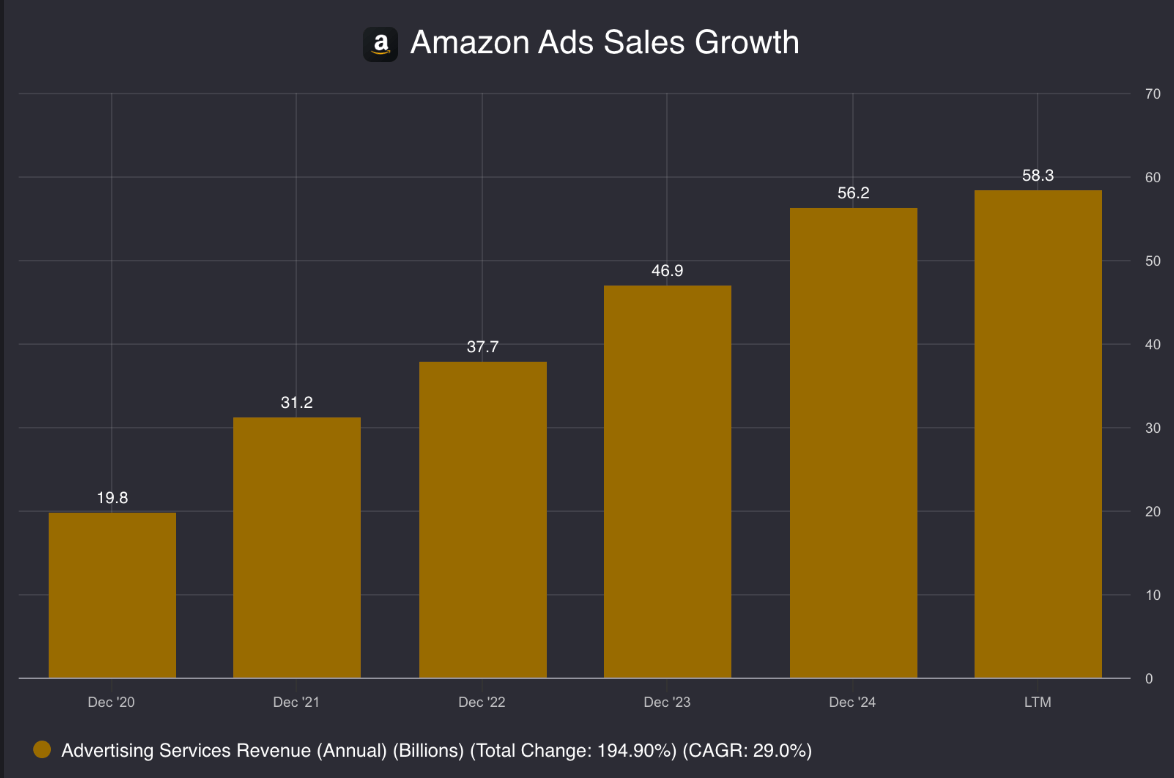

Amazon's online ad revenue surged 19% in Q1, hitting $13.92 billion and beating analyst estimates of $13.74 billion.

But here's the kicker 👇

This "small" ad business is now projected to exceed $60 billion in 2025, making it the third-largest digital advertising platform globally, trailing only Google and Meta.

What makes this growth remarkable?

Amazon's ad revenue is growing at double the pace of its overall business. While total revenue grew by 8.6%, advertising revenue increased by 19%.

The real genius lies in Amazon's expanding beyond basic search ads. They're now dominating "full-funnel" advertising through Prime Video's 200 million active shoppers and building partnerships with Meta, Pinterest, and Snap.

When 56% of global marketing leaders plan to increase Amazon ad spend, you know something fundamental is shifting.

Our Takeaway

Amazon isn't just an e-commerce company anymore; it's becoming a media empire.

With 2.5 billion monthly visitors and AI-driven ad tools, Amazon is well-positioned to capture a significant share of the $1 trillion global advertising market.

While tariffs threaten retail margins, this high-margin ad business could be Amazon's secret weapon for sustained growth.

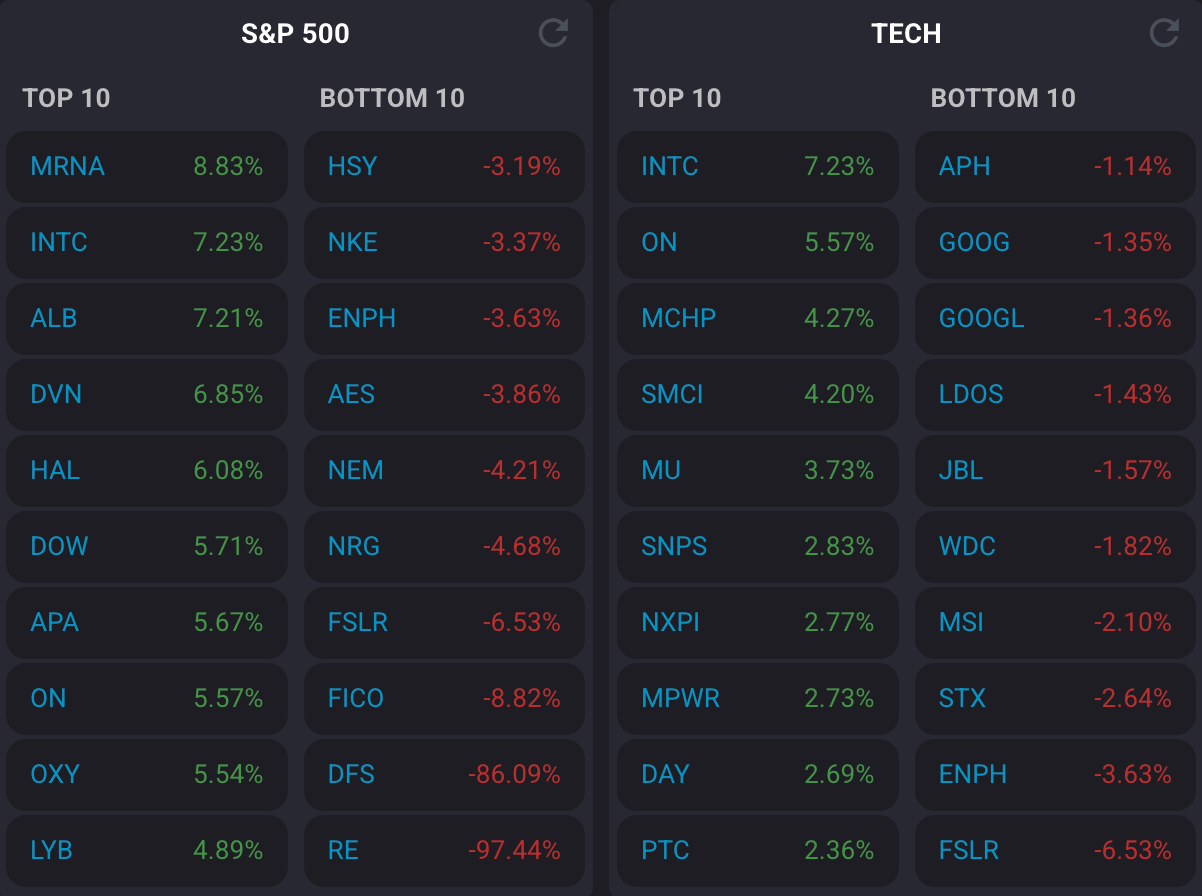

Market Overview

Stock futures remained largely unchanged as investors processed President Trump's latest tariff announcements.

Futures tied to the Dow slipped 52 points (0.1%), while S&P 500 and Nasdaq 100 futures were marginally lower.

Tuesday's session reflected the market's ongoing uncertainty about tariffs. Trump's tariff policy continues to create market volatility.

On Tuesday, he confirmed that there will be no extensions to the August 1 deadline for 25-40% tariffs on 14 countries, including Japan and South Korea.

Additionally, he announced a steep 50% tariff on copper imports and threatened up to 200% tariffs on pharmaceuticals within the next year.

Copper futures posted their best day since 1989, surging 13% following Trump's tariff announcement.

Banking stocks led the decline after HSBC adopted a "more cautious stance" on larger banks, with JPMorgan and Bank of America both falling 3%.

However, Nvidia provided some support, advancing by 1% and moving closer to a $4 trillion market cap.

Headlines You Can't Miss

Trump confirms no extensions for Aug. 1 tariff deadline affecting 14 countries with 25-40% duties.

Copper futures surge 13% to record highs after Trump announces 50% import tariffs.

Goldman Sachs highlights buy-rated dividend stocks including Lowe's and NextEra Energy for portfolio hedging.

Fed minutes from the latest FOMC meeting are set for release on Wednesday amid tariff uncertainty.

Jeff Bezos sells $666 million in Amazon shares as part of a 25 million share disposal plan through May 2026.

China's producer prices fall 3.6% in June, the biggest drop in nearly two years as deflation deepens.

Japan and South Korea face a recession specter as Trump tariffs raise economic downturn risks.

Super Micro plans to ramp up European manufacturing to capitalize on AI demand surge.

Trending Stocks

Shake Shack (SHAK): Loop Capital downgraded Shake Shack to hold from buy, maintaining a $127 price target that suggests 9.5% downside potential.

Despite the stock's 7.4% year-to-date gain, analyst Alton Stump believes the current valuation accurately reflects the company's fundamentals.

Stump noted the earlier sell-off was "unwarranted since SHAK sources nearly all its ingredients domestically," insulating it from tariff impacts.

Analyst Quote🎤: “While we remain positive on Shake Shack’s near and long-term story and would be more constructive on the shares in the event of a material pullback, we believe SHAK’s current valuation accurately reflects the company’s attractive fundamentals.”

Datadog (DDOG): Guggenheim downgraded Datadog to "Sell" from "Hold," citing significant revenue risk from its largest customer, OpenAI, which is shifting to in-house solutions.

The firm's $105 price target implies a 31% downside from Monday's close. Analyst Howard Ma estimates that OpenAI may have already begun moving away from Datadog for log management, with the planned deprecation of other functionalities creating potential headwinds for Q4 revenue.

Analyst Quote🎤: “We don’t believe this is representative of broader enterprise trends; instead, OpenAI is an outlier in terms of its hypergrowth and associated infrastructure costs that become financially impractical via third-party solutions at scale.”

Fair Isaac (FICO): Shares plunged nearly 12% after Federal Housing Finance Agency director Bill Pulte announced that Fannie Mae and Freddie Mac will allow lenders to use Vantage 4.0 Scores for credit risk assessment.

This threatens FICO's monopolistic position in credit scoring, as Vantage represents the first major alternative to the industry-standard FICO scores used in mortgage lending decisions.

Key Quote🎤: “Effective today, to increase competition in the Credit Score Ecosystem and consistent with President Trump’s landslide mandate to lower costs, Fannie and Freddie will ALLOW lenders to use Vantage 4.0.”

What’s Next?

Regional bank earnings season approaches with Raymond James expecting upside bias.

Q1 earnings season winds down with 78% of S&P 500 companies beating expectations.

August 1 deadline approaches for international tariff implementation.

The consumer inflation expectations survey shows a return to pre-tariff levels at 3%.

Track upcoming news and earnings on your portfolio companies with Ziggma.

Chart of the Day

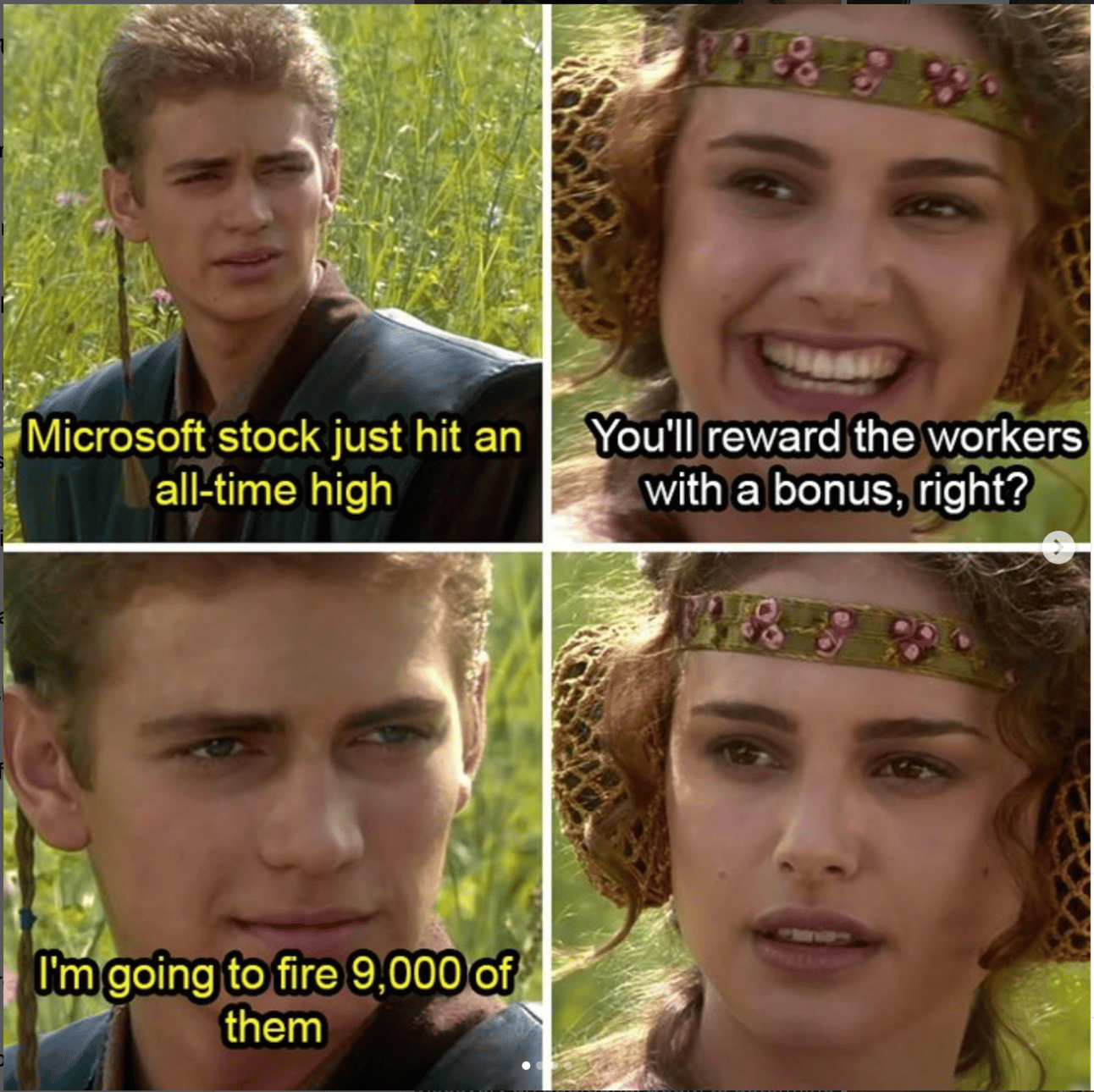

Meme of the Day

Great investing starts with great information. Forward The Market Scoop to anyone who wants to stay ahead of the market through a pertinent and entertaining newsletter format.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.