- Ziggma

- Posts

- 💰 Alphabet Tops $3 Trillion

💰 Alphabet Tops $3 Trillion

PLUS: Why is Tesla rising?

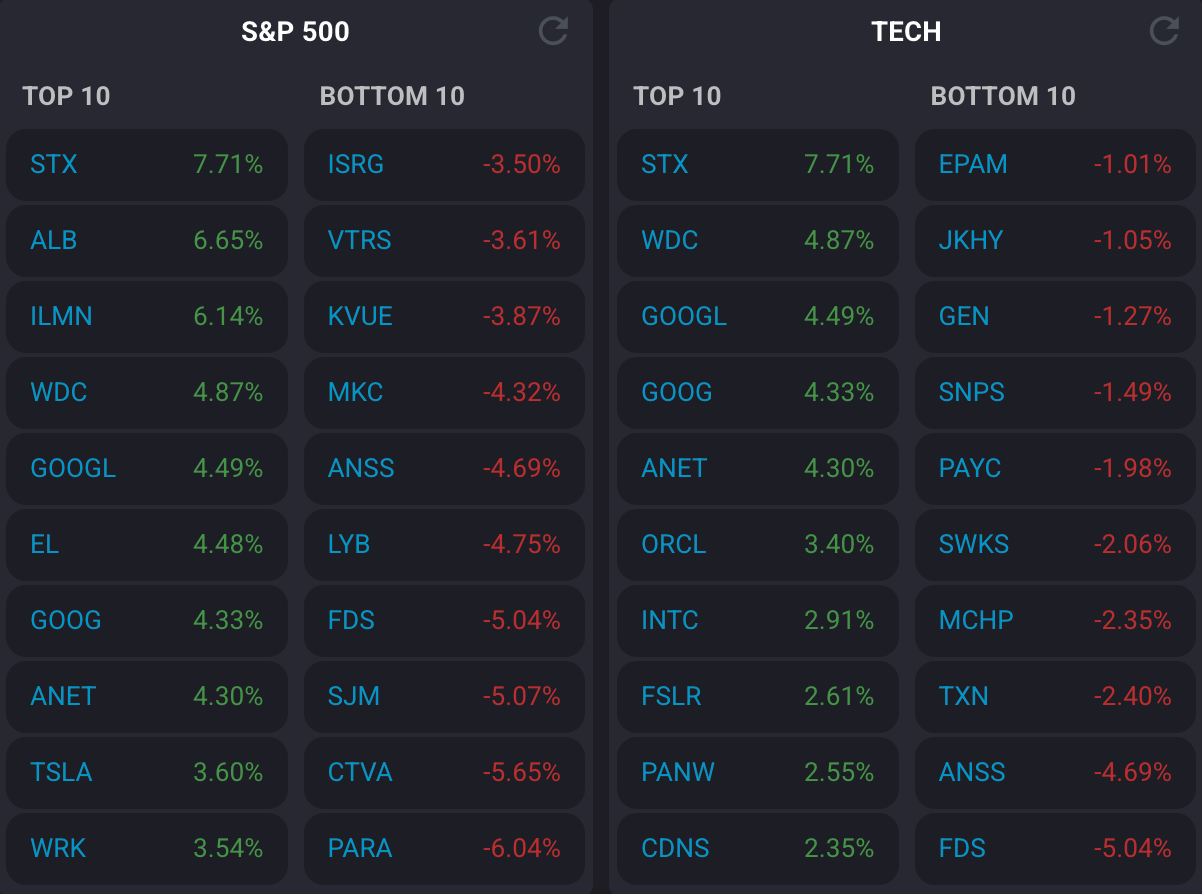

Market Performance

S&P 500: 6,615.28 ⬆️ 0.47%

Nasdaq: 22,348.75 ⬆️ 0.94%

Dow Jones: 45,883.45 ⬆️ 0.11%

Alphabet Hits a New Milestone 💸

Alphabet (GOOGL) has just become the fourth company to join the exclusive $3 trillion market cap club, alongside tech titans Nvidia, Microsoft, and Apple.

The Google parent's shares surged over 4% on Monday, pushing its market value to $3.05 trillion after trading at record highs.

This milestone comes roughly 20 years after Google's IPO and just over a decade since Alphabet's creation as a holding company.

What's driving this historic achievement? A favorable antitrust ruling earlier this month allowed Alphabet to retain control of its Chrome browser and Android operating system.

While the company must share some data with competitors, avoiding forced divestiture of these key assets removed major investor concerns about breaking up Google's ecosystem.

The rally also reflects renewed optimism around AI, with Alphabet's cloud unit delivering nearly 32% revenue growth in Q2 as investments in custom chips and the Gemini AI model pay off.

At 23 times forward earnings, the lowest among the "Magnificent 7", Alphabet trades at attractive valuations compared to mega-cap peers.

Alphabet currently has a Ziggma Stock Score of 91, despite ranking in the bottom half percentile for growth.

Our Takeaway

Alphabet's $3 trillion milestone validates its evolution beyond search into cloud, AI, and autonomous vehicles.

With the regulatory overhang lifting and AI investments gaining traction, the stock appears well-positioned for continued outperformance.

How 433 Investors Unlocked 400X Return Potential

Institutional investors back startups to unlock outsized returns. Regular investors have to wait. But not anymore. Thanks to regulatory updates, some companies are doing things differently.

Take Revolut. In 2016, 433 regular people invested an average of $2,730. Today? They got a 400X buyout offer from the company, as Revolut’s valuation increased 89,900% in the same timeframe.

Founded by a former Zillow exec, Pacaso’s co-ownership tech reshapes the $1.3T vacation home market. They’ve earned $110M+ in gross profit to date, including 41% YoY growth in 2024 alone. They even reserved the Nasdaq ticker PCSO.

The same institutional investors behind Uber, Venmo, and eBay backed Pacaso. And you can join them. But not for long. Pacaso’s investment opportunity ends September 18.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

Market Overview 📈

Stocks rose across the board as investors positioned ahead of the Federal Reserve's pivotal meeting this week.

The S&P 500 climbed 0.5% to close above 6,600 for the first time, while the Nasdaq hit fresh all-time highs.

Optimism surrounding U.S.-China trade talks provided additional tailwinds, with President Trump posting on Truth Social that negotiations were going "very well" and a deal had been reached on a "certain company" that young Americans wanted to save, likely referring to TikTok.

However, Reuters reported the U.S. will proceed with the TikTok ban unless China reduces its tariff and tech restriction demands.

The Fed is expected to cut rates by 25 basis points on Wednesday, with markets pricing in 96% probability of this outcome.

Recent economic data showing labor market weakness and tame inflation have fueled expectations for a rate cut, supporting the ongoing stock rally despite lingering economic uncertainties.

Stock Moves Deciphered 📈

ASML Holding (ASML) surged nearly 6% following a rare analyst upgrade after seven years.

The new buy rating and higher price target reflected growing confidence in ASML's AI investments and its continued dominance in advanced chipmaking equipment markets.

Estée Lauder (EL) gained 4.5% after Evercore ISI raised its price target by 15% while reiterating an "Outperform" rating.

The upgrade signaled renewed confidence in the company's growth prospects despite recent challenges in key Asian markets.

FactSet Research (FDS) declined slightly despite announcing that J.P. Morgan and Barclays joined its research platform.

While the strategic partnership represents a competitive win, the stock's muted performance reflected broader market rotation dynamics.

Headlines You Can't Miss 👀

🔥 China launches antidumping probe into U.S. analog chips, hitting On Semiconductor, Analog Devices, and Texas Instruments.

🏭 Empire State Manufacturing Index plunges to -8.7, first negative reading since June, as factory activity contracts sharply.

🏦 UnitedHealth seeks meetings with the Trump administration, according to The Wall Street Journal.

⚖️ China's market regulator says Nvidia violated anti-monopoly law, continuing probe into chipmaker's Mellanox acquisition.

🛒 Western Digital raises hard drive prices amid unprecedented demand, sending shares to all-time highs.

✈️ Alaska Air warns Q3 earnings will hit the low end of guidance, shares fall over 5% on disappointing outlook.

🥇 Gold hits fresh all-time high above $3,674, supported by softer dollar ahead of Fed meeting.

Trending Stocks 📊

Tesla (TSLA) surged 6% after CEO Elon Musk disclosed the purchase of $1 billion worth of shares on Friday, his largest open-market buy ever and his first significant purchase since 2020.

Musk acquired 2.57 million shares at various prices, which analysts viewed as a strong vote of confidence in the company as it pivots toward robotics amid intensifying EV competition.

Seagate Technology (STX) jumped to a new 52-week high following a Bank of America upgrade and a higher price target.

Strong AI-driven demand for data storage solutions, combined with the company's planned price hikes, fueled investor optimism about improving margins and revenue growth in the storage sector.

Albemarle Corporation (ALB) ticked higher on massive volume, suggesting a potential short squeeze was underway.

A UBS upgrade to Neutral from Sell, combined with renewed institutional interest, helped lift the heavily shorted stock as investors bet on a recovery in lithium demand fundamentals.

What’s Next?

Key Events to Watch 👇

September historically ranks as the worst month for equities, with the S&P 500 averaging 4.2% declines over the past five years.

🎤 Companies such as Darden, FactSet, and FedEx are set to report quarterly results this week.

🏦 Federal Reserve concludes two-day meeting on Wednesday with rate decision at 2 PM ET.

👷 Initial jobless claims on Thursday could offer valuable insights into the labor market.

🏠 Housing starts and building permits data on Friday.

Chart of the Day

Meme of the Day

Great investing starts with great information.

Forward The Market Scoop to anyone who wants to stay ahead of the market through a pertinent and entertaining newsletter format.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please exercise caution and conduct your own research.