- Ziggma

- Posts

- 💰 AI Powers Adobe Earnings

💰 AI Powers Adobe Earnings

PLUS: Why is Warner Bros. rising?

Market Performance

S&P 500: 6,587.47 ⬆️ 0.85%

Nasdaq: 22,043.07 ⬆️ 0.72%

Dow Jones: 46,108 ⬆️ 1.36%

AI Powers Adobe Earnings 💸

Adobe (ADBE) delivered a stellar third-quarter performance that should capture the attention of every investor.

The design software giant posted earnings of $5.31 per share versus expectations of $5.18, while revenue hit $5.99 billion against forecasts of $5.91 billion.

Adobe's AI-influenced annual recurring revenue (ARR) has surged to over $5 billion, up from $3.5 billion in the previous fiscal year.

CEO Shantanu Narayen revealed Adobe has already surpassed their full-year AI-first ARR target, proving that Adobe's massive AI investments are paying dividends.

The company raised its fiscal 2025 revenue guidance to $23.65 billion to $23.70 billion and increased earnings expectations to $20.80 to $20.85 per share.

While ADBE stock is down 21% year-to-date, its Firefly AI platform is viewed as a game-changer for creative professionals.

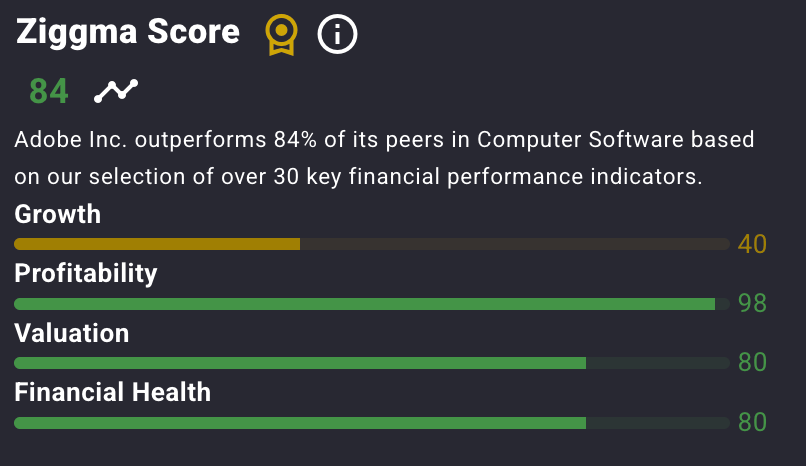

Adobe currently has a Ziggma Stock Score of 84, despite ranking in the bottom half percentile for growth.

Our Takeaway

Adobe's AI transformation is accelerating faster than Wall Street expected.

While the stock has lagged this year, these results suggest the AI boom is finally translating into real revenue growth for traditional software companies.

How 433 Investors Unlocked 400X Return Potential

Institutional investors back startups to unlock outsized returns. Regular investors have to wait. But not anymore. Thanks to regulatory updates, some companies are doing things differently.

Take Revolut. In 2016, 433 regular people invested an average of $2,730. Today? They got a 400X buyout offer from the company, as Revolut’s valuation increased 89,900% in the same timeframe.

Founded by a former Zillow exec, Pacaso’s co-ownership tech reshapes the $1.3T vacation home market. They’ve earned $110M+ in gross profit to date, including 41% YoY growth in 2024 alone. They even reserved the Nasdaq ticker PCSO.

The same institutional investors behind Uber, Venmo, and eBay backed Pacaso. And you can join them. But not for long. Pacaso’s investment opportunity ends September 18.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

Market Overview 📈

Thursday's record-breaking session was driven by a perfect storm of economic data that solidified expectations for Federal Reserve rate cuts.

The consumer price index showed mixed signals, rising 0.4% month-over-month versus the expected 0.3%, but hitting the anticipated 2.9% annual rate.

More importantly, weekly jobless claims spiked to 263,000, the highest level since October 2021, signaling a softening of the labor market.

The 10-year Treasury yield dropped to 4% as markets priced in a quarter-point rate cut at next week's Fed meeting with near certainty.

This broader rally lifted banks, such as JPMorgan, and consumer names like Walmart, on lower interest rate expectations.

The gain was notably broad-based, with 31 S&P 500 stocks hitting new 52-week highs, including Live Nation, AutoZone, and Goldman Sachs, while only four touched new lows.

Stock Moves Deciphered 📈

Equifax (EFX)rose 6% on positive regulatory developments and favorable tailwinds for the consumer credit reporting agency, boosting investor sentiment.

Celanese Corporation (CE) plummeted 13% after disclosing ongoing inventory destocking issues, raising concerns about near-term demand and profitability for the chemicals company.

Norwegian Cruise Line (NCLH) gained 5% as analysts raised price targets citing strong booking trends and positive cruise industry outlook heading into peak season.

Headlines You Can't Miss 👀

🏠 Figure Technology IPO soars 44% to $36 on Nasdaq debut, valuing crypto lender at $7.62 billion.

⚡ Interior Secretary declares "no future" for offshore wind under Trump administration.

🏦 Stephen Miran faces a Fed confirmation vote Monday, just before the policy meeting.

💊 Revolution Medicines rallies 13% on positive pancreatic cancer drug trial data.

✈️ Delta Air Lines falls 3% after reiterating Q3 EPS guidance of $1.25-$1.75.

🔬 Thermo Fisher upgraded to 'overweight' by Barclays with a $550 price target.

🛒 Oxford Industries jumps 18% after Q2 beat and reduced tariff impact expectations.

🌍 Alibaba drops 2% after announcing $3.2 billion convertible notes offering.

Trending Stocks 📊

Warner Bros. Discovery (WBD) exploded 29% following Wall Street Journal reports that Paramount Skydance is preparing a majority cash bid for the entire company.

This potential blockbuster acquisition sent shares to their best single-day performance ever, bringing year-to-date gains to 45%.

The media consolidation play could reshape the streaming landscape.

Centene Corporation (CNC) surged 12% after reaffirming its annual earnings outlook that management issued in July.

The health insurance giant also reported that its Medicare plans' quality ratings align with expectations, providing investors with confidence in its operational execution during a challenging regulatory environment for healthcare insurers.

Micron Technology (MU) jumped nearly 8% after Citi reiterated its buy rating while hiking the price target to $175 from $150.

The investment firm expects "decent results and well above consensus guide" ahead of Micron's fiscal Q4 earnings on September 23, driven by better-than-expected data center demand, which comprises 55% of revenue.

What’s Next?

Key Events to Watch 👇

September historically ranks as the worst month for equities, with the S&P 500 averaging 4.2% declines over the past five years.

🏦 Federal Reserve policy meeting concludes Wednesday with rate cut expected

🗞️ Micron reports fiscal Q4 results on September 23

📈 Oracle faces profit-taking after Wednesday's historic 36% rally

💸 Treasury yields continue to decline, with the 10-year hitting 4% threshold

Chart of the Day

Source: App Economy Insights

Meme of the Day

Great investing starts with great information.

Forward The Market Scoop to anyone who wants to stay ahead of the market through a pertinent and entertaining newsletter format.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please exercise caution and conduct your own research.